In 2021 in the wake of the COVID-19 pandemic recovery, fossil fuel prices significantly increased, especially that of gas in Europe. The start of the invasion of Ukraine by Russia in February 2022 made them temporarily skyrocket. Consequently, electricity prices surged as well. In this context, analyzing Germany’s electricity trade with France and Poland during the winter 2021-2022 is quite instructive. Germany imported lower cost electricity generated from heavily polluting coal in Poland while exporting more electricity to France, where nuclear is facing serious reliability issues. In the meantime, Germany sometimes temporarily achieved 100% clean renewable energy and delivered even more electricity price relief. The latest situation in Europe shows the direction Japan should pursue towards 2030.

The origin of the energy crisis:

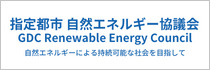

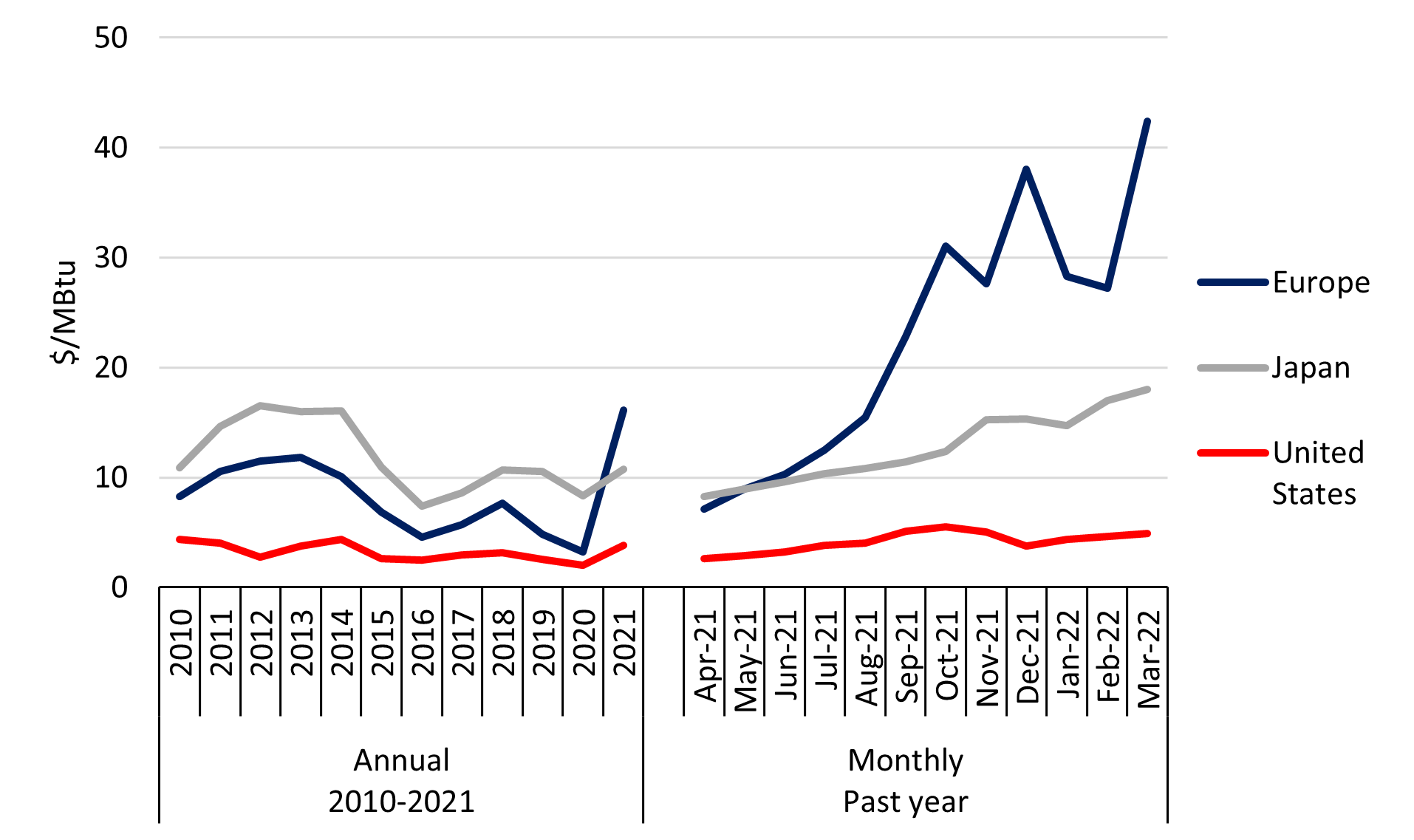

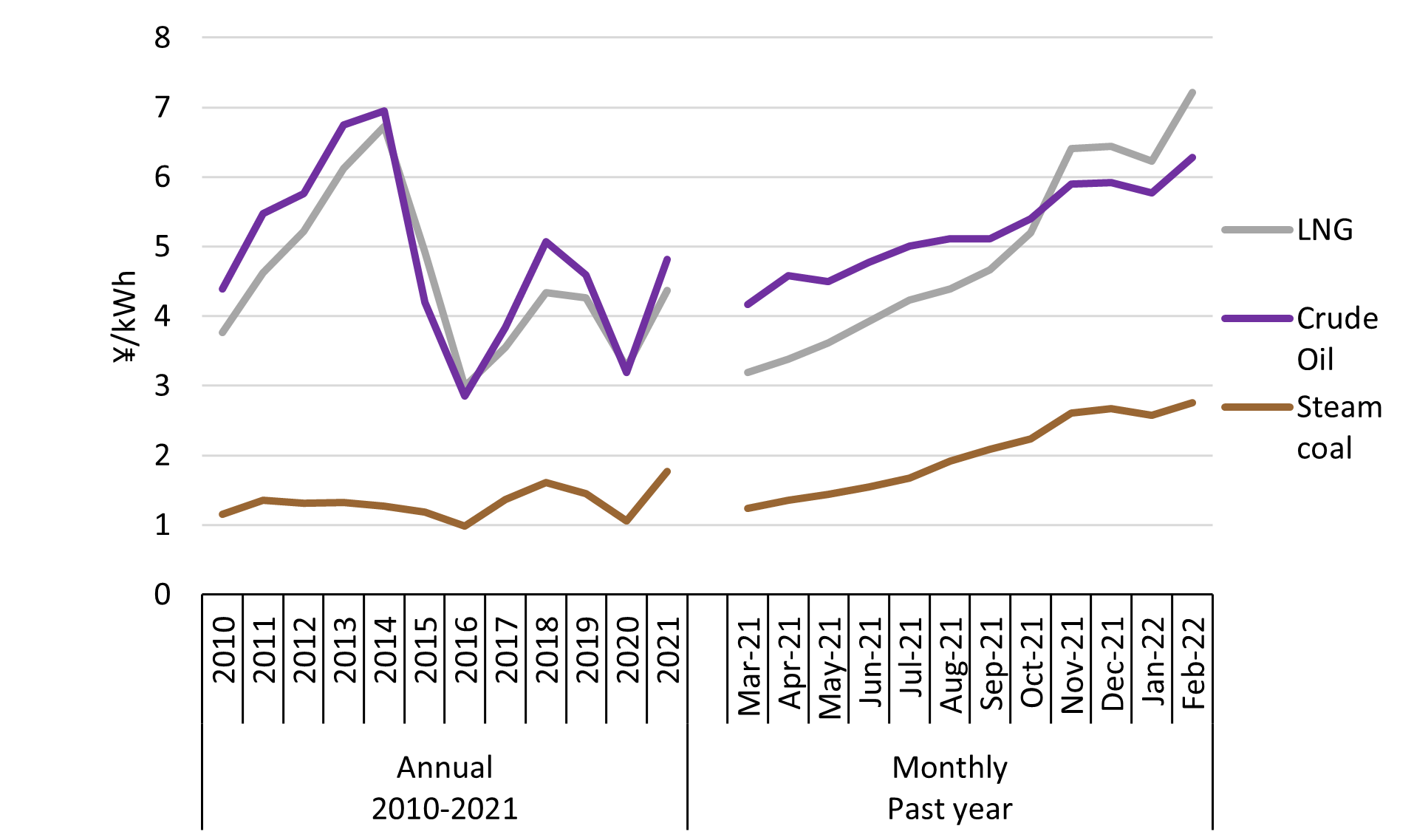

In 2020, the COVID-19 outbreak resulted in the largest global energy consumption decrease in history. Since then, driven by unprecedent fiscal and monetary stimulus and a fast roll-out of vaccines, the world has experienced an extremely rapid economic recovery – reviving energy demand.1 For example, global total coal consumption that had rather been on a downward trajectory since 2014 very strongly rebounded in 2021, and it could reach a new peak in 2022.2 Energy supply could not always keep pace with the steep increase in demand. This led to shortages and significant price increases for all fossil fuels (oil, gas and coal).Crude Oil Prices

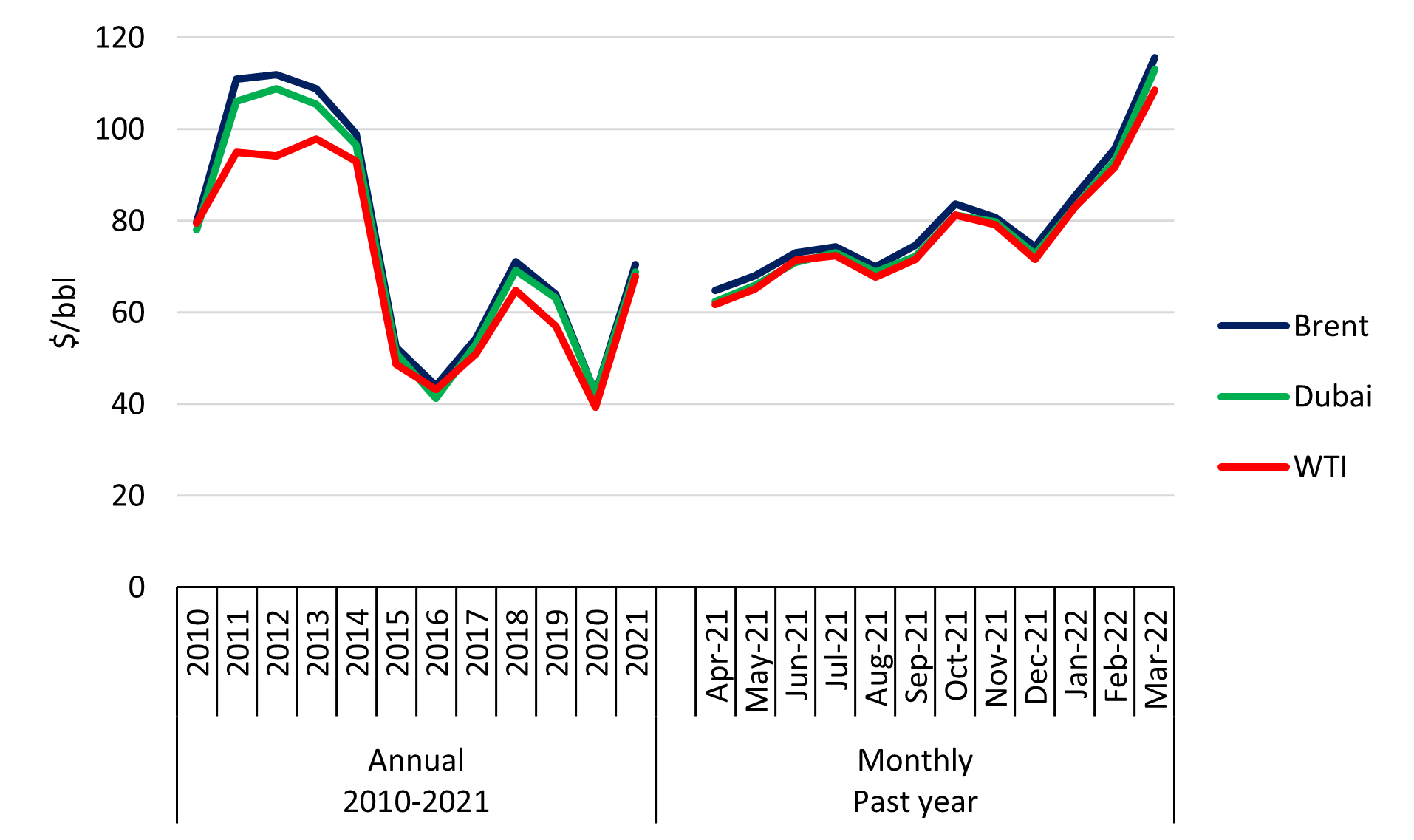

Gas Prices

Coal Prices

Japan being a fossil-fuel-poor country, it essentially relies on imports from global and regional markets to obtain these fuels. Indeed, Japan is the world’s sixth crude oil importer (6% of global imports in 2020, the latest year for which data are available), third gas importer (11%), and third coal importer (14%).3 The country is therefore vulnerable to eventual price increases such as those observed around the world recently.

Japan Fossil Fuel Import Prices

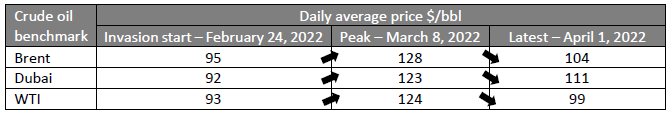

After the invasion of Ukraine by Russia, energy prices temporarily skyrocketed before declining. The table below solely focuses on oil, the world’s main energy source – 31% of total primary energy consumption in 2020, rather similar patterns have been observed for gas and coal prices as well until now.

Evolution of the Prices of the Three Main Crude Oil Benchmarks since the Invasion of Ukraine by Russia

The current uncertain geopolitical context results in price volatility because Russia is a key global energy supplier. Regarding fossil fuels, Russia is notably the world’s first gas exporter (25% of global exports in 2020), second crude oil exporter (12%) and third coal exporter (18%).4 Moreover, Russia also plays an important role in the nuclear power industry with the state-owned company Rosatom and its subsidiaries accounting for more than 35% of global enriched uranium.

Europe at the forefront of the crisis:

So far, Europe has been the continent the most affected by the ongoing global energy crisis. This is because Europe is particularly exposed to the risks of importing fossil fuels, especially gas. Indeed, Europe is the world’s first gas importer (35% of global imports in 2020), second crude oil importer (23%) and fifth coal importer (12%).5What makes the situation even more complicated for Europe is that these imports are largely dependent from one key supplier: Russia. In 2020, Russia accounted for 57%, 29% and 50% of Europe’s gas, crude oil and coal imports, respectively.

In Europe since August 2021, monthly gas prices have been high: always over $15/MBtu. They went through the roof in December 2021: almost $40/MBtu. Different reasons have been advanced to explain these high levels of prices:6

• Lower gas flows from Norway – Europe’s largest gas producer – because of maintenance in 2021,

• Limited gas flows from Russia as the country was rebuilding its own inventories in 2021, and

• Increased competition to access the fuel, especially from China which became the world’s largest liquefied natural gas importer in 2021 – an historical market change.

The invasion of Ukraine by Russia in February 2022 thus added more nervosity in an already tensed gas market.

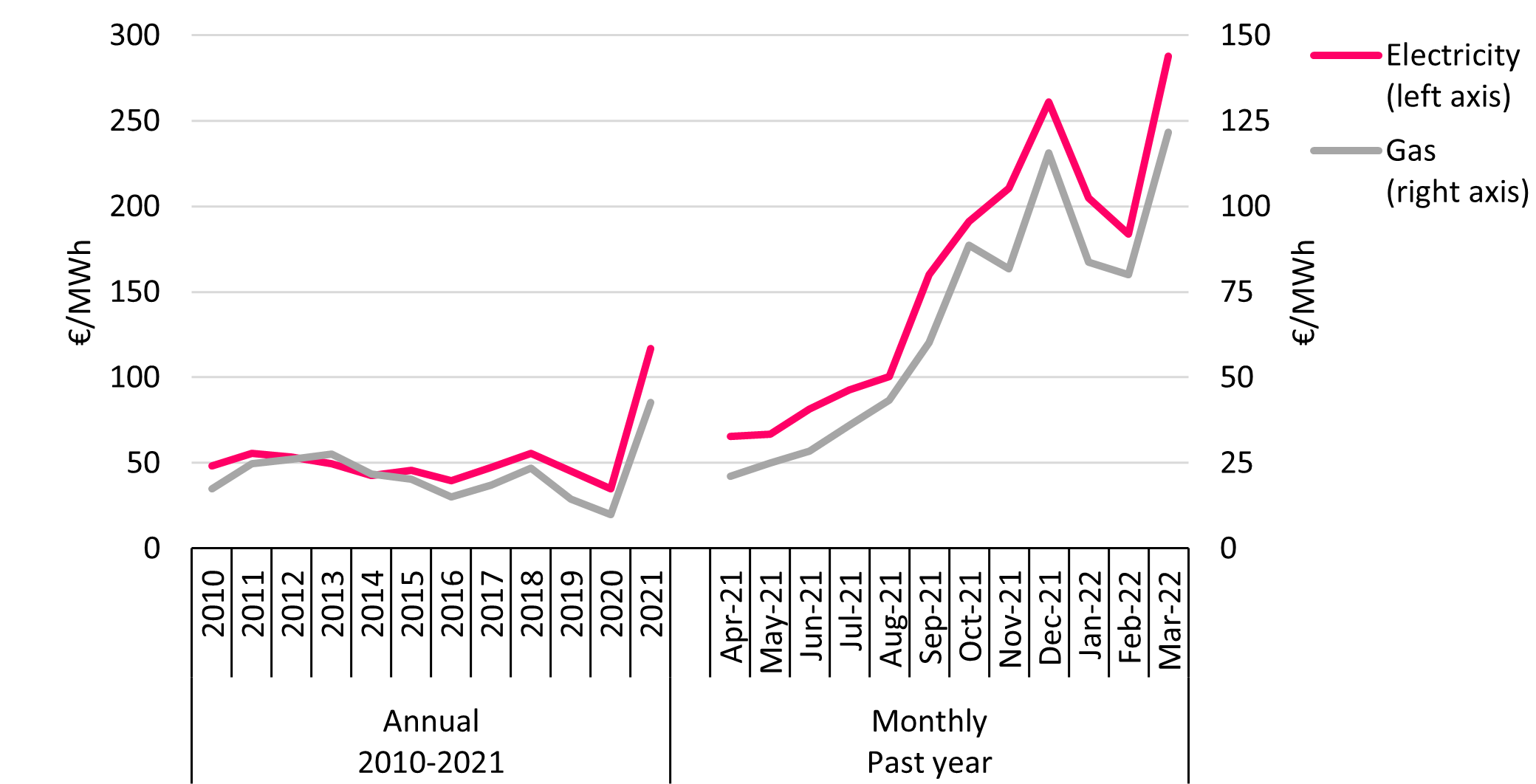

At over $40/MBtu now, prohibitively expensive gas prices in Europe are significantly impacting electricity prices. This is because based on the merit order principle wholesale electricity prices are set by power plants with the highest marginal costs. This is a critical point to be well-understood. As Europe massively reduced its coal and nuclear power plant fleets in the past decade, the relative strategic importance of gas power plants in complementing growing close to zero marginal cost renewable energy and in setting wholesale electricity prices has generally increased. This does not mean that coal and nuclear power should not be phased out, but rather that paving the way towards a 100% renewable energy system requires to actively seek clean alternatives to gas as well. Not only gas price may be exorbitant, but its use pollutes the environment, and when not domestically available relying on its imports may be a cause of severe energy insecurity.

The chart below shows the strong correlation between gas and electricity prices in Europe’s five largest economies: France, Germany, Italy, Spain and the United Kingdom. For readability purposes only average prices across these five economies are represented here.

Electricity and Gas Prices in Europe’s Five Largest Economies

High energy prices are quite painful to consumers. For instance, industries are currently sometimes constrained to either curtail or stop production (e.g., steel producers, fertilizer manufacturers, glass makers…). Households facing soaring energy bills are increasingly confronted to energy poverty.

Furthermore, several energy suppliers could not fulfill their contractual obligations towards customers and went bankrupt.

As a result of this unsustainable situation, many European governments intervened in energy markets to ease the burden (e.g., tax cuts, direct payments…). The most spectacular decision was to force state-owned company Électricité de France to sell extra volumes of nuclear electricity at a discounted price resulting in an estimated €10 billion loss for the company, triggering strikes and a legal action from unions against the French government.7

100% renewable energy is the cheapest:

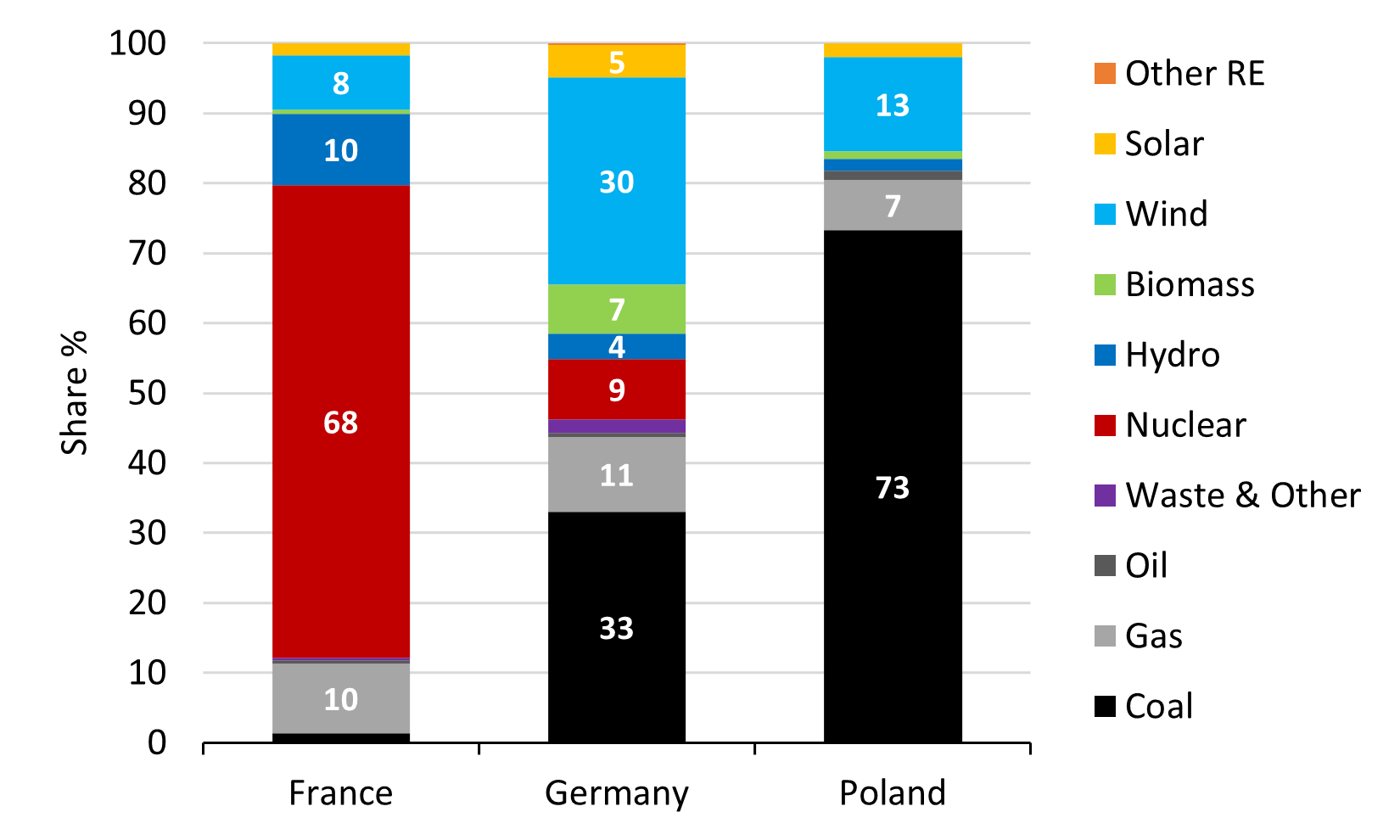

The winter 2021-2022 (defined here as from November 1, 2021, to March 31, 2022) has also been very instructive because it has highlighted strengths and weaknesses of the different power systems in Europe. Winter is usually a good stress test period for European power systems because this season combines high electricity consumption, due to increased needs for heating and lightning, and lower sunshine availability reducing power supply from solar photovoltaic. In addition, the output of wind power in Europe in winter is subject to yearly variations which need to be considered.The following brief analysis focuses on Germany’s electricity trade with two of its neighboring countries: France and Poland, which are well-known for their historical heavy reliance on nuclear and coal, respectively.

An additional important feature of these power systems is the typical fuel their marginal power plants burn. Germany still has the possibility to choose between coal (domestic and imported) and gas (imported), France – having almost achieved its coal power phaseout – mostly depends on gas (imported), and Poland mostly on coal (domestic).

Source: European Network of Transmission System Operators for Electricity, Transparency Platform – Actual Generation per Production Type (accessed April 1, 2022)

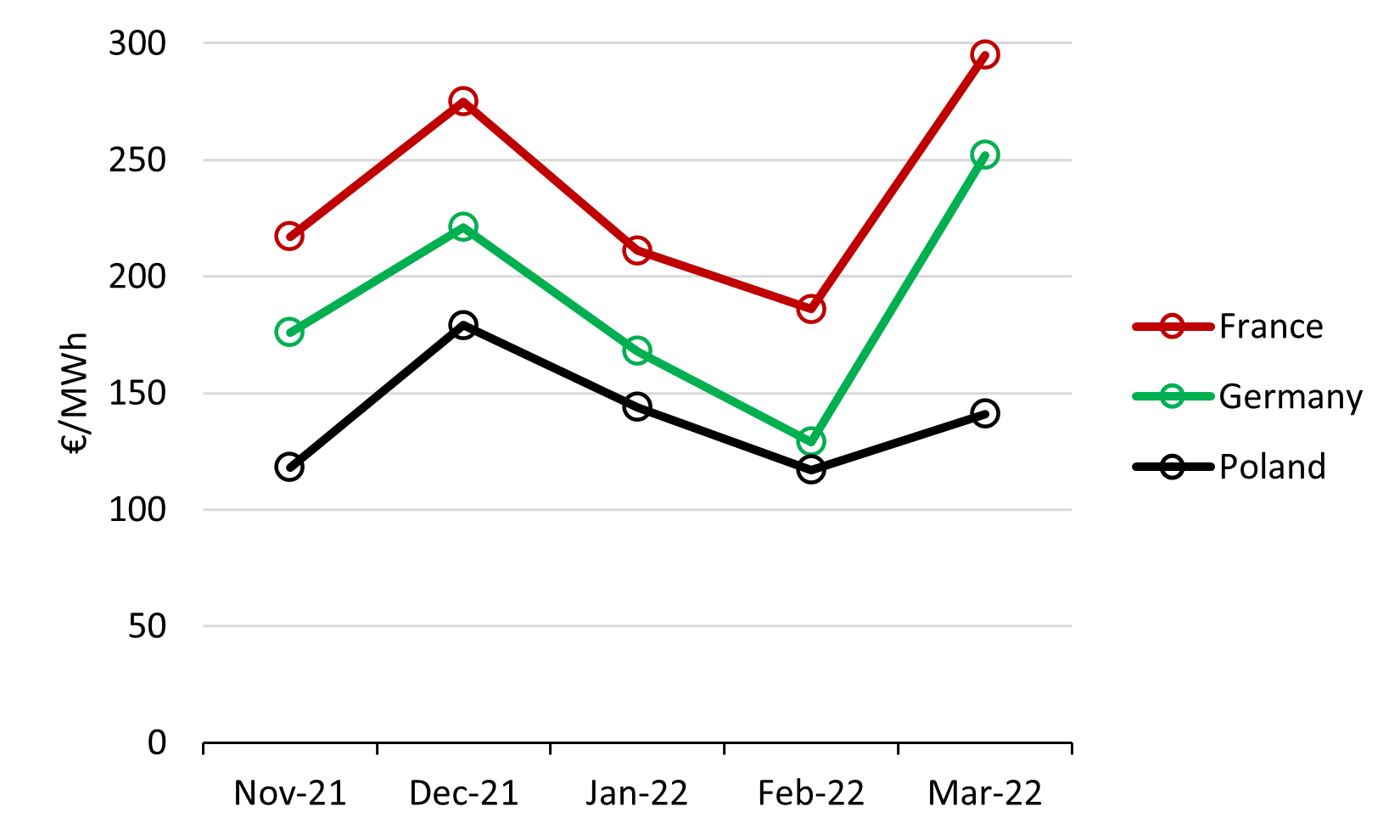

The chart below indicates monthly average power exchange prices in France, Germany and Poland from November 2021 to March 2022. Monthly prices in Poland have been constantly lower than those in Germany, and prices in Germany constantly lower than those in France. This is simply because coal, and especially Polish coal, has often been a lower cost option for marginal power in the three countries studied during this period.

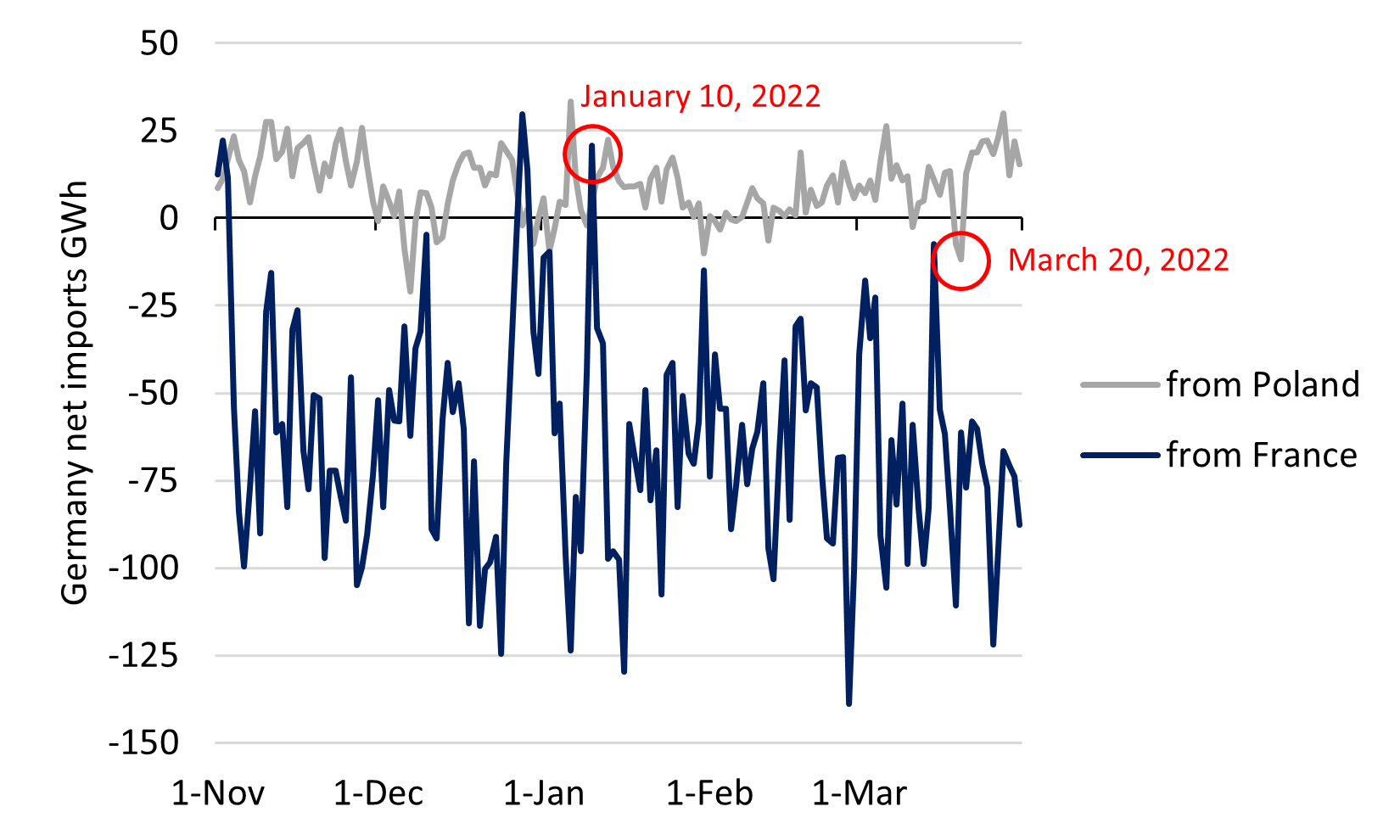

The direction of cross-border electricity trade (i.e., based on “commercial”, not “physical” flows) depends on prices on each side of a border: electricity flows from the country where the prices are the lowest to the country where the prices are the highest. As a result, it is unsurprising that electricity trade between Germany and its two selected neighbors during the winter 2021-2022 proceeded as follows: daily, Germany was almost continuously a net importer of power from Poland and a net exporter of power to France. It may also be noted that the volume of Germany’s exports to France was much larger than the volume of Germany’s imports from Poland. This is notably due to the case than the interconnection capacity between Germany and France is bigger than that between Germany and Poland: 5.8 GW (for exports) against 1.4 GW (for imports), respectively.8

Germany Daily Electricity Trade with France and Poland Winter 2021-2022

Beyond this general trend, it is also worth considering how electricity trade between these three countries has punctually been spectacularly impacted by favorable or unfavorable conditions for renewable energy:

• On January 10, 2022, quite unfavorable conditions for wind and solar power led Germany to heavily rely on both coal and gas power plants. As a result, electricity prices were temporarily high (over €300/MWh). Germany then exceptionally became a net importer of power from France where, despite reliability issues affecting some nuclear reactors, prices were a little lower.

Vulnerable Japan should learn and decisively act:

European governments are at the forefront of this energy crisis, which strengthens the sense of urgency and pushes policymakers to make critical decision such as that of Germany to pursue 100% renewable energy electricity by 2035.On the other side of the world, Japan is also clearly affected by rising fossil fuel and electricity prices. Trends in fossil fuel prices were presented in the first part of this column, it may be added here that monthly average power exchange prices continuously exceeded ¥20/kWh from January to March 2022.9

Moreover, on March 22, 2022, the area of Tokyo has been confronted to a tight supply-demand situation during a cold snap. This event is another good reason for the Japanese government to quickly become more forward-thinking when it comes to increasing renewable energy deployment nationwide and implementing new measures of flexible energy management. The latter could include sophisticated demand response programs supported by advanced forecasting technologies covering both supply and demand.

Finally, those calling for a restart of nuclear reactors in Japan may be invited to closely monitor the latest developments related to nuclear power reliability overseas. Among others, they would certainly find France’s nuclear power empirical struggles enlightening.

Indeed, the capacity factor of nuclear power averaged a quite low 69% in France during the winter 2021-2022, against 80% during the winter 2018-2019 (the last winter before the COVID-19 pandemic started).10 This poor performance was due: on the one hand to the pandemic that has deeply affected the schedule of maintenance work and ten-year inspections of nuclear reactors since the first quarter of 2020, on the other hand to the temporary shutdowns of five reactors following the discovery of faults near welds in the emergency injection circuit during the winter 2021-2022.

- 1International Energy Agency, Global Energy Review: CO2 Emissions in 2021 (March 2022).

- 2International Energy Agency, Coal Power’s Sharp Rebound Is Taking it to a New Record in 2021, Threatening Net Zero Goals (December 17, 2021).

- 3BP, Statistical Review of World Energy 2021 (July 2021).

- 4Ibid.

- 5Ibid.

- 6International Energy Agency, Statement on Recent Developments in Natural Gas and Electricity Markets (September 21, 2021).

- 7Électricité de France, Publication of the Decree and Orders Relating to the Additional Allocation of 20 TWh of ARENH Volumes for 2022: Update of the Impact on the 2022 EBITDA Outlook (March 14, 2022).

- 8Bundesnetzagentur, Monitoringbericht 2021 (March 2022) (in German).

- 9Japan Electric Power Exchange, Trading Information – Fiscal Year 2021: Spot Market Trading Results (accessed April 4, 2022).

- 10Réseau de Transport d’Électricité, Download eCO2mix Indicators – En-cours Annuel Consolidé and En-cours Mensuel Temps Réel (accessed April 11, 2022) (in French).