Because of reliability failures France’s nuclear power is currently underperforming. Despite this problem the French government remains supportive of nuclear power as demonstrated by the new policies announced by President Emmanuel Macron in favor of this technology on February 10, 2022. Nevertheless, implementing these policies will be challenging and require a strong business operation structure in Électricité de France (EDF). EDF is France’s former national vertically integrated monopoly for electricity and the world’s #1 nuclear power company – the cornerstone of the French power system. On July 6, 2022, French Prime Minister Elisabeth Borne confirmed the State’s intention to control 100% of EDF (instead of 84%).1In the status quo, because of EDF’s economic fragility, resulting from issues related to nuclear power and detrimental political choices, the government does not consider the company capable of executing the planification of the country’s energy transition in the power sector – and notably its new nuclear power program. However, this 100% renationalization will certainly not make EDF and nuclear power suddenly thrive. Key actions will be needed regarding new financing schemes for nuclear power, end user price increases, and the reorganization of the company.

Current difficulties of nuclear power in France

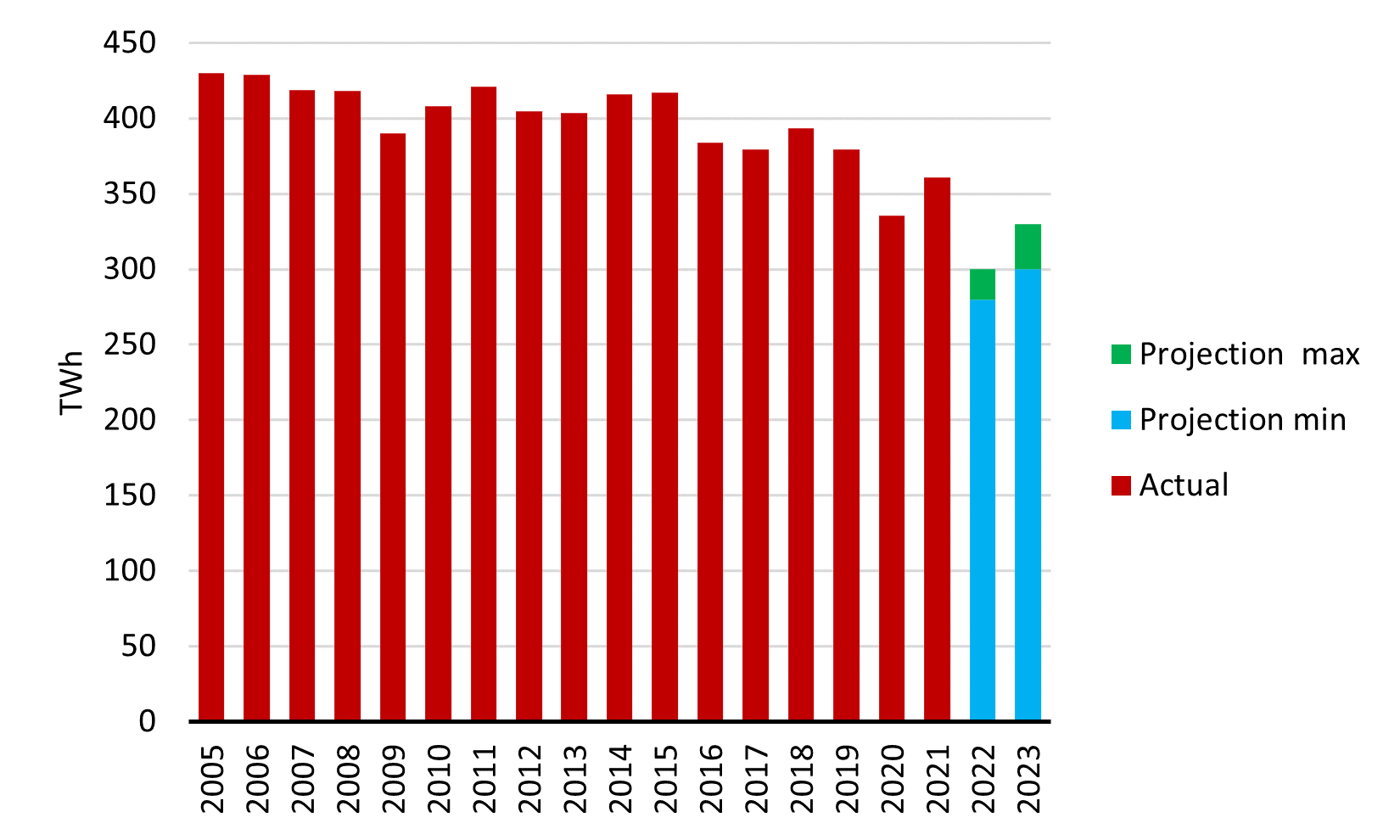

In May 2022, EDF, the sole owner and operator of France’s 56 nuclear reactors (61 GW), projected electricity generation from nuclear power to significantly decrease to 280-300 TWh in 2022 and slightly rebound to 300-330 TWh in 2023. Both projections are well-below the country’s nuclear electricity generation peak of 430 TWh reached in 2005 – approximately -33% and -27%, respectively (Chart 1).

These negative projections are due to five factors currently affecting the output of French nuclear power. First, the “Grand Carénage”, a program focusing on safety upgrades and reactor lifetime extensions taking place from 2014 to 2025 – covering all existing reactors (average age of the fleet: 37 years), limits the availability of nuclear reactors.2Second, the COVID-19 pandemic has derailed the maintenance of reactors which is usually tuned like clockwork. Third, discoveries of cracks in pipes resulting from stress corrosion have led to the temporary shutdowns of 12 reactors of the most recent reactors for inspections. Fourth, unfavorably dry and warm weather conditions make it more complicated to cool reactors which must either reduce their output or temporary shut down. And fifth, the endless delays to start operating Flamanville-3 under construction since 2007 (completion originally planned for 2012 and now expected for 2023 at the earliest) results in a lack of 1,630 MW. As a result, since the beginning of 2022 more than half of French nuclear reactors have sometimes been unavailable leaving a deep hole in the French power system.

Finally, it may be noted that because of these underperformances, as well as the closures of almost all coal and oil power plants in France – which have not been sufficiently replaced by renewable energy, the country has become short on power supply capacity. Therefore, it now needs to rely on expensive imports. In this regard, on April 3, 2022, France’s power imports reached a new record of almost 14 GW (out of which more than half from Germany).3This is an upset for a country that is traditionally one of the world’s largest net exporters of electricity.

Despite difficulties France supportive of nuclear power again

On February 10, 2022, French President Macron announced his optimistic intention to extend the lifetime beyond 50 years of all the country’s existing reactors and to build 6 to 14 new large reactors as well as some small modular reactors (additional 25 GW by 2050).4The construction of the first new large reactor should start in 2028 with commissioning targeted in 2035. The first prototype of small modular reactor is forecasted for 2030. This announcement is the first positive set of objectives for the French nuclear industry in decades. It also has the merit to be clear after a period of very confusing energy policies between 2012 and 2021.

Two reasons may explain French policymakers’ recent change of heart in favor of nuclear power:

First, a report by the national transmission system operator Réseau de Transport d'Électricité (RTE), “Energy Futures 2050”, a long-term outlook of the French power system in the context of carbon neutrality by 2050 and beyond. The highlighted economic finding in this analysis is that: Under an electricity consumption scenario of reference, an electricity supply based on 50% nuclear power and 50% renewable energy would be the most cost-efficient electricity generation mix for the French power system in 2060. This scenario would require massive reactor lifetime extensions and constructing 14 new large reactors as well as some small modular reactors. It is hard not to see the similarities with President Macron’s announcement, which undoubtedly found a source of inspiration in RTE’s report. Earlier this year, Renewable Energy Institute already debated France’s new nuclear power plans in a column, questioning their feasibility because of the techno-economic difficulties they actually face [published on January 28, 2022].

Second, because of the ongoing energy crisis, energy security is under the spotlight again as during the oil shocks of the 1970s. At that time, France’s bold answer was to launch an unequaled nuclear power program to reduce the country’s exposure to fossil fuel imports. About a half century later the legacy of this program is significant with almost 70% of France’s electricity generation in 2021 still coming from nuclear power – by far the highest share in the world – thanks to the 56 reactors all connected to the grid between 1978 and 1999. So, what the French government sees in nuclear power is a good old remedy. To justify this stance, it considers that even if natural uranium is not mined in the country – and therefore needs to be imported (essentially from Niger, Kazakhstan, Uzbekistan, and Australia in the case of France), uranium is relatively easy to transport and store. However, this approach is controversial because it necessarily implies a contradictory continued dependance on foreign countries.

Finally, despite its recent underperformances, the domestic nuclear industry remains seen as one of the last few industrial strengths of France. This is not the case of the country’s renewable energy industry, which is not well-positioned: Neither in terms of access to critical minerals as inputs, nor in terms of manufacturing capacity of key technologies such as solar photovoltaic modules or wind turbines.

EDF’s 100% renationalization

Under these circumstances, the French government made the decision to turn back the clock by resuming EDF as a 100% nationalized entity. The following sub-sections answer the main questions about this renationalization.

The double objective of this strategical decision is (1) to retake full control of the country’s power sector energy transition & energy security and (2) put an end to the unsustainable situation of continuously frustrating minority shareholders with political decisions penalizing the company’s interests to protect customers. This is a clear signal the French government considers that in the status quo EDF is not capable of executing the planification of the country’s energy policy in the power sector which will require more low carbon electricity to decarbonize the transportation and the heating & cooling sectors. That is because of the economic difficulties the company is confronted with. Therefore, a major shake-up of EDF is needed and having a single decisionmaker should facilitate this process. The takeover bid on the 16% of the capital remaining to be acquired (i.e., shares and convertible bonds) is estimated at €9.7 billion.5

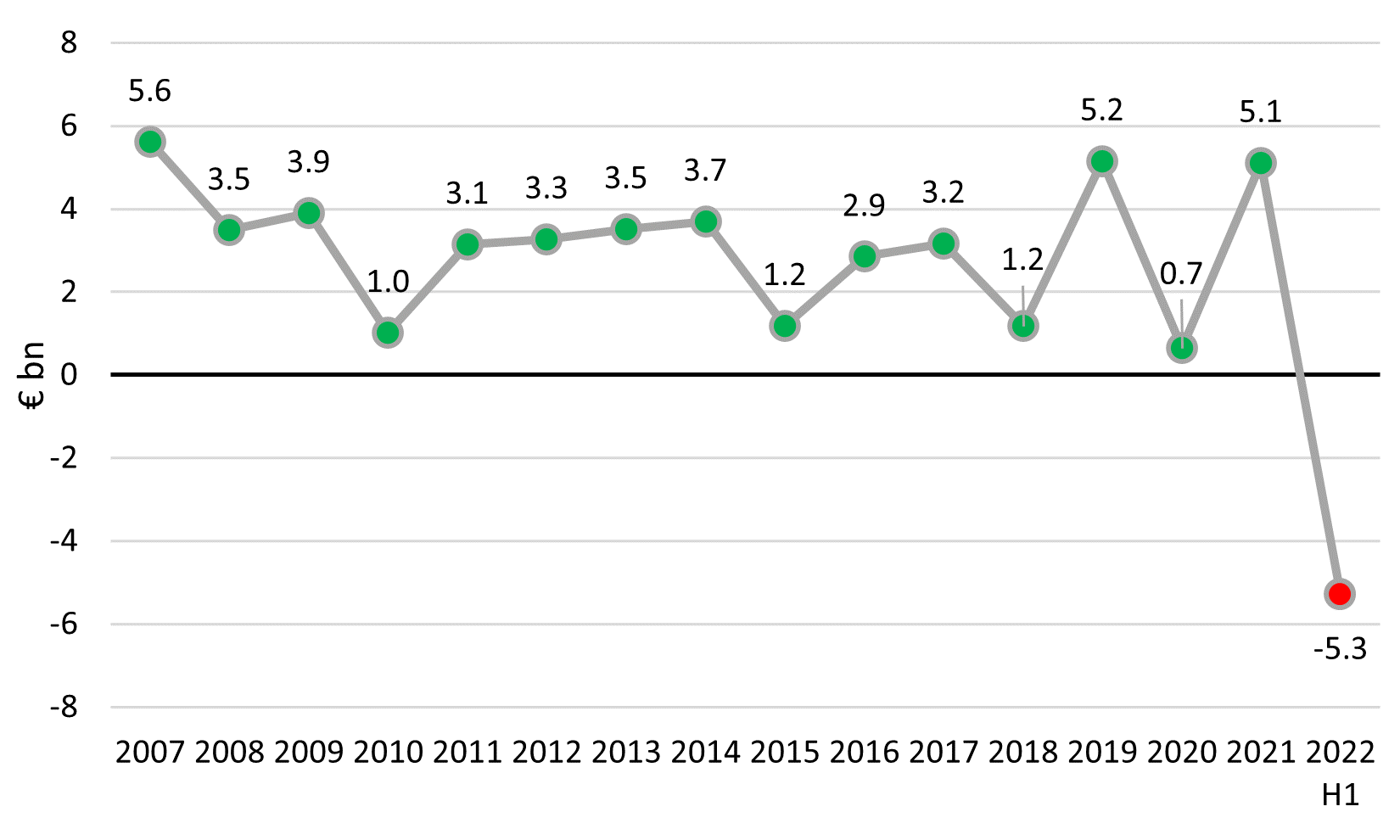

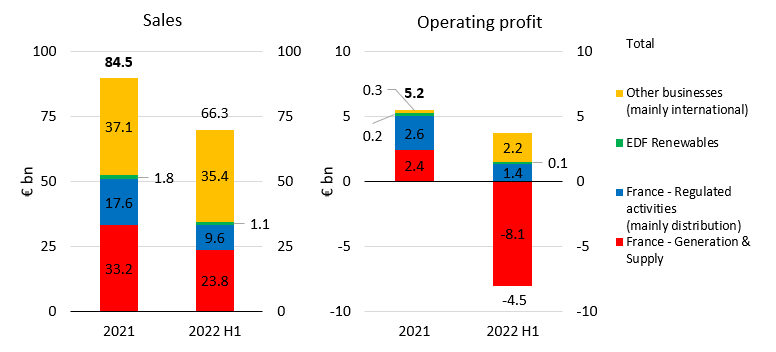

In the first half of 2022 the company recorded an historical loss of €5.3 billion (Chart 2). There are two main reasons for EDF’s present economic difficulties: (1) worsening performances of the French nuclear industry, especially in the first half of this year (already presented in the first section of this column) – a terrible timing given the invasion of Ukraine by Russia causing severe turmoil on energy markets, and (2) two key harmful political choices by French governments; the “Regulated Access to Historic Nuclear Electricity” (abbreviated ARENH in French and used in hereinafter) and the tariff shield. Because neither the issues related to French nuclear power nor those related to French energy policies will be solved in 2022 H2, further deterioration of EDF’s net income may be expected by the end of this year.

Source: EDF, Financial Results 2007-2022 H1 (accessed August 1, 2022).

Moreover, in the past 15 years EDF’s net financial debt quasi tripled: From €16.3 billion at the end of 2007 to €42.8 billion at the end of June 2022. This is mainly because of EDF’s appetite for internationalization translating into costly acquisition of foreign companies (e.g., British Energy for €19 billion in 2009 and Edison for €5 billion in 2012), and because of major investments into two domestic major nuclear power projects: the “Grand Carénage” program (about €50 billion) and the country’s single reactor under construction Flamanville-3 (around €23 billion).

This level of indebtment limits EDF’s ability to finance France’s energy transition that requires massive investments in nuclear power, renewable energy, and power grids.

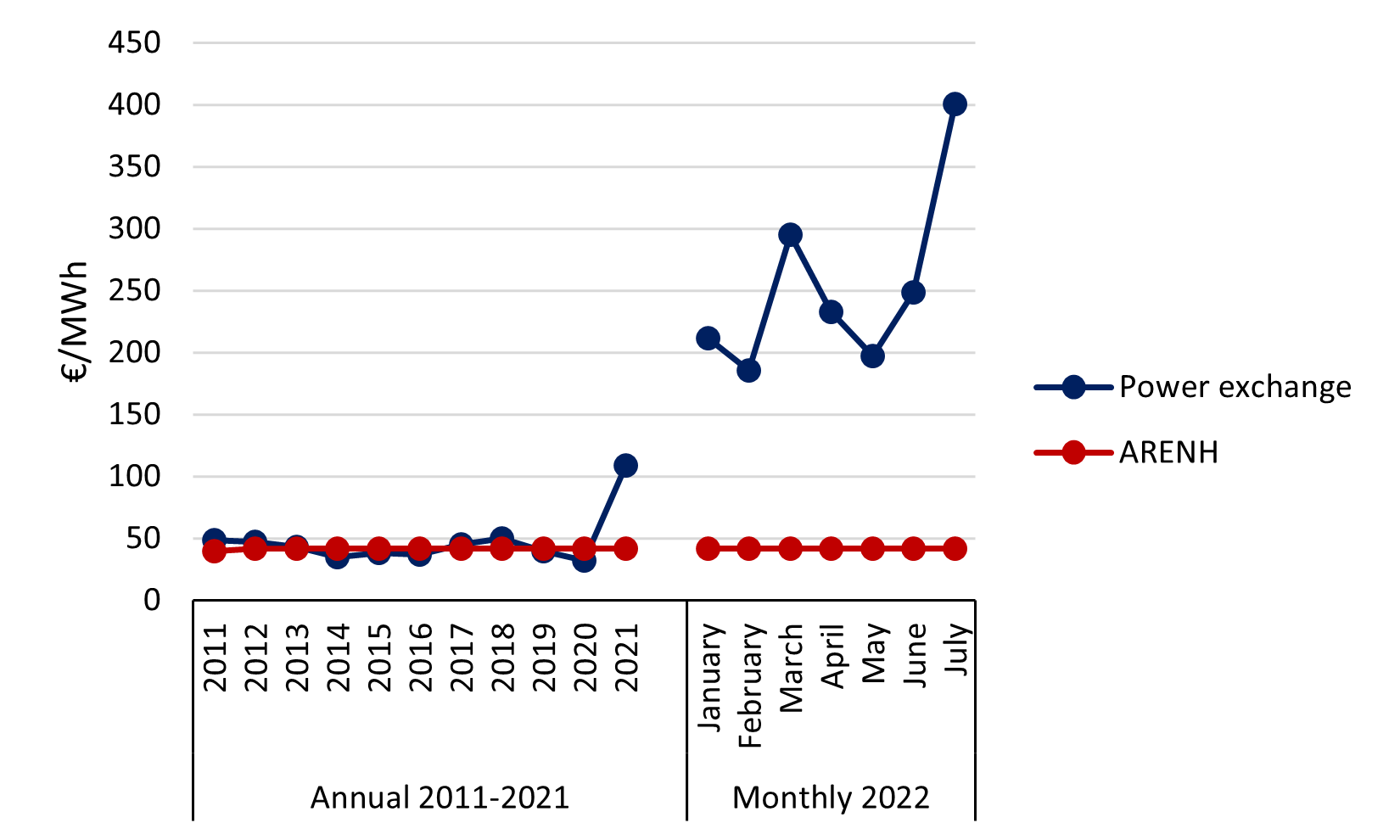

Enacted in 2010 and into force since 2011 to theoretically encourage supply competition in the framework of France’s electricity system reform, the ARENH mechanism forces EDF to sell up to 100 TWh per year of its own nuclear power-based electricity to new entrants (e.g., ENGIE, Iberdrola, Vattenfall…) who could not have otherwise competed with EDF until the recent emergence of cost competitive renewable energy, enabling arbitrage among electricity generating technologies. The price of the ARENH should reflect the cost of existing nuclear power without a profit for EDF (i.e., sale at cost price). The original price was €40/MWh in 2011 and it marginally increased to €42/MWh from 2012. ARENH prices have often been competitive compared to power exchange prices, especially in 2021-2022 (Chart 3). Despite the heavy investments of the “Grand Carénage” program, the ARENH price remained at the same level for a decade resulting in prolonged underpayments of EDF’s assets (it will, at last, increase in 2023 – €49.5/MWh).6

Moreover, because of the ongoing global energy crisis the French government implemented a tariff shield as a protective means in a tense social context marked by increasing energy poverty and the traumatic memory of the yellow vest protests (notably against the high cost of living) still haunting policymakers. Thus, despite skyrocketing wholesale electricity prices, the increases of EDF’s regulated electricity retail tariffs for residential and some professional customers are temporarily capped at only 4%.7Furthermore, EDF was forced to sell an extra 20 TWh to its competitors in the framework of the ARENH at a price of €46.2/MWh, and to buy 20 TWh from its competitors at a price of €257/MWh.8This decision was made to protect EDF’s competitors from a wave of bankruptcies and keep a parody of competition in the supply market alive. In reaction to this situation, on August 9, 2022, EDF filed a legal claim against the French government for indemnification for an amount estimated to date at €8.3 billion.9This absurd outcome demonstrates the failure of the French electricity system reform. Instead, diversifying cost competitive generating sources of electricity such as solar photovoltaic and wind should have been a priority. An area where, unfortunately, efforts have been insufficient until now – preventing true competition.

Finally, it may be noted that in 2020, because it was the country’s oldest nuclear power plant (two reactors of 880 MW each: both 42 years of commercial operations), Fessenheim was forced to permanently shut down. According to EDF, this decision was motivated by political opportunism to respect an outdated election promise which had no economic justification. On environmental and safety grounds, the cautious French nuclear safety authority was not opposed to the continuing the operations of the plant. The European Commission authorized a compensation (i.e., State aid) of more than €370 million to EDF for closing the plant.10

As of mid-August 2022, it is challenging to predict the outcome of EDF’s 100% renationalization because of the lack of available details. Nevertheless, this strategic move will certainly not make EDF and nuclear power suddenly thrive. Moreover, key painful decisions will need to be adopted regarding end user tariffs and the reorganization of the company.

EDF’s 100% renationalization as well as the inclusion of nuclear power in the European Union Taxonomy are favorable developments for both the company and the technology. On the renationalization side, it is notably envisioned that fully owning the company will give French energy policymakers additional leverage when it comes to providing and accessing better financing conditions for nuclear power that is very capital-intensive with high financial costs (e.g., out of the €23 billion of Flamanville-3’s cost, approximately 20% are financing costs).11Yet, this will probably not be sufficient, and new financing schemes for nuclear power are likely to be necessary (e.g., contract for difference as in the United Kingdom).

Furthermore, given the enormous debt of the company and the need for massive investments, significant end user price increases are inevitable. The French government will be on a tight rope to strike the right balance between the interests of the company and those of the customers. This should start by finding solutions to stop sacrificing EDF on the altar of social peace. Pragmatism, pedagogy, and assistance to the most vulnerable customers will be critical.

Finally, this renationalization is an opportunity to reorganize the company. Powerful unions have already expressed a strong opposition to the dismantling of the company into different completely separated businesses (i.e., “Hercules” restructuring deal: Nuclear / hydro / other renewable energy, distribution & supply). Even if this pathway is abandoned, French policymakers should not miss the chance to ambitiously rebalance the company’s activities. Possibly in favor of distribution and renewable energy two segments which performances – compared to the segment “France – Generation & Supply” (including nuclear power) – give satisfaction in terms of operating profit despite relatively low sales (Chart 4).

Sources: For 2021; EDF, Consolidated Financial Statements at December 31, 2021 (February 2022). And for 2022 H1; EDF, Half-year Financial Report at June 30, 2022 (July 2022).

|

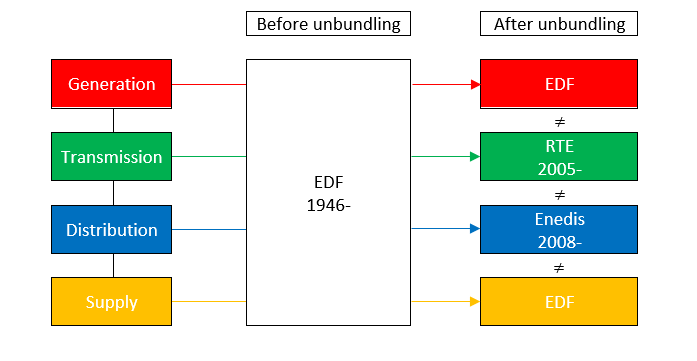

History of EDF The company was created in 1946, as the national vertically integrated monopoly for electricity (i.e., in charge of generation, transmission, distribution, and supply). In the framework of the French electricity system reform legal unbundling was adopted (see illustration below). RTE became France’s independent national transmission system operator in 2005 (net income of €0.7 billion in 2021).12Today EDF’s activities still cover generation and supply, as well as distribution via the independent subsidiary Enedis (since 2008). EDF Renewables is the company’s subsidiary specialized in electricity generation from renewable energy (established in 2004, wholly owned since 2011).  |

- 1EDF, Capital Structure – updated July 25, 2022 (accessed August 4, 2022).

- 2International Atomic Energy Agency, Power Reactor Information System: Countries, France – updated August 14, 2022 (accessed August 15, 2022).

- 3RTE, eCO2mix - Key figures: Commercial Exchanges in France (accessed August 15, 2022).

- 4French government, La nouvelle stratégie énergétique de la France – updated July 20, 2022 (accessed August 4, 2022) (in French).

- 5Le Monde, Marjorie Cessac, EDF: l’État annonce une renationalisation à 9,7 milliards d’euros – July 19, 2022 (accessed August 4, 2022) (in French).

- 6Les Échos, Julien Dupont-Calbo, Crise de l'énergie: le Parlement allège la facture pour EDF – August 2, 2022 (accessed August 4, 2022) (in French).

- 7EDF, Exceptional measures announced by the French Government – January 13, 2022 (accessed August 4, 2022).

- 8EDF, Publication of the decree and orders relating to the additional allocation of 20 TWh of ARENH volumes for 2022: update of the impact on the 2022 EBITDA outlook – March 14, 2022 (accessed August 4, 2022).

- 9EDF, Legal claim concerning the allocation of additional electricity volumes at a regulated price for 2022 – August 9, 2022 (accessed August 15, 2022).

- 10European Commission, Aides d'État: la Commission autorise l'indemnisation d'EDF pour la fermeture anticipée de la centrale nucléaire de Fessenheim en France – March 23, 2021 (accessed August 4, 2022) (in French).

- 11Cour des Comptes, La Filière EPR (July 2020) (in French).

- 12RTE, Rapport de Gestion 2021 (March 2022) (in French).