Series: Considering the True Acceleration of Electricity System Reform

Vol.3: Is a capacity mechanism needed in Japan today?

Summary of the discussions on capacity mechanism and their points at issue

in Japanese

The Electricity Market Development Working Group (hereinafter referred to as “WG”) is currently discussing the implementation of a capacity mechanism, already debating over the system design.

However, the basic concept, including what is meant by “capacity mechanism” or why it is needed, has not been widely informed to the public. This paper first discusses whether a capacity mechanism should be implemented at this stage considering Japan’s current situation. It further discusses the major challenges concerning the implementation of a centralized capacity market, which is currently being discussed, as well as issues expected at the time of such implementation.

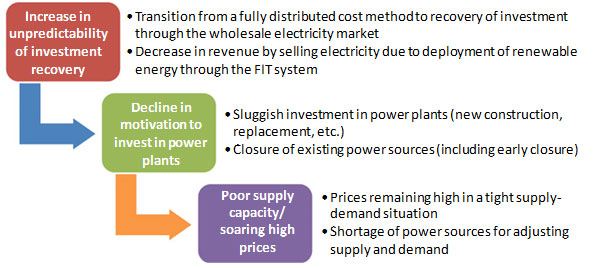

The Agency for Natural Resources and Energy explains the need to implement a capacity mechanism as follows: Through electricity system reform, and utilization of a fully distributed cost method, the secured cost recovery system will be replaced by a system in which costs are recovered based on prices determined by the wholesale electricity market (hereinafter referred to as the “Market”). Market prices fluctuate and the future is never guaranteed. In such unpredictable circumstances, power producers may not want to build new power plants because of the risk that their investments may become irrecoverable. In such a case, the supply capacity of power plants may decrease, tightening the supply-demand situation, due in part to the closure of existing power plants, and this will result in a rise of prices in the market place. To address this concern, it is necessary to establish, in advance, a capacity mechanism to secure capacity requirements (supply capacity).

Source: Agency for National Resources and Energy, Ministry of Economy, Trade and Industry (2016), p.8.

However, there are other mechanisms that can mitigate increases in unpredictability. These mechanisms, such as long-term contracts, the forward market and the futures market, can address future uncertainties. First of all, we have to prioritize improving and building such market systems to be functioned better. The implementation of a capacity mechanism should be discussed in case there would be concerns of capacity shortage despite such reform. Ways to activate the market are also on the agenda of the WG, so the discussion should be firstly focused on them.

Moreover, a decrease in supply capacity inevitably entails an increase in market prices, which is likely to increase the chance of recovering fixed costs, encouraging investment in power plants. In the first place, putting a ceiling on the market price has been one of the reasons cited by countries and regions where capacity mechanisms have been implemented. In other words, even if the supply capacity declines, the rise in the market price would be curbed due to the price cap, curbing at the same time the rise in the incentives to recover fixed costs. This scenario can justify the implementation of a capacity mechanism. On the other hand, in Japan, price caps have not been set on the market, and in this respect, the grounds for implementation of a capacity mechanism are weak.

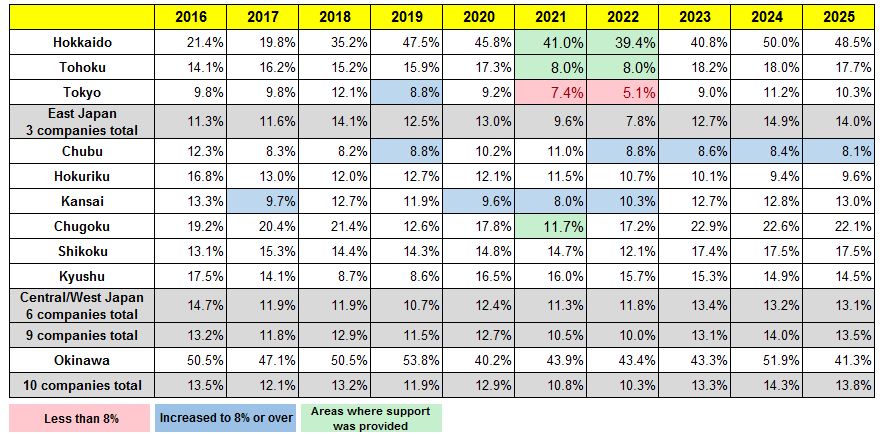

Nonetheless, if Japan’s supply capacity was insufficient at this point, incentives for increasing the supply capacity may be justifiable. However, according to the “Electricity Supply Plan (FY 2016)” aggregated by Organization for Cross-regional Coordination of Transmission Operators, Japan (OCCTO), supply capacity will fall below the 8 percent reserve margin only in FY2021 and 2022, and only within areas covered by TEPCO. Here the entire capacities of Hokkaido-Honshu transmission lines (the increased capacity) and the Tokyo-Chubu transmission facilities are assumed to be unused, while the reserve margin in Hokkaido is about 40 percent (in 2021 and 2022), which is a substantial supply capacity surplus. In fact, this indicates that the operational capacity of the transmission lines between Hokkaido Electric Power Co., Inc. and Honshu is apparently insufficient, and that operations and reinforcement of the power lines will require improvement.

Source: Organization for Cross-regional Coordination of Transmission Operators, Japan (2016), p.12.

The WG has already begun discussions on the implementation of a capacity mechanism, and especially, the implementation of a centralized capacity market seems to have been central to these discussions. The basic framework of a centralized capacity market is as follows; the system operator sets the capacity to be secured for future use, and then the power producers each tender bids for the capacity they can supply. The bid prices are arranged in ascending order by bid price, and the last bid price which fills up the required capacity is determined to be the capacity price. The capacity is then purchased by retailers. Because these retailers need to secure enough capacity to fulfill their customer demands, they pay for the capacity they need.

There are a variety of issues in designing a system for a centralized capacity market. However, because of space limitations, this paper singles out five critical challenges and issues.

The first challenge is the question of whether the system operator can set the appropriate capacity required for the entire market. Setting an insufficient capacity would result in a shortage of supply capacity, and setting excess capacity would result in surplus payments to power producers, further resulting in unjustly high electricity charges (Azuma, 2015). Hattori (2015) points out that the per-kWh cost for capacity tends to be most expensive in a centralized capacity market.

The second issue is the difficulty of a system design. “In order to hold an auction, a variety of different parameters need to be provided externally beforehand. This is known to make the system design complex, and be the cause of a variety of problems. Although the United States has a long history of this kind of operational experience, changes in their system design have been made repeatedly. (Hattori, 2015)”

The third issue is that while a capacity mechanism has a low market risk, as seen in the wholesale electricity market, its system risk is often overlooked. Hattori (2015) also brings up this point. There is a possibility that the system will be subject to repeated changes, which seems to prove the difficulties of a system design. In addition, if the capacity setting is affected by the intention of the power industry or by political motives, the unpredictability of capacity prices will increase.

The fourth issue is the inflexibility of a centralized capacity market. As variable renewable energy such as solar and wind is expanding as electricity sources, flexibility becomes the key to supply and demand adjustment. However, such a need cannot necessarily be fulfilled under a centralized capacity market. In a centralized capacity market, simple capacity is evaluated rather than flexibility, with capacity being determined in ascending order by price regardless of flexibility.

The fifth issue is the fact that the price paid for capacity from old power generation facilities, which have already been depreciated will be the same as that from new power generation facilities, depending on the system design. Normally, facilities for which depreciation has completed do not require fixed costs, and the maintenance cost may be fully covered by revenues realized from the wholesale electricity market. Paying additional capacity prices to old power generation facilities under such circumstance may result in an unreasonable increase in electricity charges. For this reason, the capacity market should be split between depreciated power generation facilities, and undepreciated/new power generation facilities respectively as we plan the system design. For example, a minimum amount paid per kW should be set for depreciated facilities, under which conditions, capacity to be supplied is then solicited from power producers. When the supply capacity is insufficient, bids can be called for from undepreciated and new facilities through the centralized capacity market. In this way, the market can be designed in two steps.

As just described, designing a centralized capacity market entails a host of difficult challenges, and therefore, a hasty implementation is not recommended.

Lastly, the relationship between capacity mechanism and the Feed-in Tariff (FIT) system is noted.

With FIT, electricity from qualifying facilities is purchased at a fixed price. The facility’s fixed cost is included in this purchase price. Therefore, it is not necessary to make additional payments for capacity to FIT qualifying facilities. The question here is whether these FIT qualifying facilities have capacity value. Hydropower, bioenergy and geothermal generation are stable power sources, and both solar PV and wind power have a certain degree of stable supply during peak hours. In this regard, the capacity value of renewable energy should be appropriately evaluated. The price for renewable energy deemed as having capacity value should be considered as avoidable costs, and should be deducted from the purchase price when determining the surcharge.

References

Azuma, Aiko. (2015). Designs of Capacity Mechanisms for Germany: Strategic Reserve or Capacity Market? Electricity System Reform and Renewable Energy, Nippon Hyoron sha co., Ltd.

Agency for National Resources and Energy, Ministry of Economy, Trade and Industry. (2016). About Capacity Mechanism. Document 3, 2nd Meeting of Electricity Market Development Working Group, Policy Subcommittee for Acceleration of Electricity System Reform, Strategic Policy Committee, Advisory Committee for Natural Resources and Energy

Hattori, Toru. (2015). On Choice and Implementation of Capacity Mechanism: Coping with the Uncertainty associated with the Institutional Design. Review of Electricity Economics, No. 61. pp. 1-16.

Organization for Cross-regional Coordination of Transmission Operators, Japan. (2016). Aggregation of Electricity Supply Plans for FY2016 (*Available only in Japanese)