Big year for wind power in Germany in Japanese

and lead author of GermanEnergyTransition.de.

Solar fell below the minimum target for the year, and Germany is no longer pursuing much bioenergy. But wind power boomed in three ways: onshore, offshore, and overall power production thanks to a windy year.

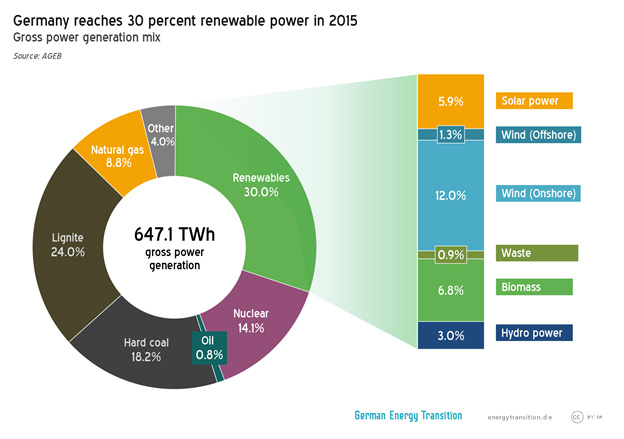

In 2015, the share of renewables in power supply grew by as much as six percentage points, reaching 33 percent of demand and 30 percent of total generation – the difference being power exports, which also reached a new record high. A tenth of the electricity generated in Germany is now for export.

Practically all of this success can be attributed to wind power. Almost no biogas facilities are being built; the country only added roughly half of its already modest target of a mere 100 megawatts. Solar also fell short of its minimum target of 1.5 gigawatts, coming in at between 1,370 and 1,476 megawatts (the data are still preliminary – see this report in German). But the wind sector had its second-best year ever in terms of new installations, coming in at 3.5 gigawatts, slightly ahead of the 3.2 gigawatts from 2002 – but quite a long way from the 4.4 gigawatts in 2014.

Offshore, Germany was the leader in new wind farms last year as well, though the country only got 1.3 percent of its electricity from turbines in the water. Much of that newly added capacity offshore had already been built in 2014 but not yet connected to the grid. The offshore sector is, however, expected to continue to grow strongly for the rest of this decade; the official target is 6.5 gigawatts by 2020, and that could be raised to 7.7 gigawatts. The country currently only has 2.3 gigawatts installed offshore.

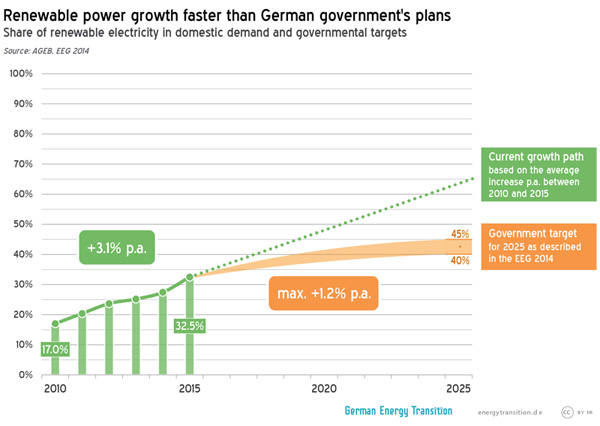

Onshore, the wind sector is expected to continue to boom this year, but the party may be over soon. The country is transitioning from feed-in tariffs to auctions, mainly so that the government can keep renewables from exceeding the target of 45 percent of power supply by 2025. Consider this: last year alone, the share of renewables covering domestic power demand grew by nearly 6 percentage points, but that number will need to fall to a mere 1.2 percentage points annually over the next decade. Auctions are the policy mechanism that the German government is using to slow things down.

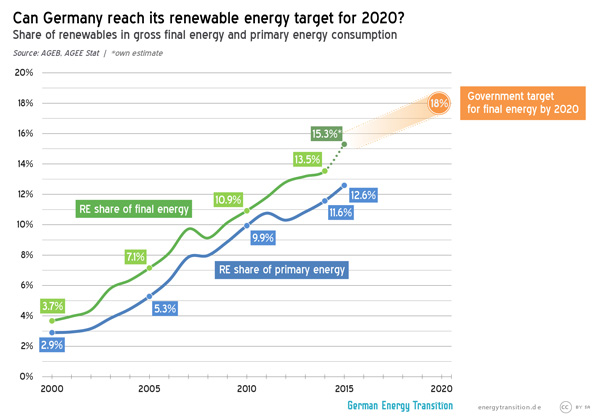

But why would the government do that, especially with the CO2 reduction target for 2020 likely to be missed? The reason is financial havoc in the power sector, where the conventional fleet is quickly becoming a stranded asset. Furthermore, Germany might possibly be back on target in other respects, such as the share of renewables in final energy. Thanks to the lurch in renewable power last year and otherwise mild temperatures, 20 percent renewable final energy no longer seems out of reach, especially if more progress is made in transport and heat.

The Energiewende thus stands at a crossroads. The era of renewables overshooting targets (growing faster than expected) is coming to an end. Government policy will see to that. The challenges are arguably more financial (how to pay for conventional asset losses, how to cover the cost of divestment from coal mines, especially for the workers and communities affected, etc.) than technical. The German grid continues to get more reliable, with only 12 minutes of downtime on average in 2014 (the last year for which data are available). And even the debate about unscheduled power flows (loop flows) into Poland have taken on a different slant now that the Poles seem increasingly reliant on German electricity.

Perhaps the main take away is therefore that all of the technical discussions about storage, grid stability, fluctuating wind and solar, etc. should not be the focal point right now. The early retirement of conventional plants precedes the need for power storage solutions in particular. Before engineers come up with the ultimate storage solutions, policymakers first need to produce some buyout options to soften the blow on coal miners and municipal utilities with stakes in the big coal utilities.

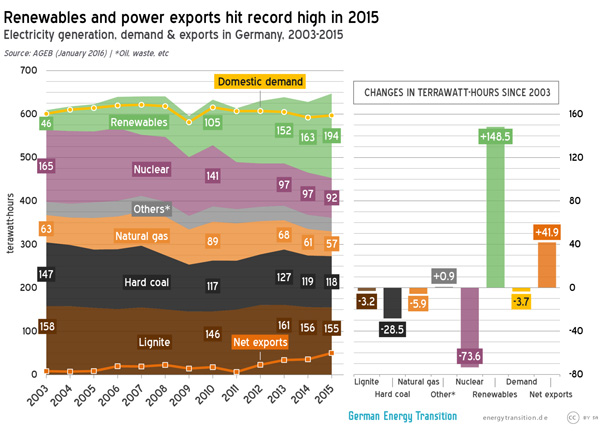

For the moment, however, we can celebrate the statistics in the following chart, which shows that coal is down, nuclear is down, and renewables are up relative to 2003, when the first nuclear plant was closed as part of the phaseout.

Craig Morris (@PPchef) is the lead author of German Energy Transition. He directs Petite Planète and writes every workday for Renewables International. He is grateful to Patrick Matschoss of the IASS for input into the German government’s changing justification for the switch to auctions.