Cross-border electrical grid interconnections are key tools for decarbonization and energy security. As new interconnection projects keep progressing around the world (e.g., Africa, Asia-Pacific, Europe, North America…), operational projects demonstrate great value with the current turmoil in energy markets. Even more in countries confronted to unfavorable weather conditions such as drought (Norway) or nuclear power outages (France). For the time being, the power systems of Japan and South Korea are operated in isolation, preventing them from enjoying the benefits of being interconnected, such as trading renewable energy electricity.

Inspiring new power interconnection projects

Various progresses in advancing new power interconnection projects are taking place around the world. Five of these recent projects have been selected and are briefly presented as sources of inspiration.

First, the start of the construction of the Champlain Hudson Power Express transmission line between Québec, Canada and New York, United States was officially announced in November 2022.1 Thanks to this 1.25-gigawatt (GW) interconnection long of approximately 550 kilometers (km) it is expected that cheap and clean hydropower from Canada will contribute to help the State of New York meet its 70% renewable energy (RE) goal by 2030. The interconnection is scheduled to be fully operational in 2026.

Second, the construction of the Central Asia-South Asia interconnection project (CASA-1000), that will enable to export 1.3 GW of hydropower from Kyrgyzstan and Tajikistan to Afghanistan and Pakistan via transmission lines totaling 1,387 km, is making good progress (Chart 1). For instance, as of October 10, 2022, of the project’s 4,264 transmission towers to be constructed, 2,247 were completed – 53%.

Chart 1: CASA-1000 Interconnection Project

Third, the Australia-Asia PowerLink interconnection project between Australia and Singapore was deemed as an investment ready proposal by the Australian government in June 2022 (Chart 2).2 The capacity of the cross-border interconnection should be about 2 GW and the length of the subsea cables 4,200 km.3 Together with this interconnection, it is planned that 17-20 GW of solar capacity and 36-42 gigawatt-hours of battery storage will be built in Australia. An important hurdle, however, remains to be cleared: convincing the Singaporean government – in principle favorable to RE electricity imports – of the validity of this project. At the moment, on the Australian side, construction is expected to start in 2024 and full operations to be reached by 2029.

Chart 2: Australia-Asia PowerLink Interconnection Project

Fourth, the GREGY interconnection project between Greece and Egypt was presented at the Conference of Parties 27 in Sharm el-Sheikh, Egypt in November 2022.4 This project envisions interconnecting Southern Europe and North continents via a 3 GW 950-km long submarine cable in the Mediterranean Sea. Together with this interconnection, it is planned that 9.5 GW of RE capacity will be built in Egypt. More details should become available as the project is further developed.

And fifth, though it is a project based on existing interconnection infrastructures, it may be highlighted here that Laos and Singapore signed a power purchase agreement to trade RE electricity cross-border in June 2022. Based on this agreement Laos exports 100 megawatts of hydropower to Singapore via Thailand and Malaysia.5

Finally, even if their tangible achievements have been limited to date, it is interesting to note that a couple of competing initiatives are now actively promoting developments of new cross-border power interconnections across the world: the Green Grids Initiative – One Sun, One World, One Grid (launched by India and the United Kingdom in 2021) and the Global Energy Interconnection Development and Cooperation Organization (launched by China in 2016). This signals the growing strategic importance of international electricity trade flows.

Dynamical bidirectional electricity trade between Norway and the United Kingdom

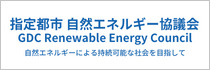

In Europe, cross-border electricity trade is a well-anchored reality with many existing power interconnections enabling to effectively share electricity throughout the entire continent. This section focuses on a case study of a new interconnection between Norway and the United Kingdom. On the one hand Norway is traditionally a net exporter of cheap hydropower, on the other hand the United Kingdom is generally short on domestic power capacity (with an electricity generation mix dominated by gas, RE – mainly wind, and nuclear) and massively relies on imports (Chart 3).

Source: International Energy Agency, Energy Statistics Data Browser: Norway Electricity 2021 and United Kingdom Electricity 2021 (both accessed December 15, 2022).

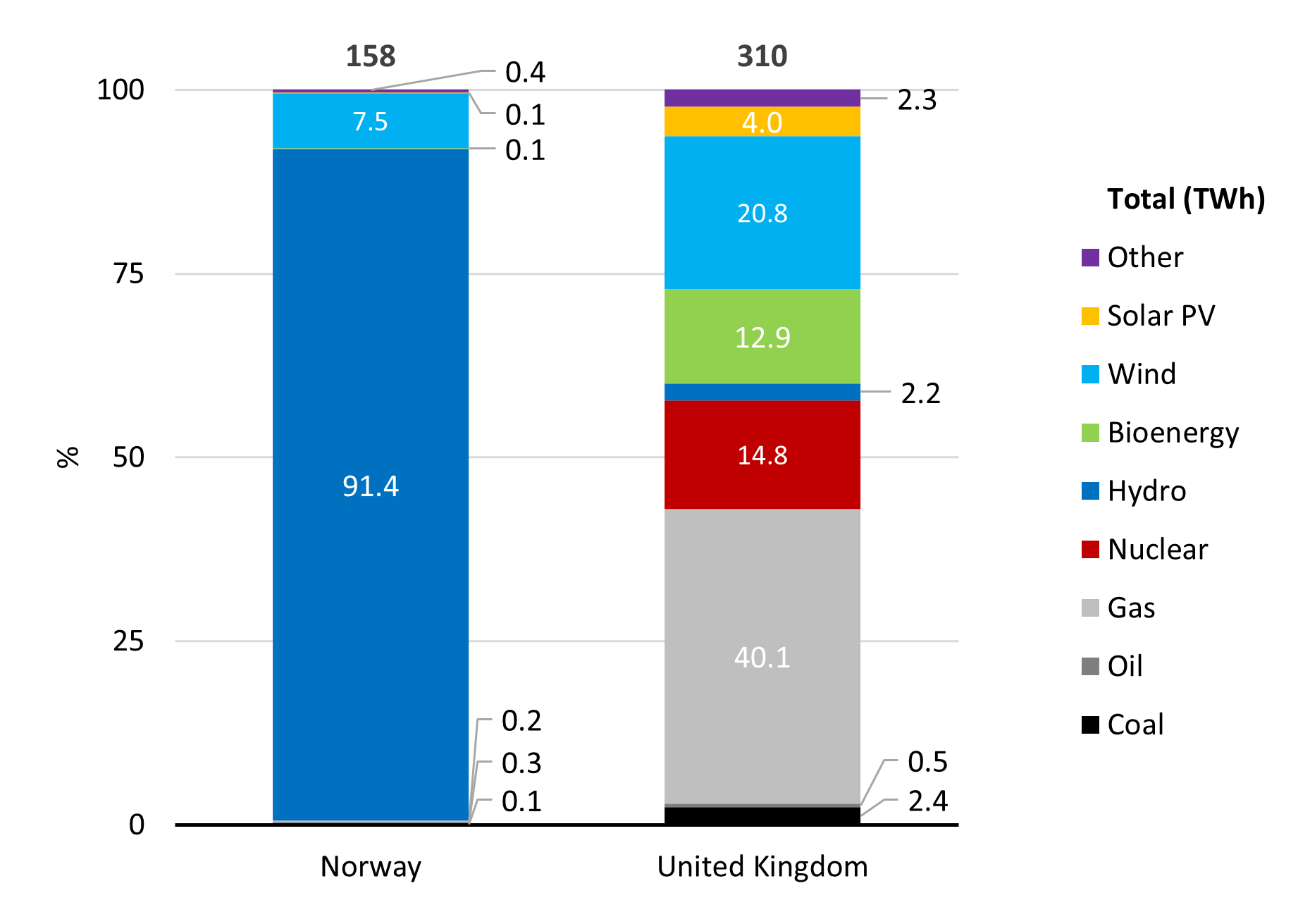

Since October 2021 Norway and the United Kingdom are interconnected via the North Sea Link, the world’s longest subsea electricity interconnector (720 km at depths of up to 700 meters, capacity of 1.4 GW, and cost of €1.6 billion).6 The North Sea Link is one of the four undersea power interconnection projects commissioned between mainland Europe and the United Kingdom in the past 11 years, it is also the most recent one to date (Chart 4). In terms of length, it will soon be overtaken by the Viking Link (760 km), a new 1.4 GW interconnection project between Demark and the United Kingdom to be commissioned in 2023. The dynamic development of undersea cables for power interconnections in the United Kingdom should inspire an island country like Japan.

Chart 4: Undersea Power Interconnection Projects Between Mainland Europe and United Kingdom

Source: National Grid, Interconnectors (accessed December 20, 2022).

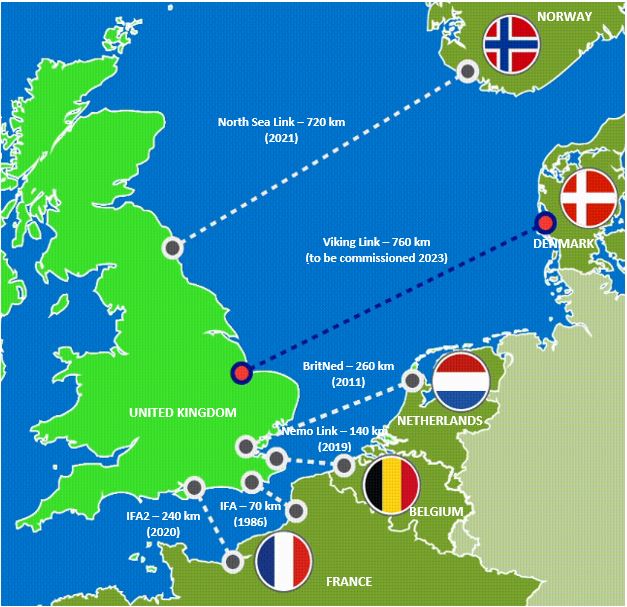

Given Norway and the United Kingdom’s respective power system characteristics, it was widely anticipated that Norway would essentially be exporting power to the United Kingdom. Against all odds, unexpected drought in Norway in 2022 sometimes resulted in higher prices in Norway than in the United Kingdom (Chart 5).

Chart 5: Norway and United Kingdom Monthly Power Exchange Prices 2022

Source: EPEX SPOT, Monthly Power Trading Results (February 2022-January 2023).

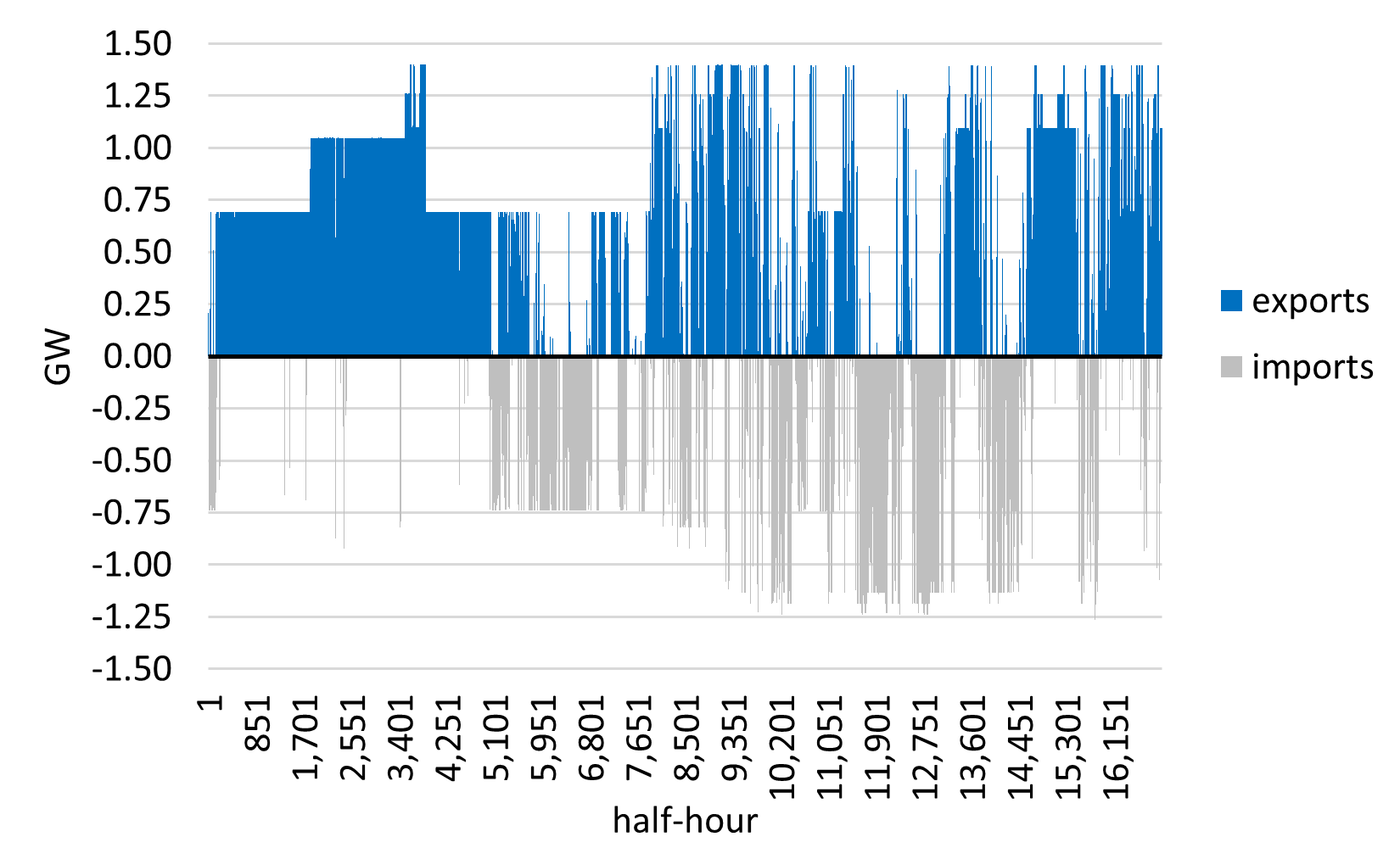

Thus, the prediction that Norway would essentially be exporting power to the United Kingdom turned out to be wrong. Instead, very dynamic bidirectional electricity trade unfolded (Chart 6).

Chart 6: Norway Power Exports and Imports to United Kingdom 2022, as of December 20

As of December 20, 2022 (latest data available at the time of writing), in total, Norway was a net exporter of electricity to the United Kingdom, but only by a mere 2.7 terawatt-hour (TWh) (against a theoretical maximum of almost 11.9 TWh).

This is a good example that with ever changing conditions, cross-border electricity trade typically benefits to both stakeholders whatever their original respective position is supposed to be (i.e., exporter or importer).

France net importer of electricity for the first time since 1980

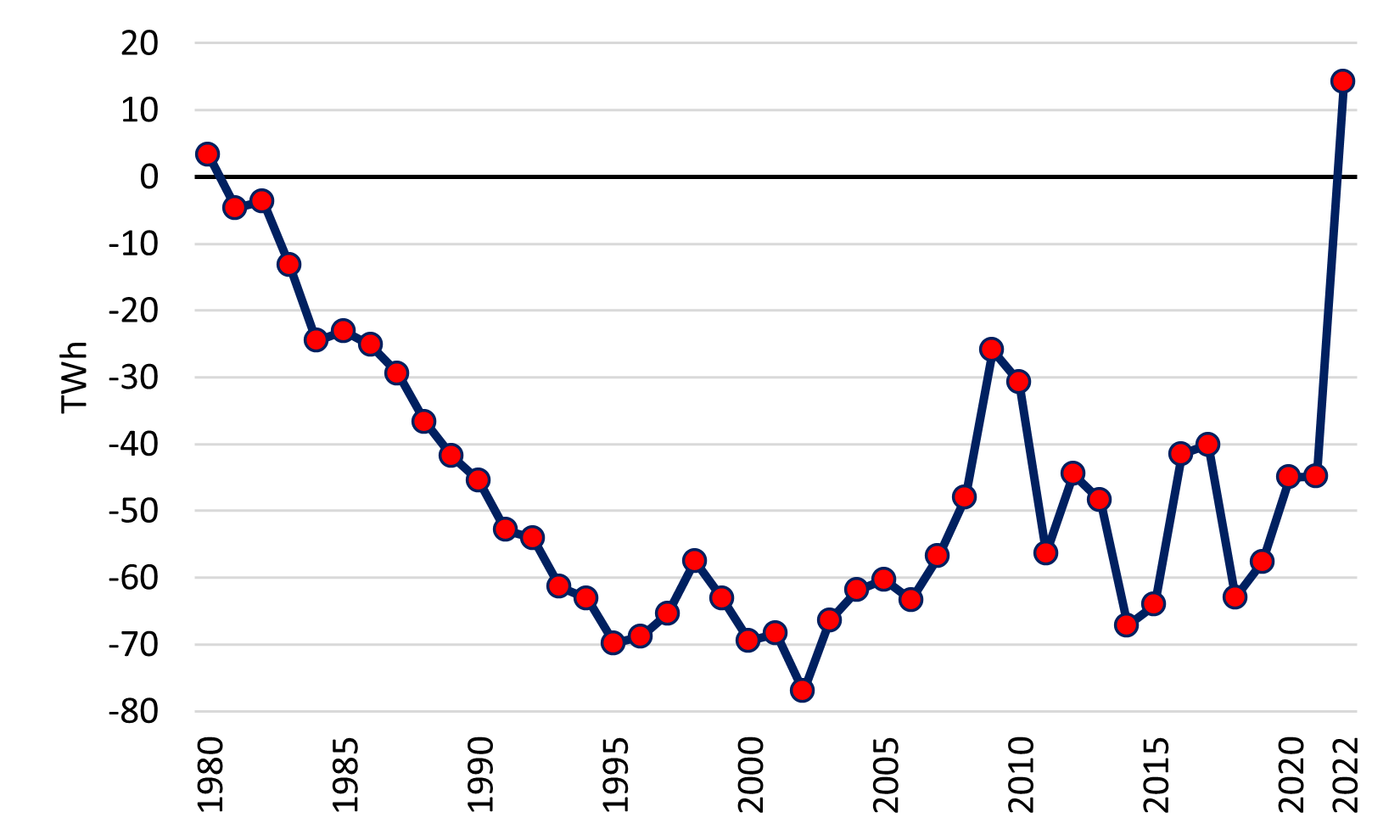

From 1981 to 2021, a long period of four decades, France has continuously been a net exporter of electricity. In 2021, France was even the undisputed world’s largest net exporter of electricity (clearly ahead of Canada, the world’s second largest net exporter of electricity). Witnessing France becoming again a net importer of electricity in 2022 (electricity net imports of more than 14 TWh) is therefore an enormous surprise (Chart 7).

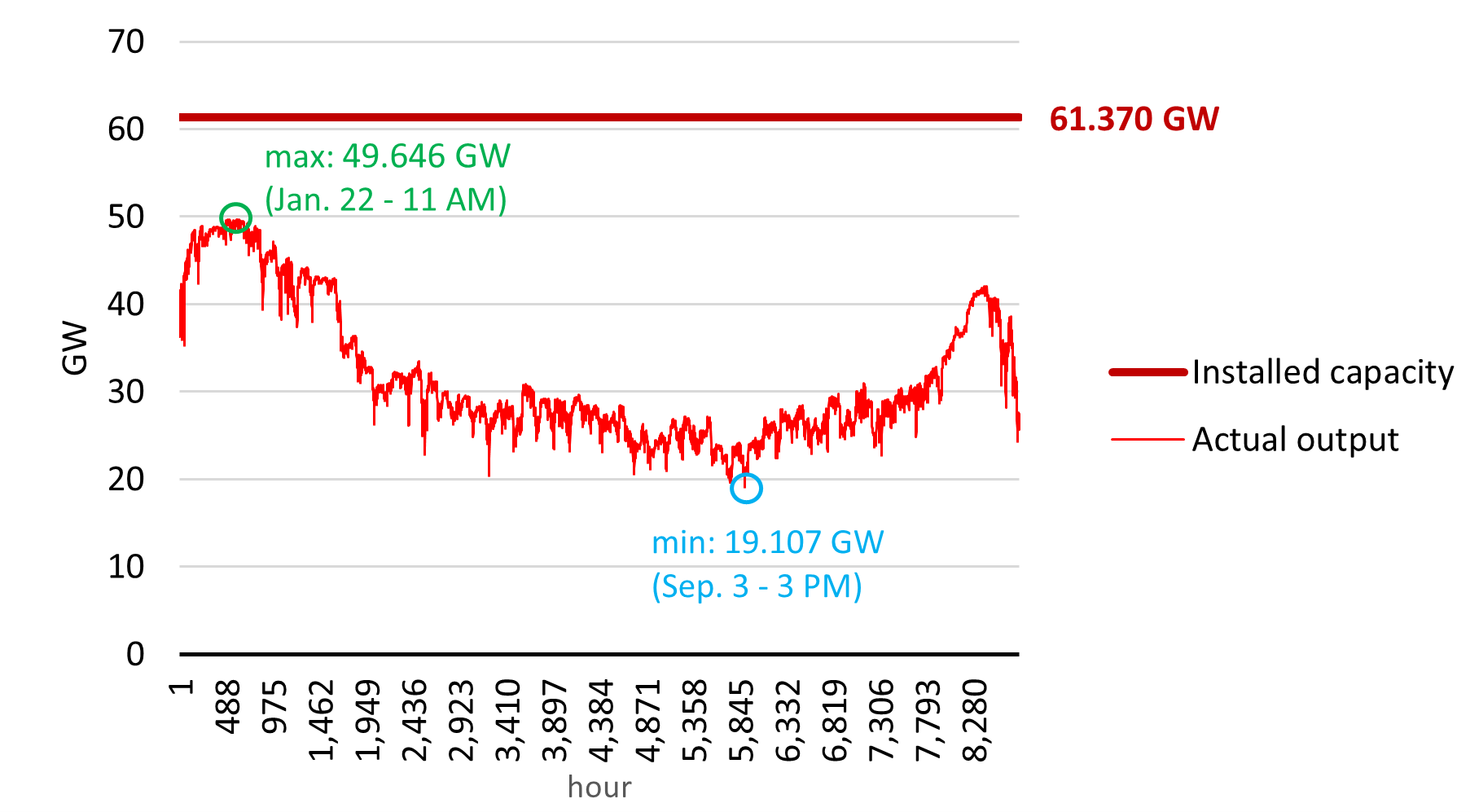

This result is mainly due to the poor performances of the French nuclear power fleet (56 reactors with a combined capacity of 61.370 GW) in a year that has been marked by outages affecting many reactors. These outages were due to different technical issues, among which two were particularly important. First, the “Grand Carénage”, a program focusing on safety upgrades and reactor lifetime extensions taking place from 2014 to 2025, limited the availability of nuclear reactors. Second, discoveries of cracks in pipes resulting from stress corrosion led to several temporary reactor shutdowns for inspections and repairs.7

More specifically, in 62% of the hours of the year 2022, more than half of the country’s nuclear power installed capacity did not deliver electricity (Chart 8).

Chart 8: France Hourly Nuclear Power Output VS. Installed Capacity 2022

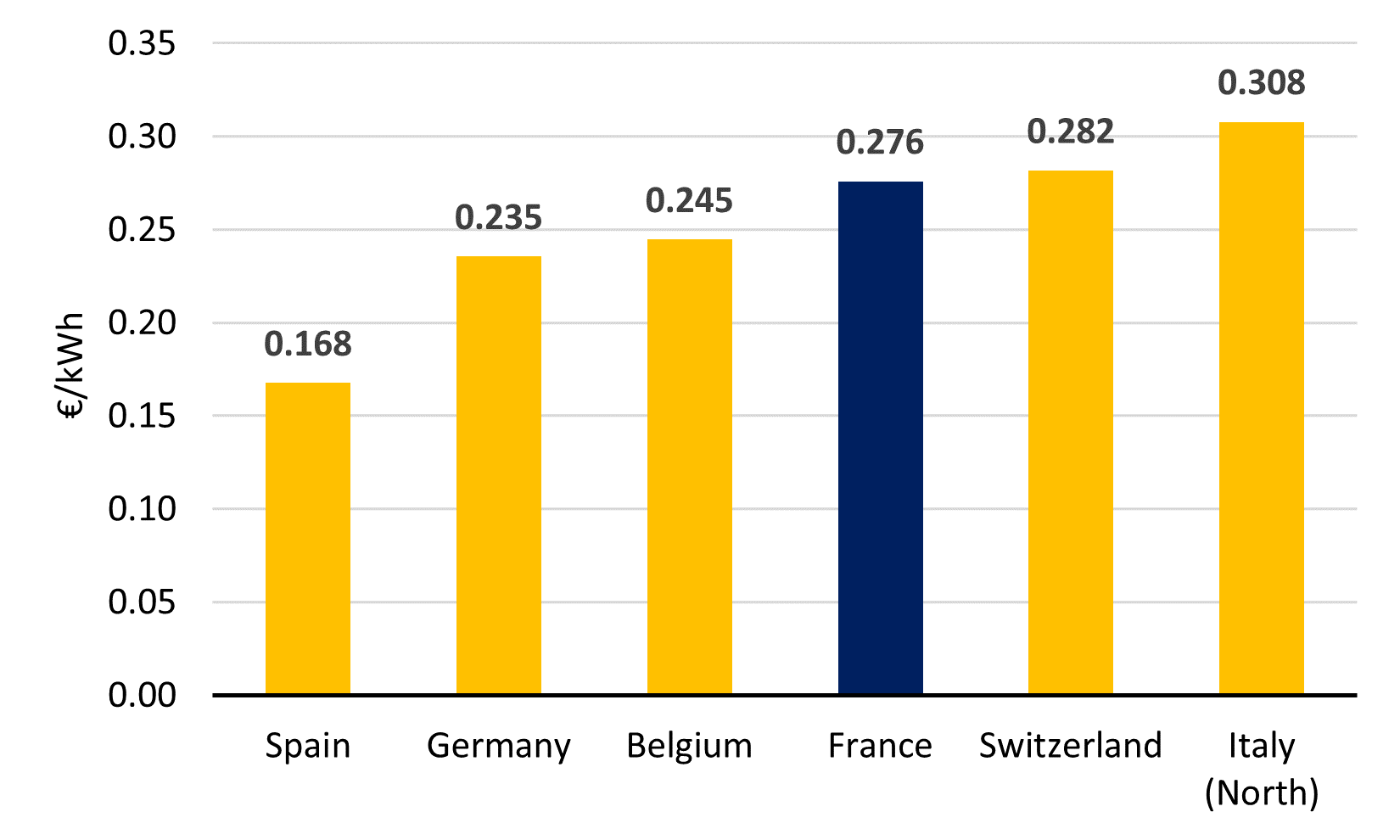

Because of this lack of supply capacity, France to meet its electricity demand thus had to substantially rely on power imports, which prices were often lower than domestic prices (Chart 9).

Chart 9: France and Interconnected Neighboring Countries Average Hourly Power Exchange Prices 2022

Source: European Network of Transmission System Operators for Electricity, Transparency Platform: Day-Ahead Prices (accessed January 11, 2023).

Some of the French imports notably came from the ElecLink, a new 1 GW interconnector between France and the United Kingdom, connecting the two countries through the Channel Tunnel, commissioned in May 2022.8 Regarding, progress of new interconnection projects in France, it may also be added here, that in November 2022 France and Ireland announced the official signing of the technical and financial agreements for the Celtic Interconnector.9 This project will connect the two countries via a 0.7 GW, 575-km long cable (essentially undersea). This project is estimated to cost €1.6 billion and is planned to be commissioned by 2026.

Japan and South Korea missing yet another opportunity

On the other side of Earth, in Northeast Asia, the same economic, environmental, and energy security benefits could be brought by international power interconnections. Particularly in Japan and South Korea, two large power system remaining desperately isolated, where RE electricity generation is insufficient and sometimes wastefully curtailed. Indeed, instead of partnering, each country keeps evolving in parallel without trying to exploit the benefits an interconnection between them would offer.

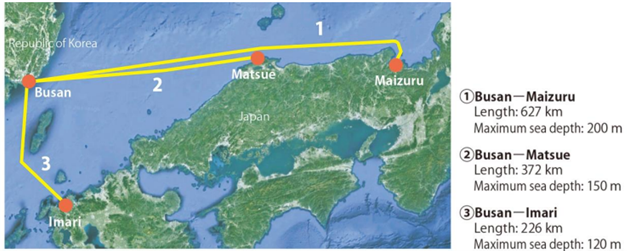

In a report published in June 2018, the Asia International Grid Connection Study Group, a group of experts in electrical grid, energy policies and RE from academics, business and research related fields, and which Secretariat office function is undertaken by Renewable Energy Institute, considered three possible interconnection routes between Japan and South Korea (Chart 10). For the sake of the following analysis conciseness, only one of these routes is referred to in this column: the Imari (Kyushu, Japan)–Busan (South Korea) route.

Chart 10: Japan-South Korea Possible Interconnection Routes

According to the Asia International Grid Connection Study Group, Kyushu and South Korea may be interconnected via a subsea cable of “only” 226 km – less than a third the length of the North Sea Link, at a maximum sea depth of “only” 120 meters – about one-sixth the depth of the North Sea Link. This means the realization of a power interconnection project between Kyushu and South Korea is technically feasible. Moreover, the cost of such interconnection was also estimated: ¥129 billion (excluding domestic grid reinforcement).

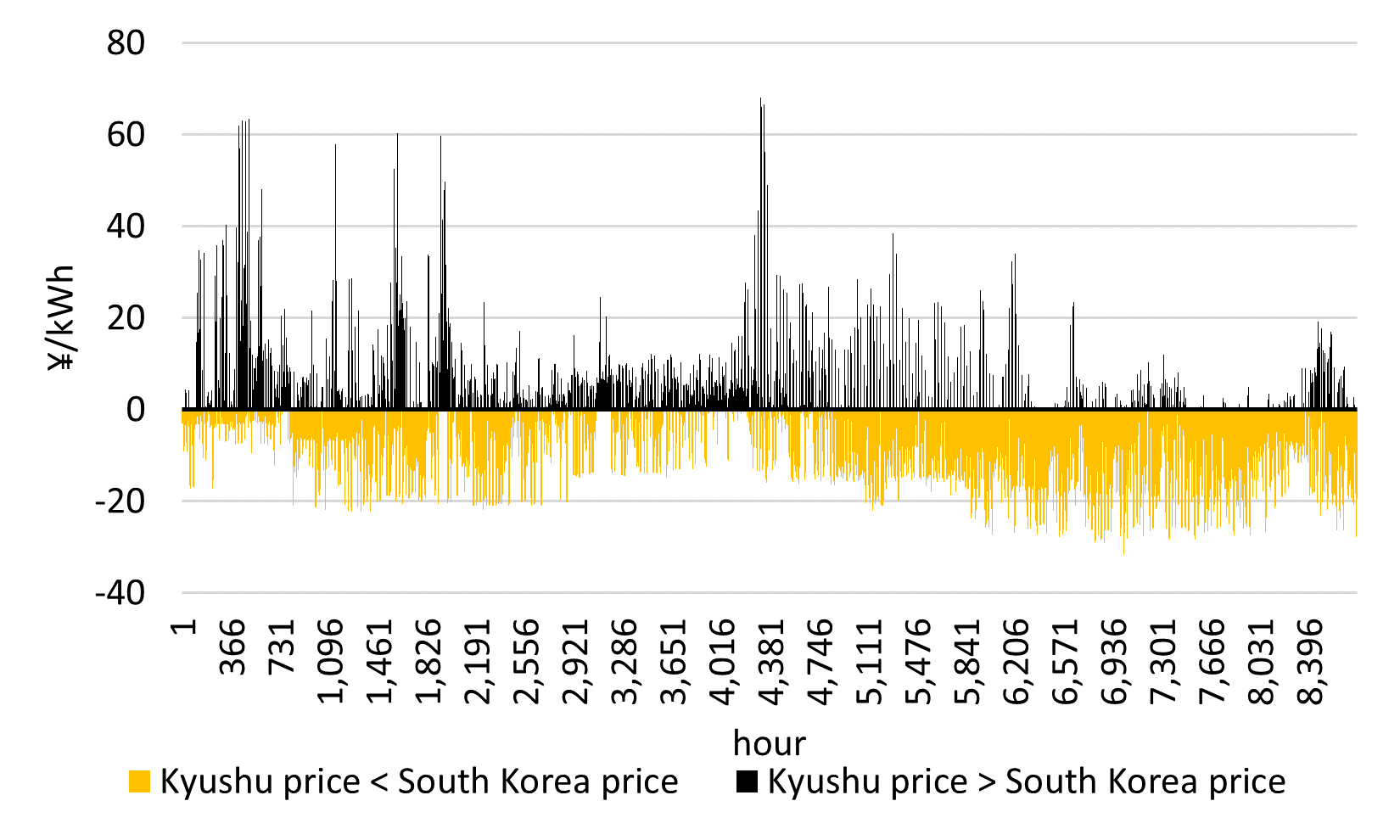

Considering economic and environmental perspectives, the frequent significant differences in hourly power exchange prices in Kyushu and South Korea should draw attention, as well as solar photovoltaic (PV) and wind power curtailment in Kyushu. Differences in hourly power exchange prices is an important prerequisite for profitable electricity trade. Even without referring to extreme examples or entering into details, it is clear that such differences exist between Kyushu and South Korea, and that power exchange prices in Kyushu are often lower than in South Korea (in 68% of the hours of 2022) (Chart 11).

Sources: Data for Kyushu, Japan Electric Power Exchange, Spot Market Trading Results: Fiscal Years 2021-2022, and data for South Korea, Electric Power Statistics Information System, System Marginal Price: Hourly 2022 (both accessed January 11, 2023).

These differences are mainly due to different power system structures: Kyushu’s power supply is less dependent on expensive fossil fuels (coal, gas, and oil) than that of South Korea, notably thanks to RE and especially solar PV, and Kyushu’s power supply is relatively large compared to its power demand (i.e., enabling Kyushu to always unidirectionally export power to Chugoku, Japan – the only other area it is interconnected with) which is not a feature of South Korea’s power system.

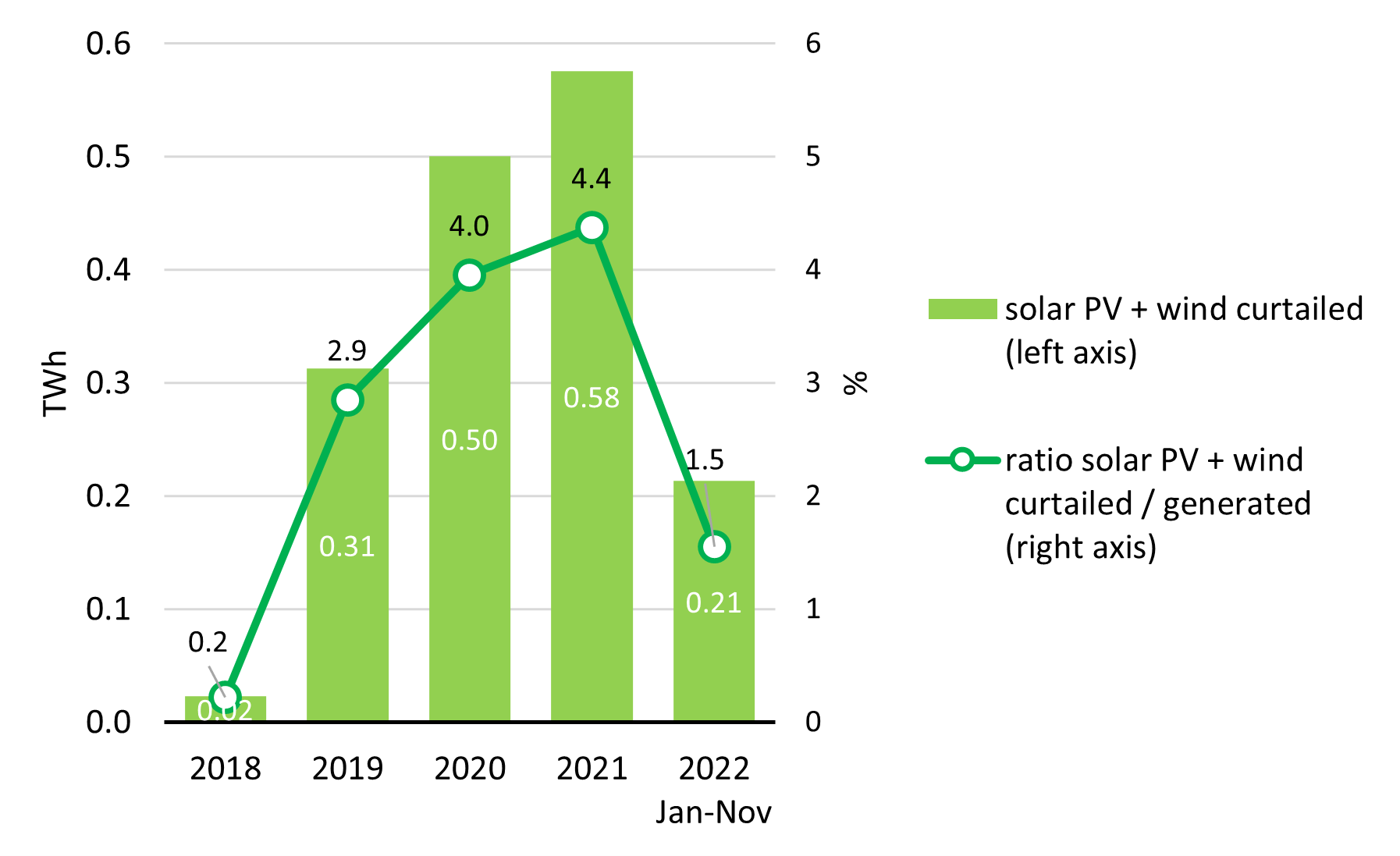

Curtailment of solar PV and wind power in Kyushu is an economic and environmental waste (Chart 12), exacerbated by an irrational priority dispatch rule in favor of nuclear power in Japan (i.e., solar PV and wind power curtailment is negatively impacted by the deliberate inflexible operations of nuclear power plants).

Chart 12: Kyushu Solar PV + Wind Power Curtailment 2018-2022

Source: Renewable Energy Institute, Power Supply & Demand Chart: Kyushu 2018-2022 (accessed January 11, 2023).

Would an interconnection between Kyushu and South Korea exist, this issue would at least partially be alleviated. It would also be an opportunity for South Korean companies such as Hyundai, LG or Samsung to make progress towards their challenging 100% RE commitments. According to the International Energy Agency, in 2021, the share of RE in South Korea was only 6.9% – more than three times less that of Japan (21.7%).10

Finally, the soccer world cup 2022 in Qatar recently ended. Readers of this column have probably not forgotten that roughly two decades ago Japan and South Korea uniquely and successfully co-hosted this popular event. It is regrettable that after so many years, these two countries did not manage to extend their remarkable collaboration from the soccer fields to the energy field.

- 1New York State, Governor Hochul Announces Start of Construction on 339-Mile Champlain Hudson Power Express Transmission Line to Bring Clean Energy to New York City – November 30, 2022 (accessed December 21, 2022).

- 2Australian Government – Infrastructure Australia, Australia-Asia PowerLink – June 24, 2022 (accessed December 21, 2022).

- 3Sun Cable, Sun Cable’s Australia-Asia PowerLink Deemed Investment Ready by Infrastructure Australia – June 24, 2022 (accessed December 21, 2022).

- 4Copelouzos, Elica SA, a Company of Copelouzos Group, Presented the Iconic Project of the Egypt-Greece Electrical Interconnection Egypt-Greece at the United Nations World Conference on Climate Change COP27 – 8 November 2022, (accessed December 21, 2022).

- 5Energy Market Authority, Singapore Commences First Renewable Energy Electricity Import via Regional Multilateral Power Trade – June 23, 2022 (accessed December 22, 2022).

- 6North Sea Link, National Grid Powers Up World’s Longest Subsea Interconnector Between the United Kingdom and Norway – October 1, 2021 (accessed December 15, 2022).

- 7Renewable Energy Institute, France’s Nuclear Power: Current Difficulties, New Policies, and 100% Renationalization (August 23, 2022).

- 8ElecLink, Commissioning Activity Successfully Completed – May 13, 2022 (accessed December 20, 2022).

- 9European Investment Bank, Celtic Interconnector Agreements Signed between France and Ireland – November 25, 2022 (accessed December 20, 2022).

- 10International Energy Agency, Energy Statistics Data Browser: South Korea Electricity 2021 and Japan Electricity 2021 (both accessed December 19, 2022).