In the first half of 2023, renewable energy (RE) met slightly more than half of Germany’s electricity consumption. This is a remarkable result, mainly achieved thanks to energy efficiency & savings. After phasing out nuclear power on April 15, 2023, Germany replaced a part of its domestic uncompetitive fossil-based electricity generation with imports, mainly RE-based electricity. By 2030, 80% of Germany’s electricity consumption should come from RE, and by 2035 the country’s power sector should be fully decarbonized. To achieve these ambitious objectives, Germany has adopted aggressive installed capacity targets and policies in favor of wind and solar. To complement the variable output of these two technologies, batteries, and hydrogen-ready gas-fired power plants are the solutions advanced. Thanks to their economic competitiveness, batteries are already growing fast. Less mature hydrogen-ready gas-fired power plants will be supported via a competitive procurement process.

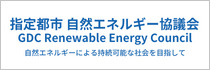

53.7% of Electricity Consumption from RE in 2023 H1 Thanks to Energy Efficiency & Savings

This year from January 1st to June 30th (i.e., 2023 H1), the share of RE (incl. wind, solar, biomass & renewable waste, hydro, and geothermal) in Germany’s net electricity consumption (i.e., consumption = generation + imports - exports) reached an impressive 53.7% (Chart 1). This is almost three percentage points more than in the same period last year. This is also higher than the 52.1% realized in 2020 H1, when conditions for wind power were excellent and electricity consumption was affected by the outbreak of the COVID-19 pandemic. It may also be briefly noted that the share of RE in Germany’s electricity consumption is usually higher in H1 than in H2 because of better conditions for RE electricity generation in the first half of the year.

Chart 1: Germany Share of RE in Net Electricity Consumption 2019 H1-2023 H1

Source: Fraunhofer ISE, Energy-Charts – Net Electricity Generation in Germany in Half Year 1-2 2019-2023 (accessed July 11, 2023).

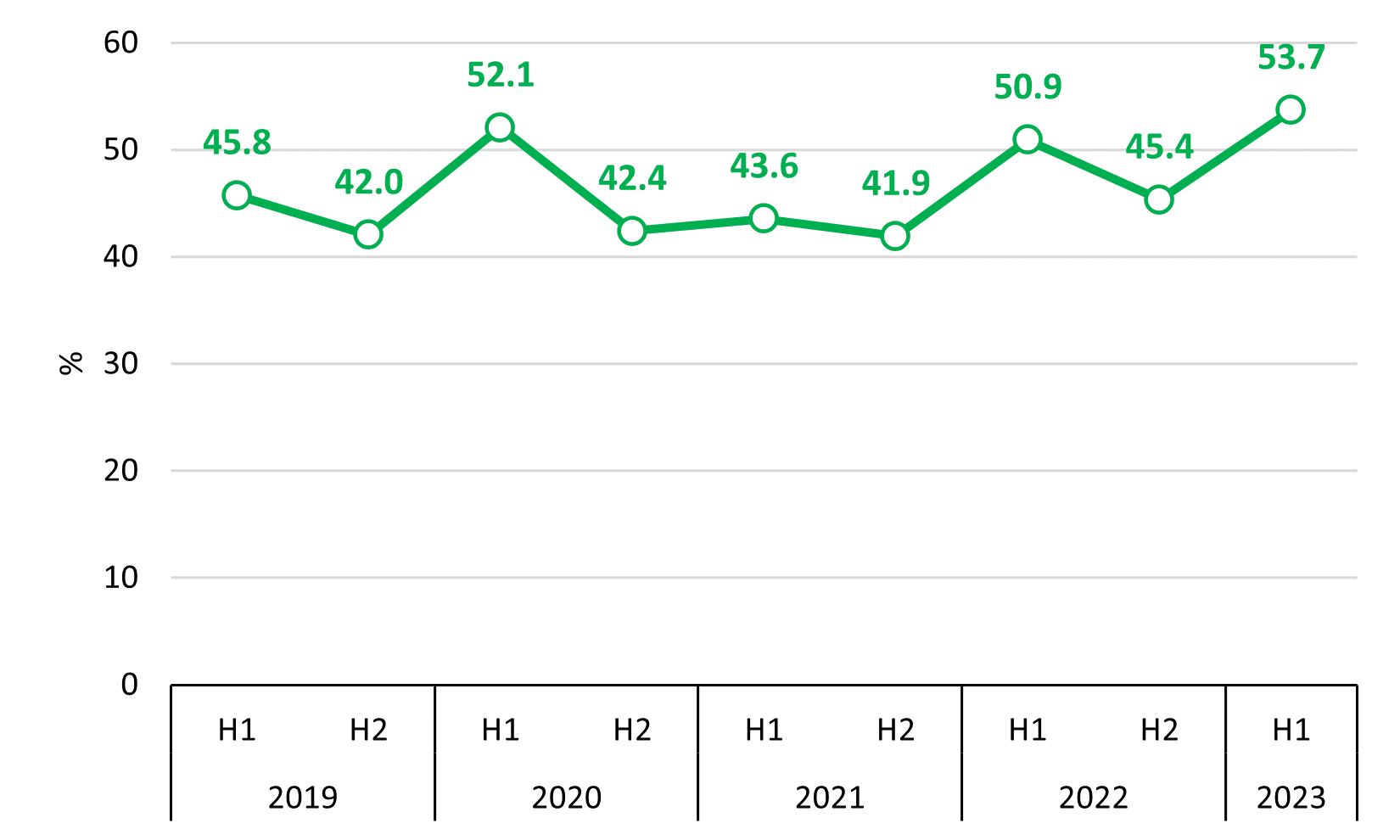

This RE share of 53.7% could be achieved thanks to a significant decrease in electricity consumption in 2023 H1. Indeed, Germany’s electricity consumption decreased by 5.7% compared to 2022 H1 (Chart 2). In 2023 H1, electricity consumption was even 3.5% lower than in 2020 H1. This is thus an outstanding development considering how the impact of COVID-19 was negatively strong on electricity consumption in the first weeks of the pandemic, with partial lockdown measures (from March 22 to May 4, 2020, in Germany) slowing down economic activity.

This spectacular reduction in Germany’s electricity consumption in 2023 H1 was due to two main factors: expensive retail electricity prices (i.e., ¥54/kWh for household consumers1 and ¥40/kWh for non-household consumers2 in 2022 H2, the latest period for which data are available) and a mild winter. In Germany, electricity consumers have been particularly affected by the invasion of Ukraine by Russia (from February 2022) that has triggered substantial increases in fossil fuel prices used for electricity generation (i.e., coal and gas). Many other European countries currently face high retail electricity prices for the same reason. Prices in Germany are a little higher than in other European countries due to higher taxes and levies (which do not include the RE surcharge anymore since it has been abolished in July 2022). Subsidies have been introduced to cap electricity prices and it will take some time for retail prices to drop.

In response to high retail electricity prices, energy efficiency progresses (e.g., switching to LED lights), and energy savings have been thoroughly pursued (e.g., measures were introduced to limit lighting in public monuments and buildings as well as night illuminated advertisements, and an awareness and behavior campaign “80 million together for energy change” was launched to urge citizens to reduce their consumption3). These actions delivered very convincing results.

Chart 2: Germany Change in Electricity Supply 2023 H1-2022 H1

Source: Fraunhofer ISE, Energy-Charts – Net Electricity Generation in Germany in Half Year 1 2022-2023 (accessed July 11, 2023).

Conversely, electricity generation from RE did not improve but stagnated in 2023 H1 (-0.6% YoY). This is because there can be large swings in electricity generation from RE depending on years, and in the first quarter of this year conditions were unfavorable for wind and solar power. As a result, both decreased slightly in the first half, despite more capacity being installed (+4% for wind and + 14% for solar4). These decreases were not offset by a small increase in hydro.

Germany Replaces Domestic Fossil Power with Net Imports Mainly Based on RE Electricity

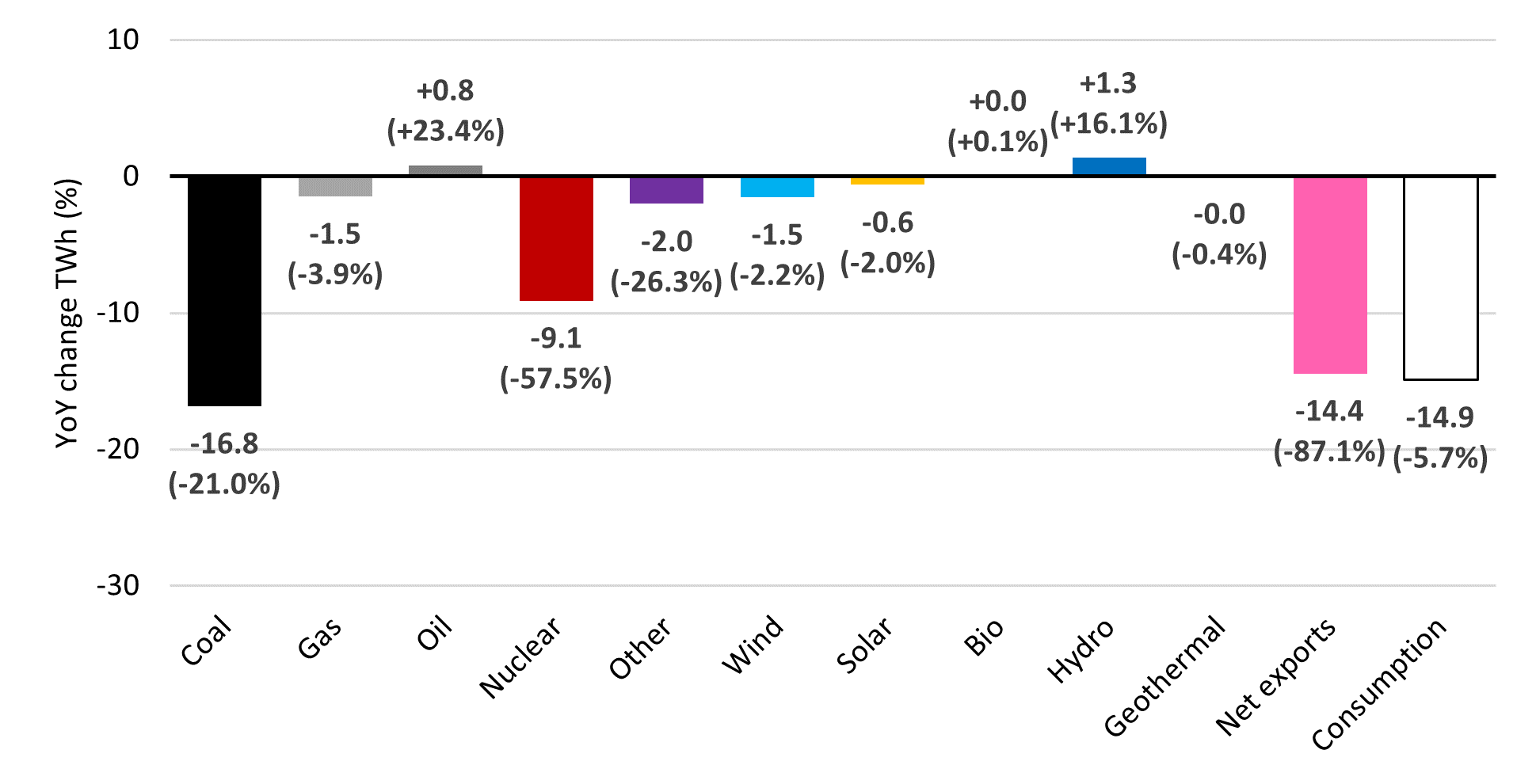

In 2023 H1, despite falling net exports (-87.1% compared to 2022 H1) Germany remained a net exporter of electricity (2.1 TWh). After phasing out nuclear power on April 15, 2023, Germany became a net importer of electricity (Chart 3).

Chart 3: Germany Daily Cross-Border Electricity Trade 2023 H1

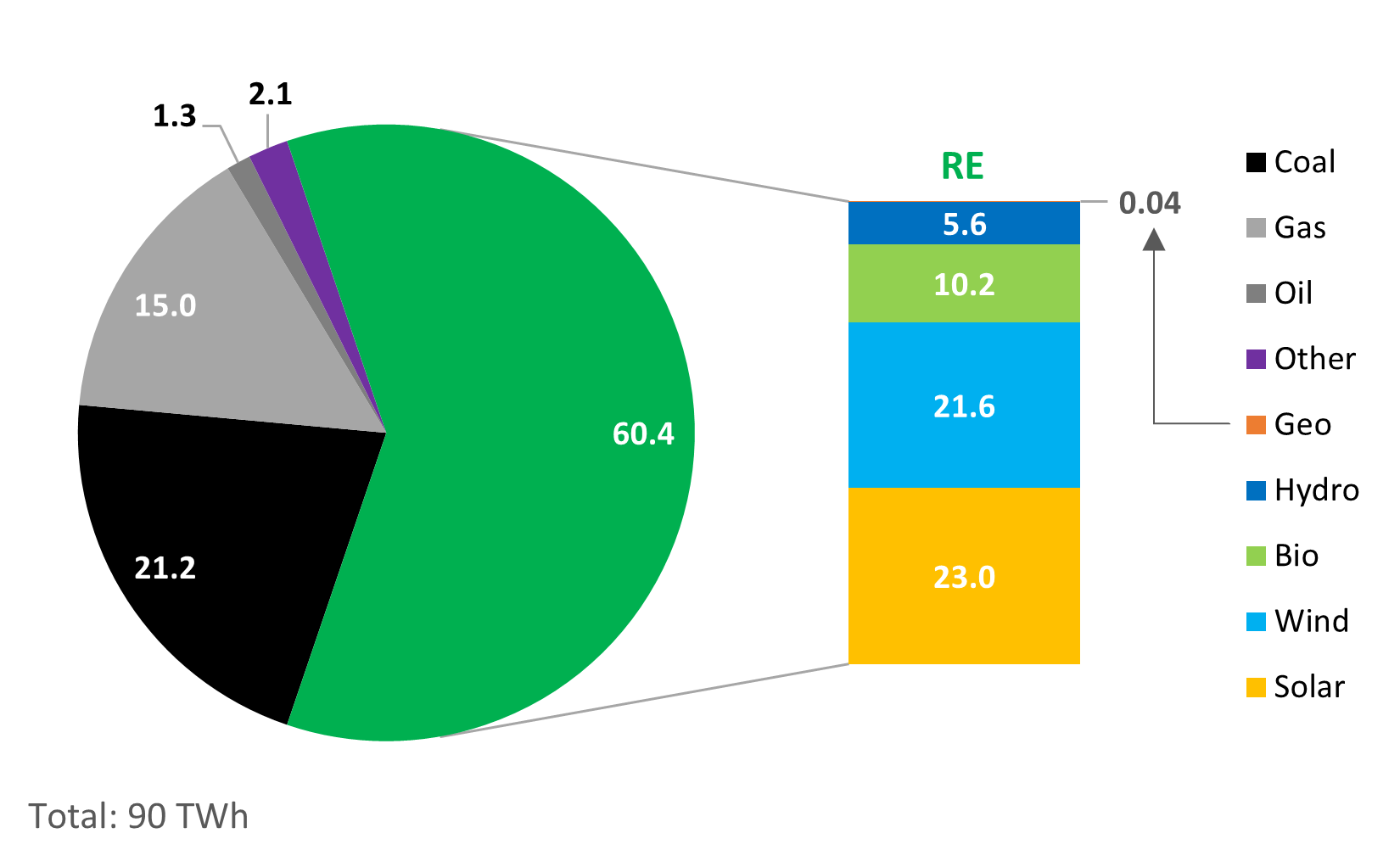

The reason why Germany became net importer of electricity in the first few months after completing its nuclear power phaseout is the country’s heavy reliance on uncompetitive fossil power (i.e., coal and gas). Between April 16 and June 30, 2023, fossil fuels accounted for 37.5% of Germany’s electricity generation mix (Chart 4). On a slightly more positive note, despite being high, this fossil power share was nonetheless lower compared to that of 44.2% observed between January 1 and April 15, 2023. Between April 16 and June 30, 2023, the share of RE in Germany’s electricity generation (i.e., not considering cross-border electricity trade) was 60.4%.

Chart 4: Germany Net Electricity Generation Mix April 16-June 30, 2023

Source: Fraunhofer ISE, Energy-Charts – Net Electricity Generation in Germany in 2023 (accessed July 11, 2023).

In Europe, where electricity is traded across borders and the economic dispatch of power plants is optimized throughout the continent, the merit order principle prevails. Based on this principle, power plants with the lowest marginal costs are dispatched first. Typically, these are RE power plants such as wind and solar. Nuclear power which marginal cost is higher than RE follows. Finally, fossil power plants which marginal costs are the highest are the latest to be dispatched. Keeping in mind this market mechanism is important to understand why, for example, in France when the combined production of RE and nuclear exceeds domestic demand and cross-border trade opportunities are fully seized, the output of nuclear is reduced instead of curtailing that of RE. The situation in Japan, where nuclear is prioritized over wind and solar, contradicts this logical principle.

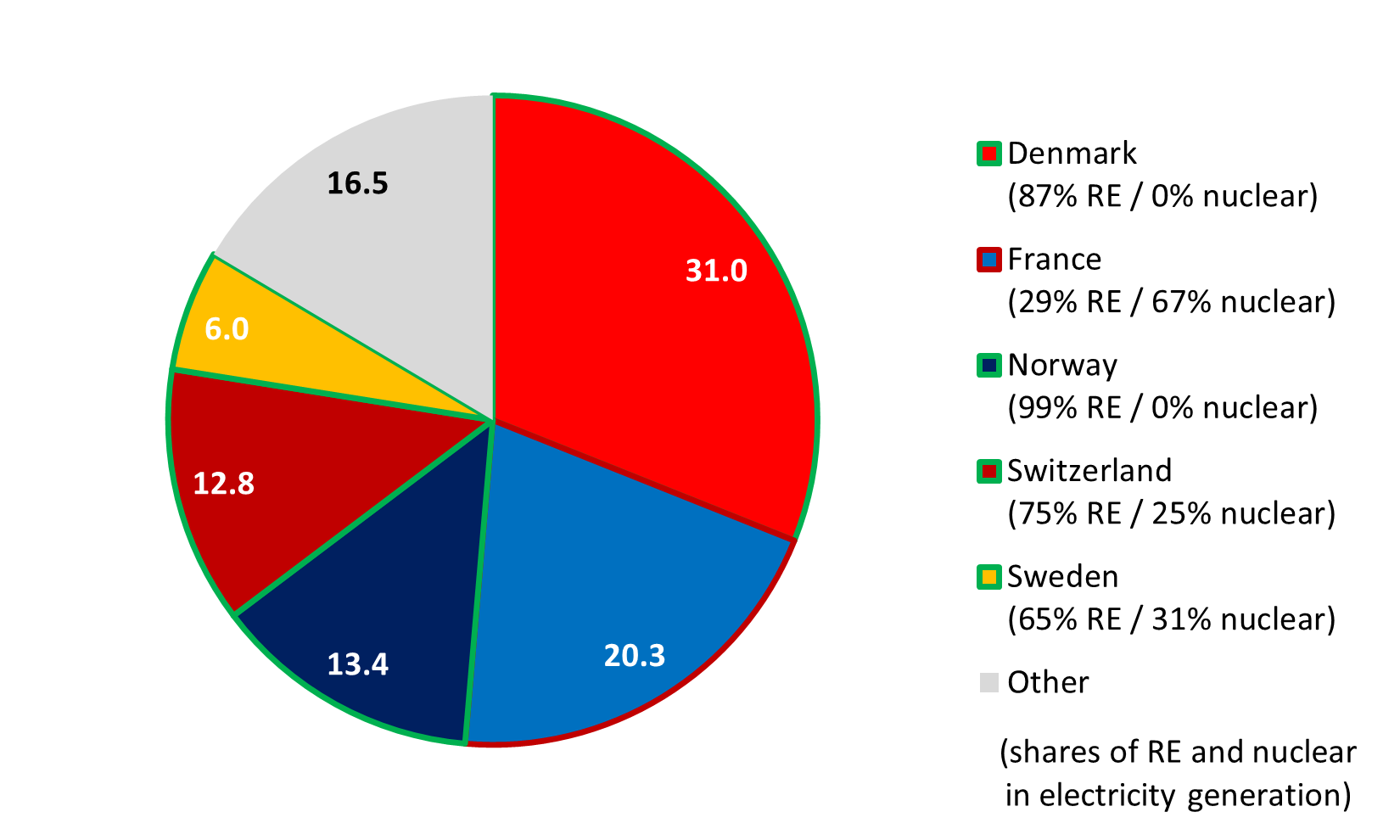

In the case of Germany, domestic fossil power plants suffering from high fuel and carbon costs are outcompeted by RE and nuclear power plants in neighboring countries. Indeed, in the period considered, Germany essentially imported electricity from five countries which electricity generation mixes are largely decarbonized (i.e., RE + nuclear shares surpassing 85% of total electricity generation): Denmark, France, Norway, Switzerland, and Sweden (Chart 5). It may be emphasized that 63.2% of Germany’s total net imports came from four countries (Denmark, Norway, Switzerland, and Sweden) where the share of RE in electricity generation ranged between 65% and 99%. In comparison, only 20.3% – three times less – came from France where the share of nuclear power was 67%. This makes it clear that Germany’s net imports were mainly based on electricity generated from RE, not nuclear power.

Chart 5: Germany Net Imports of Electricity by Country-of-Origin April 16-June 30, 2023 (%)

Sources: for shares of net imports by country; Fraunhofer ISE, Energy-Charts – Daily Cross Border Electricity Trading of Germany in 2023. And for shares of RE and nuclear in electricity generation; Fraunhofer ISE, Energy-Charts – Net Electricity Generation in Denmark, France, Norway, Switzerland, and Sweden in 2023. (All accessed July 11, 2023).

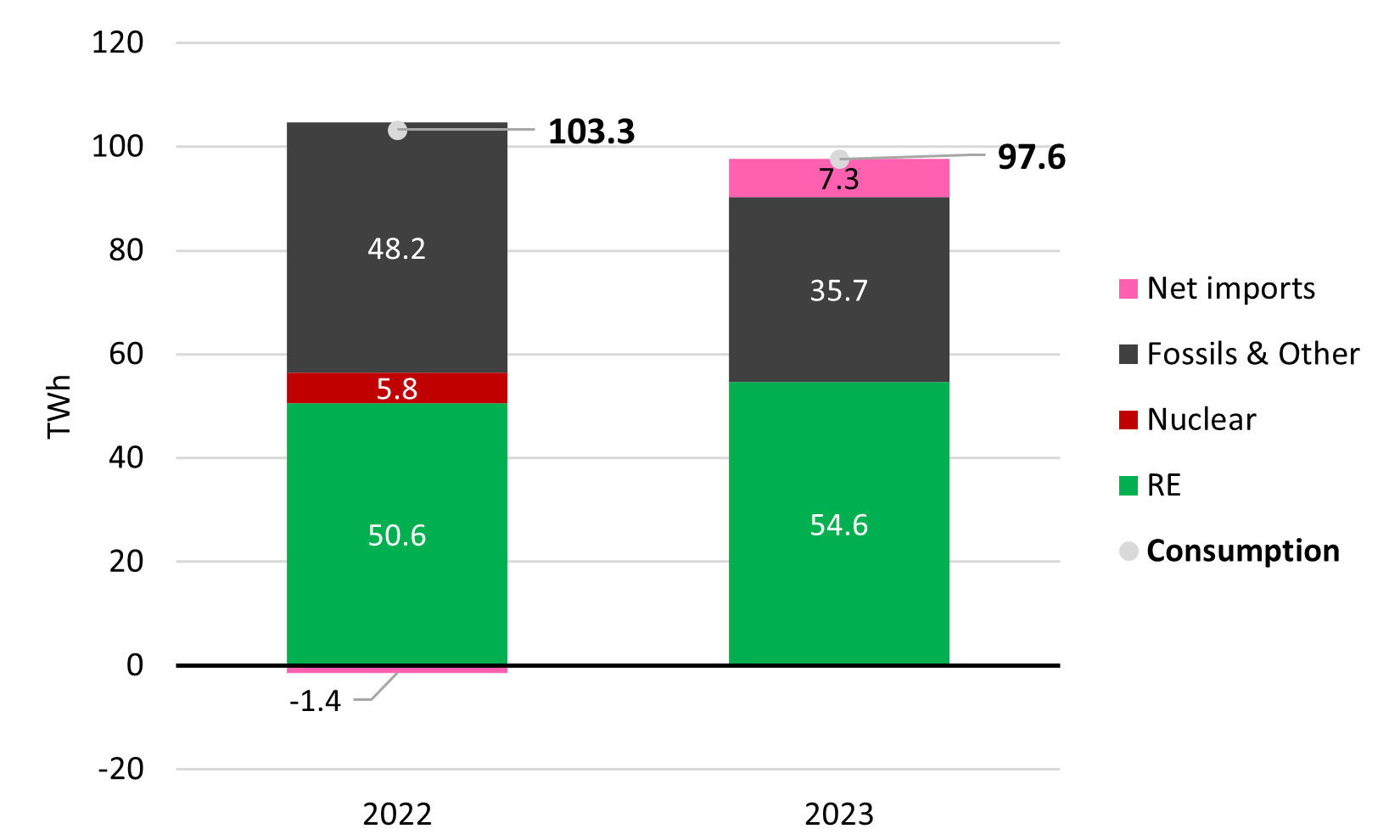

Finally, to avoid misunderstanding that Germany replaced its former domestic nuclear power output with nuclear power imports instead, it must also be stressed that since Germany phased out nuclear power the country managed to combine a 4.0 TWh YoY increase in RE electricity generation with a 5.6 TWh YoY decrease in electricity consumption (Chart 6). This combination (9.6 TWh) exceeds the 5.8 TWh YoY decrease in electricity generation from nuclear power. Therefore, net imports replaced domestic electricity generation from fossil fuels, not nuclear power.

Chart 6: Germany Electricity Supply April 16-June 30, 2022 and 2023

Source: Fraunhofer ISE, Energy-Charts – Net Electricity Generation in Germany in 2022-2023 (accessed July 11, 2023).

Accelerating the Deployment of Wind, Solar, Batteries, and Hydrogen

To reaffirm the competitiveness of its electricity generation mix, Germany rapidly needs to decrease its reliance on fossil power. To do so, the country targets RE to meet 80% of its gross electricity consumption by 2030. To achieve this goal, Germany needs to dramatically expand wind (both on- & off-shore) and solar power, as well as batteries and hydrogen-ready gas-fired power plants. The latter two solutions are for storage purposes, to ensure power supply remains stable when the large majority of electricity is generated from wind and solar.

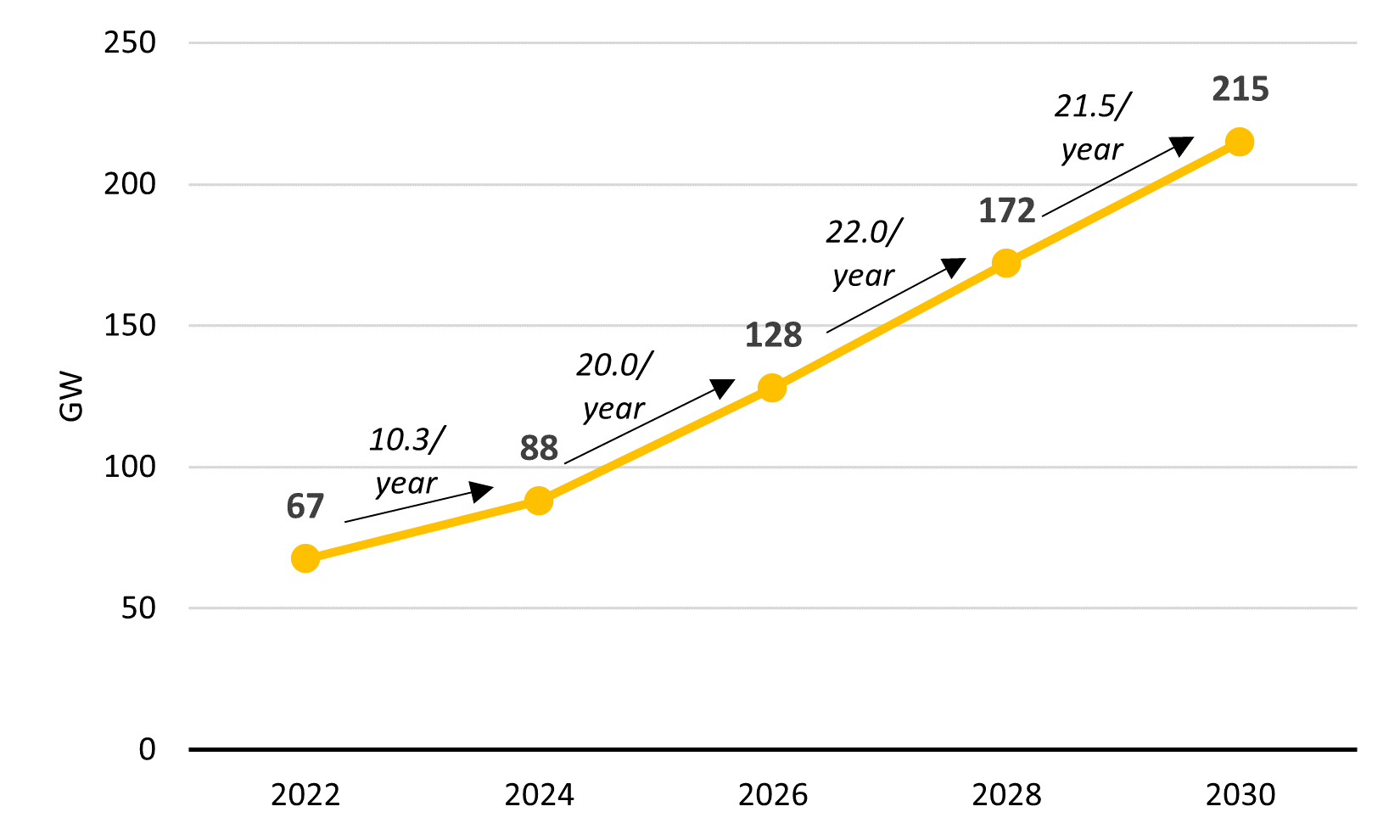

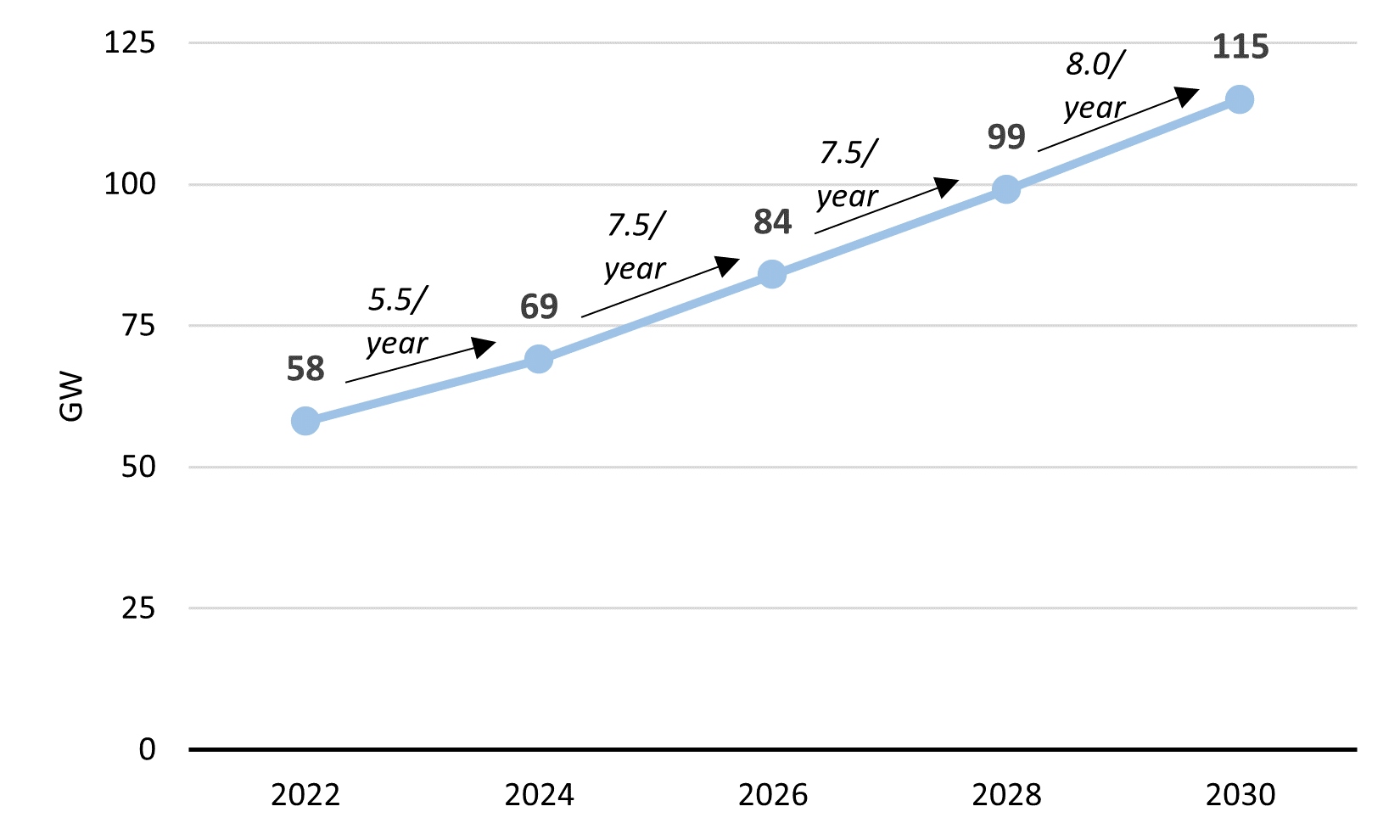

In 2023 H1, the expansion of solar was on track with the country’s planned expansion (+5.1 GW, against half year growth requirement of 5.1 GW) (Chart 7). This was made possible thanks to massive solar PV equipment imports from China, a strong dependency that is a sensitive issue in terms of energy security. To mitigate this risk, Germany will need to diversify its solar PV equipment imports and strengthen its domestic manufacturing capacity.

Chart 7: Germany Solar Power Expansion Trajectory 2022-2030

On the other hand, the expansion of both onshore wind (only +1.0 GW, against half year growth requirement of 2.7 GW) (Chart 8) and offshore wind (only +0.2 GW against half year growth requirement of 1.4 GW, based on a target of 30 GW by 2030 – against 8.1 GW installed in 2022) were not on track in 2023 H1. Regarding wind power, the global wind industry is currently confronted with a challenging economic environment (i.e., more expensive materials and shipping and financing costs) negatively impacting technologies’ growth. Furthermore, onshore wind sometimes faces local opposition in Germany slowing down deployment pace (e.g., in the federal state of Bavaria, southeastern Germany, the conservative government has long been opposing onshore wind power on the ground that it is detrimental to landscapes).

Chart 8: Germany Onshore Wind Expansion Trajectory 2022-2030

To reach its ambitious RE objectives, Germany pursues aggressive promotion policies for both solar and onshore wind. For example, since the beginning of this year, in half of Germany’s sixteen states, legislations are into force to make the installation of solar panels on the roofs of buildings mandatory5. Moreover, in June 2022, the German government adopted a law requiring state governments to secure land, so that 2% of the national territory will be dedicated to onshore wind by 20326.

As for complementary clean energy technologies: batteries are efficient in frequently providing quick flexibility for short periods of time (i.e., up to a few hours). And hydrogen-ready gas-fired power plants are expected to occasionally provide power in case the combined output of wind and solar remains low for a prolonged period (e.g., a month or more as it could empirically be observed). In other words, these two technologies should play the role of backups that is currently played by fossil power. It may be noted here that even if Germany’s electricity grid is well-interconnected with those of its neighbors (e.g., it could import up to 14.5 GW on May 3, 2023 / nearly 20% of the country’s annual peak demand7), the country’s pumped storage hydro capacity is limited (i.e., 6.4 GW – four times less than Japan’s 27.5 GW8 / below 10% of the country’s annual peak demand). Therefore, batteries and hydrogen-ready gas-fired power plants are of strategic importance to Germany.

Battery storage is growing fast in Germany. Cumulative installed capacity increased from only 1.6 GW in 2020 to 4.3 GW in 20229 – almost a tripling. Another 1.4 GW was installed in the first half of this year. This quick uptake is made possible by the cost competitiveness of battery storage. For new utility-scale projects in Germany, BloombergNEF estimates the levelized cost of electricity (LCOE) at ¥12/kWh for onshore wind + battery, ¥18/kWh for solar PV + battery, and ¥28/kWh for a standalone battery (4-hour system)10.

Hydrogen-ready gas-fired power plants are another priority of the German government. These plants are gas-fired power plants capable of burning hydrogen (details about any co-firing are unknown). This type of power plant belongs to the category “decarbonized thermal power”. This terminology also covers power plants such as those co-firing ammonia & coal, as well as those equipped with carbon capture and storage, two technologies promoted by the Japanese government. These latter two technologies are very questionable because of their uncertain economic and environmental efficiencies and because they imply a continued dependence on fossil fuel imports which is unsatisfying from an energy security perspective.

The approaches of the German and Japanese governments towards decarbonized thermal power differ insofar as the German government already made it clear that the hydrogen-ready gas-fired power plants it promotes should ultimately switch from fossil gas to green hydrogen (produced from RE power). Germany has a little more than a decade to make this switch happen to be consistent with its commitment of achieving a fully decarbonized power system by 2035.

In March 2023, Chancellor Scholz called for 17-21 GW of new hydrogen-ready gas-fired power plants for operation by 2030-3111. These new plants are equivalent to about a quarter of Germany’s current operational fossil power capacity (76.4 GW)12. This decision was based on a recommendation of the German Federal Network Agency, the country’s electricity grid regulator. A competitive procurement process is expected to be organized soon to support the take-off of this innovative technology. The key challenge for this technology is to demonstrate its commercial viability which will depend on the cost competitiveness of hydrogen-ready turbines and of green hydrogen. This process will be useful to bring transparency about the actual economics of hydrogen-ready gas-fired power plants. For Germany, BloombergNEF estimates the LCOE of a new load-following combined-cycle gas turbine (CCGT) with green hydrogen at ¥33/kWh and that of a new peaking open-cycle gas turbine (OCGT) with green hydrogen at ¥84/kWh13.

New batteries and CCGT with green hydrogen should outcompete new nuclear – the main technological alternative to complement RE in future 100% decarbonized power systems. For instance, BloombergNEF estimates the LCOE of new nuclear at ¥54/kWh in France14.

However, in the transition period that will span over the next 15-20 years, significant cost reductions will be necessary for new batteries and CCGT with hydrogen in Germany to close the gap with existing French state-owned nuclear power which amortized cost is regulated by law at ¥8/kWh15. This amortized cost reflects the remaining initial investment cost to be recovered over an operational period of 40-50 years – depending on reactors (the average age of the French nuclear reactor fleet is 38 years), the fuel cost, the operation & maintenance cost, and the decommissioning & waste management cost. Economic competitiveness of existing nuclear reactors may deteriorate because of repeated unplanned outages – as recently witnessed in France – and/or technical difficulties in extending their lifetime. Regarding lifetime extensions, it is important to note that these can only be obtained under strict conditions of safety. These are more complicated to demonstrate as reactors get older, which should lead to pragmatic and timely decisions about permanent shutdowns. It cannot be excluded that such negative developments could affect existing nuclear power. If they occur, they will contribute to reducing the cost gap with new batteries and CCGT with green hydrogen.

Exchange rates used (observed on July 12, 2023):

• €1 = ¥154

• $1 = ¥140

- 1Eurostat, Electricity prices for household consumers - bi-annual data (from 2007 onwards) (accessed July 5, 2023).

- 2Eurostat, Electricity prices for non-household consumers - bi-annual data (from 2007 onwards) (accessed July 5, 2023).

- 3Clean Energy Wire, Benjamin Wehrmann, Julian Wettengel, Germany introduces energy saving provisions as key relief runs out and higher prices loom – August 26, 2022 (accessed July 10, 2023).

- 4Fraunhofer ISE, Net installed electricity generation capacity in Germany in 2022 and 2023 (accessed July 11, 2023).

- 5Renewables Now, Anna Ivanova, Overview - Rooftop solar to become mandatory in several German states in 2023 – December 22, 2022 (accessed July 10, 2023).

- 6Renewable Energy Institute, Emi Ichiyanagi, Germany Allocates 2% of its Land to Onshore Wind by 2032: Cabinet Approves "Onshore Wind Energy Act" – June 29, 2022 (accessed July 10, 2023).

- 7Fraunhofer ISE, Net electricity generation in Germany in 2023 (accessed July 10, 2023).

- 8International Hydropower Association, World Hydropower Outlook 2023 (June 2023).

- 9Fraunhofer ISE, Net installed electricity generation capacity in Germany in 2020, 2022, and 2023 (accessed July 10, 2023).

- 10BloombergNEF, Levelized Cost of Electricity 2023 H1 (June 2023) [subscription required].

- 11HYCAP, James Munce, Germany plans new hydrogen-ready gas-fired power plants, highlighting U.K. opportunities – March 12, 2023 (accessed July 5, 2023).

- 12Fraunhofer ISE, Net installed electricity generation capacity in Germany in 2023 (accessed July 10, 2023).

- 13BloombergNEF, op. cit. note 10.

- 14Ibid.

- 15International Energy Agency, Power Purchasing Act (accessed July 7, 2023).