This paper is the English translation of the Japanese original which was released on 29 June 2023.

[Position Paper]

Revised Basic Hydrogen Strategy Offers No Clear Path to Carbon Neutrality

In June of this year, the government revised its Basic Hydrogen Strategy, after six years. Renewable Energy Institute (REI) comprehensively assessed the original Basic Hydrogen Strategy adopted in 2017 and its policy developments in a previous report, “Re-examining Japan’s Hydrogen Strategy: Moving Beyond the ‘Hydrogen Society’ Fantasy”1 (hereinafter “earlier REI Hydrogen Report”). As we pointed out in that report, Japan’s hydrogen policies have been significantly at odds with global hydrogen strategy trends and hydrogen development trends in Europe, the US, China, Australia, and elsewhere. It must again be revisited both as a decarbonization strategy and in terms of energy security strategy. Japan’s strategy of prioritizing gray and blue hydrogen, whose impact on reducing emissions is nonexistent (or unclear), and relying on imports for much of that hydrogen, has left Japan trailing behind European countries and China in terms of domestic green hydrogen production.

The revised Basic Hydrogen Strategy (hereafter also “revised Hydrogen Strategy” or “revised strategy”) does attempt to catch up with international policy developments and real-world hydrogen trends and even to correct the weaknesses of the 2017 strategy to some degree. However, the revision is unconvincing. Given that many other countries have been accelerating their efforts, Japan’s backwardness is more conspicuous than ever.

The earlier REI Hydrogen Report listed three particularly notable issues with the government’s initiatives in terms of decarbonization and energy security.

1. Selection of low-priority applications

2. Prioritization of fossil-fuel-based gray and blue hydrogen

3. Significant lag in domestic green hydrogen production

In this report, we examine the revised Hydrogen Strategy in terms of whether it credibly addresses these three points, whether it is effective in cutting CO2 emissions, and whether it ensures the competitiveness of Japanese companies. Furthermore, in the conclusion, we point out that hydrogen strategy should be put in place as part of an effective renewable energy-based decarbonization strategy.

| 1. Have Applications of Hydrogen Been Reconsidered? |

|---|

As we reported in the earlier REI Hydrogen Report, even if its cost continues to fall, hydrogen is a relatively expensive option as far as available decarbonization technologies go. Accordingly, as long advocated by the IEA2 and confirmed in the recent G7 Summit Leaders’ Communiqué,3 hydrogen should be selectively used for applications in which it is difficult to achieve emission reductions in other ways.

One of the biggest issues with Japan’s hydrogen strategy has been its vision of a future society in which hydrogen is used in all sectors4and its promotion of hydrogen use in low-priority sectors. Typical examples of this are the ill-considered choice to promote the use of fuel cell vehicles (FCVs) for passenger automobiles when more practical decarbonization technologies such as EVs are available, and the use of fuel cells (ENEFARM) for supplying household electricity and heat when heat pumps and solar PV offer more sensible options. In the 10 years since 2012, 70% of the government’s hydrogen-related spending has gone toward such low-priority or undesirable applications.

In describing its basic approach to deployment, the revised Hydrogen Strategy clearly states that “hydrogen is a means of decarbonization in hard-to-abate sectors, such as heat utilization and carbon feedstock replacement, where electrification is difficult.” This appears to signal a shift in intention from the previous line of using hydrogen in all sectors. However, the report also states that in the automotive sector, “efforts will focus on the commercial vehicle sector” and that these efforts will be pursued “in addition to passenger automobiles.” There is no clear intention to correct the misguided course of action taken up to now. The report also mentions a policy of accelerating the penetration of home fuel cells.

Japanese manufacturers were world leaders in the commercialization of FCVs and home fuel cells. For over a decade, huge amounts of money have been spent on R&D and adoption subsidies in an effort to set in motion new markets for fuel cell products. In the meantime, however, the global reality has changed significantly, as global markets for less expensive, more convenient alternatives such as EVs, heat pumps, and solar PV power systems have steadily expanded.

An Obsession with FCV Passenger Automobiles Threatens Japan’s Auto Industry

Despite the Japanese government’s policy promoting them, the number of FCV passenger automobiles sold has fallen far short of the target. As of the end of fiscal 2020, the total number of units owned was just 5,170, or around one-eighth of the target figure of 40,000 units.5 Although the 2030 target for passenger automobiles was redefined to include FC trucks and buses, the numerical target of 800,000 units remains unchanged. As well as delaying the entry of local manufacturers into the domestic EV market, the policy of promoting FCVs has also held back the growth of this EV market. This has also led to a decline in the international competitiveness of manufacturers of EV batteries and vehicle charging equipment, and other companies that should be tackling global markets. While the policy calls for the use of FCVs, the shift to EVs for light trucks and fixed-route buses is progressing.

Are Home Fuel Cells Effective for Decarbonization?

In the 5th Strategic Energy Plan, announced after the first Basic Hydrogen Strategy, the target for home fuel cells was set at 5.3 million units by 2030, but this was revised down to 3 million units in the subsequent 6th Basic Energy Plan. Still, the total number of units sold in the 13 years to March 2023 was 480,000,6so even to meet this lowered target for 2030, it would be necessary to deploy five times as many products in half the time (seven years to 2030, compared to 13 years). The revised strategy blames the downward revision on the high cost of products and calls for manufacturers to cut costs by 30%; a very tough demand. But perhaps the problem is that the government is looking in the wrong direction by expecting home fuel cells, which use city gas, to contribute to decarbonization.

The question of whether home fuel cells can make a significant contribution to decarbonization needs to be freshly reviewed. Current home fuel cells work by reforming city gas to produce hydrogen, but the CO2 generated by this reforming reaction is emitted as is (untreated). Therefore, to make such fuel cells effective in reducing CO2 emissions, it is essential to either make direct use of a pure hydrogen source (that meets emission standards), such as green hydrogen, or to decarbonize city gas.

Since it would require a huge capital investment to enable hydrogen delivery through city gas piping for the former option, the gas industry advocates the use of synthetic methane, which can be used without the need to modify existing equipment. However, the production of carbon-neutral synthetic methane requires green hydrogen and a carbon source derived from biomass or DAC (Direct Air Capture: direct capture of CO2 from the air), which are unavoidably expensive. The industry is seeking a differential subsidy to compensate for this added cost. However, adding a subsidy for synthetic methane on top of the cost of hydrogen, which is already subsidized, constitutes a double subsidy. Furthermore, since the household sector is becoming increasingly electrified, this would also amount to a double investment in terms of public infrastructure, resulting in a waste of precious financial resources.7

In the case of FCVs as well as home fuel cells, if Japan continues to stray from the direction the rest of the world is moving in, obsessing over products and technologies aimed only at the Japanese market that are difficult to expand into overseas markets, there is a serious risk that the country’s export-oriented manufacturing industry will lose its international competitiveness.

Coal-Ammonia Co-Fired Power Generation Goes Against Power Decarbonization

The revised Hydrogen Strategy identifies power generation as the leading sector for hydrogen application, seeking to make the use of hydrogen and ammonia in this sector a driving force for hydrogen demand. When variable renewable energy sources such as solar PV and wind power accounts for most of the power supply, mono-fuel-fired power generation using green hydrogen or other fuel is expected to play a useful role in load balancing. To prepare for this eventuality, it makes sense to pursue the development of hydrogen and ammonia mono-fuel technologies. However, the revised Hydrogen Strategy places ammonia co-firing in coal-fired power generation at the center of its vision for hydrogen and ammonia utilization in the power sector. As widespread international and domestic criticisms have pointed out, current plans for coal-ammonia co-firing will not only fail to help cut CO2 emissions;8 they will also have the effect of extending the life of coal-fired power generation.

Although the Japanese government tried to get an endorsement of its coal-ammonia co-firing strategy in writing at the recent G7 meeting, the official communiqué did not recognize the use of ammonia for power generation as a common G7 policy; it only mentioned (in a note) that some countries were aiming to use it. Furthermore, the communiqué stipulated that all measures needed “to be consistent with the 1.5°C pathway and the G7 consensus of fully or predominantly decarbonizing the power sector by 2035.” Therefore, for Japan’s hydrogen strategy to be internationally credible, the use of coal-ammonia co-firing will not be an option for the power sector.

| 2. Has the Policy of Prioritizing Hydrogen Derived from Fossil Fuels Changed? |

|---|

Up to now, Japan’s hydrogen strategy has focused on gray hydrogen to provide the bulk of supply,9 at least until 2030, despite the fact that gray hydrogen makes no contribution to reducing CO2 emissions. No clear criteria to define what level of emission reductions should be aimed at with blue hydrogen have been formulated either.

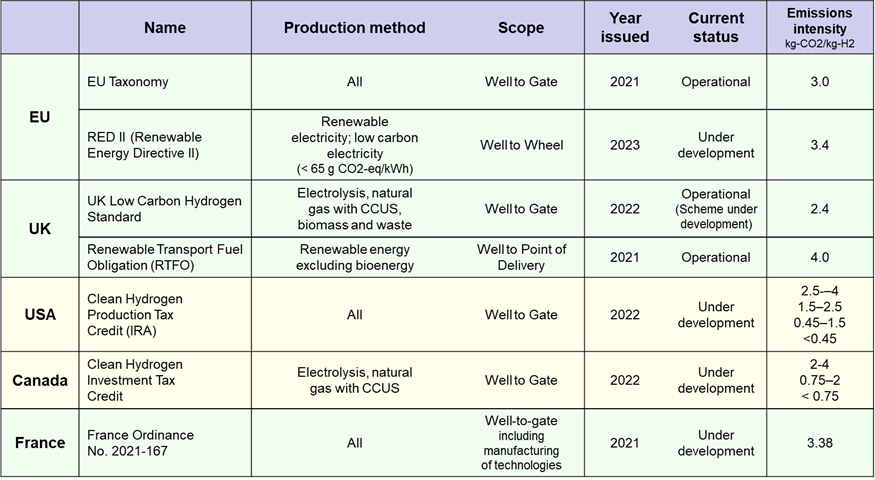

The revised Hydrogen Strategy does include an emission intensity standard to define low-carbon hydrogen (3.4 kg-CO2/kg-H2) for the first time. However, moving faster than Japan, some EU countries, the US, and other progressive nations had already specified standards by late 2021 or early 2022. They have either started operating standards (for regulations and tax incentives) or expect to launch them after completing prescribed procedures (Table 1). Many private organizations around the world have also set up low-carbon hydrogen standards for calculating the environmental impact of hydrogen and products created using hydrogen, as well as for helping to make investment decisions (Table 2).

Comparing the emission intensity reference value in the standard recently released by the Japanese government with the corresponding values of these other front-runner countries reveals that the standard is far from stringent. The reference value of the EU Taxonomy standard is 3.0 (kg-CO2/kg-H2), while that of the UK Low Carbon Hydrogen Standard is only 2.4. Both these emission intensity levels are stricter than that of Japan. Two other schemes have the same or a higher value than Japan (EU’s RED II and UK’s RTFO, respectively), but their scope is broader than that of the Japanese standard (Well to Gate), extending to cover subsequent transport, including energy conversion (Well to Point of Delivery, in the case of RTFO), and even further to consumption in the vehicle or other equipment that the hydrogen is ultimately used for (Well to Wheel, in the case of RED II). This means that, in effect, these reference values are stricter than the Japanese value. The US and Canada use a threshold intensity of 4.0 in a tax incentive scheme based on CO2 emissions. Although Japan’s reference value is lower than this threshold, it applies only to the smallest range of incentives. Thus, it is evident that out of all the players, Japan’s reference value represents the lowest hurdle to emissions. On top of this, the private-sector-led standards shown in Table2 call for even stricter threshold values, with the exception of CertiHy, the earliest and broadest of the hydrogen emission standards (2018).

Table 1: Low-carbon hydrogen emission intensity reference values by country

Well to Point of Delivery: From feedstock supply to transport (incl. energy conversion) and to delivery at vehicle/equipment (using H2)

Well to Wheels: From feedstock supply to transport (incl. energy conversion) and to consumption at vehicle/equipment (using H2)

Source: Created by REI, based on "Towards hydrogen definitions based on their emissions intensity" (IEA, April 2023)

Table 2: Low-carbon hydrogen emission intensity reference values of private sector standards

Note that in connection to emission standards for hydrogen production, the Japanese government claims that “Japan will take the lead in formulating global standards for ‘clean hydrogen’ to map out a clear path for the transition to clean hydrogen,”10 as if it were a great achievement for Japan to shift from using a color-based classification (gray, blue, or green) according to hydrogen production methods to making assessments based on the CO2 emissions (carbon intensity) generated in the production process.11 In reality, however, as noted above, many countries had instituted emission standards before Japan. And most of these standards are more stringent than Japan’s. The shift by Japan to assessing the emissions of hydrogen technologies in terms of carbon intensity does not make it a leader in clean hydrogen.

Gray Hydrogen Does not Meet Low-Carbon Standards

Another point that needs to be clarified is that the trend to evaluating the cleanness of hydrogen in terms of emission levels, rather than using a color-based classification scheme (green, blue, and gray), does not, in any way, imply that the use of gray hydrogen is acceptable. Gray hydrogen generates 11.4 kg-CO2eq per kg of H2, which fails to comply with any of the low-carbon hydrogen emission standards listed in Table 1.

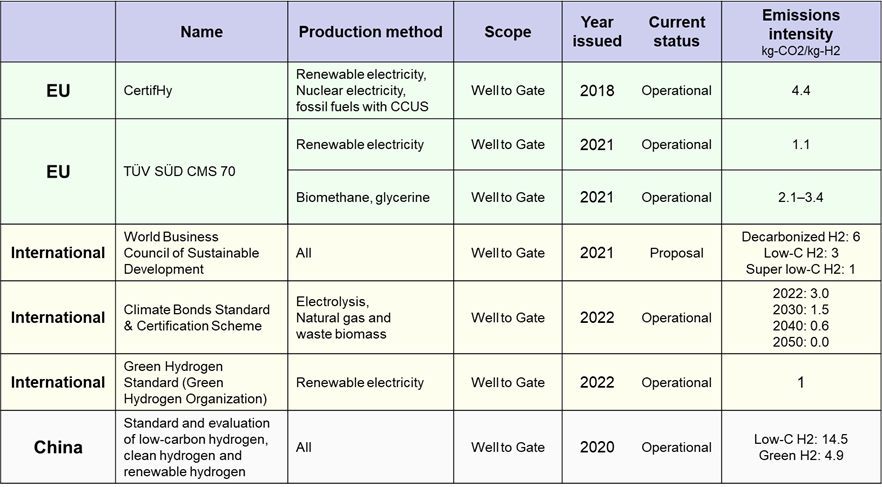

Figure 1 shows the IEA’s classification of CO2 emission levels for various hydrogen production methods into nine levels, A to I. Japan’s reference value (3.4 kg-CO2/kg-H2) corresponds to G, the seventh strictest level. This level corresponds to blue hydrogen, which is hydrogen produced from coal or natural gas (steam reforming), with CCS for separating and storing the CO2 generated during the production process. As shown in Fig. 1, a high capture rate, 93%, is assumed for this CCS.12 Compliance with even stricter standards in the future will require either a higher CO2 capture rate or a reduction in CO2 and methane emissions upstream. In either case, such measures will drive up the cost of equipment and facilities, leading to lower cost competitiveness.

Fig. 1: Examples of emission intensity levels in hydrogen production

Source: “Towards Hydrogen Definitions Based on Their Emissions Intensity” (IEA, April 2023)

Deferring the Application of Low-Carbon Hydrogen Standards Until 2030 and Beyond

Another issue with the revised Hydrogen Strategy is that it attempts to defer the introduction of hydrogen emission regulations. The Act on Rationalizing Energy Use (“Energy Conservation Act”), which was amended in 2022, incorporates a shift to non-fossil fuels to reduce dependence on fossil fuels. Under a simultaneous amendment of the Act on Sophisticated Methods of Energy Supply Structures, hydrogen and ammonia are regarded as non-fossil fuels. In connection to this, the revised strategy states, “In measures relating to the transition to non-fossil fuel energy based on the Energy Conservation Act, the transition to clean hydrogen in the industrial sector will be accelerated by conducting assessments in terms of carbon intensity beyond the current target year of FY2030.” Thus, the evaluation of the carbon performance of hydrogen is to be deferred until FY2030 or later. It is also implied that gray hydrogen (as currently defined) will continue to be used until then.13

In addition, as mentioned above, to conform to low-carbon standards with fossil fuel-derived hydrogen, CCS must be implemented with a capture rate of at least 90%. However, the revised Hydrogen Strategy states that CCS will only be implemented after 2030 to “accelerate the development of the business environment, including the preparation of business laws, with a view to launching CCS projects by 2030...”

In effect, while posturing to stress the importance of carbon intensity and emission standards for hydrogen, the government has publicly stated that they will not be applied for at least another seven years. From the standpoint of Europe, the US, and other countries that were early in announcing standards and that have already put them into operation, hydrogen use in Japan does not currently contribute to reducing CO2 emissions. Consequently, the products and materials that use hydrogen will be rated as having high CO2 emissions.

Even if they are using gray hydrogen, if enterprises in Japan disclose data on domestic standards and demonstrate efforts to meet GHG emission standards, they are likely to obtain certification for decarbonized hydrogen and to qualify for difference subsidies, at least for the time being. This state of affairs makes it difficult to establish incentives for a quick transition to green hydrogen and other cleaner forms of hydrogen. Exporters, however, would face a double burden, because they would need to disclose GHG emissions based on the international standards in Tables 1 and 2 in addition to disclosing data domestically. There is also a substantial risk that even companies that are certified as decarbonized in Japan will not be accepted as “clean” internationally. As a result, the materials or products of the manufacturer may be rated as generating “high GHG emissions,” leading to a loss of competitiveness. This means that there would be no benefit of using materials or products that are rated as “low-carbon hydrogen” under domestic standards, and no incentive to use them.13

As mentioned above, the reference values quoted in the revised Hydrogen Strategy are less stringent than those of the standards in other countries. On the other hand, by 2030, when such standards will start to go into effect in Japan, it is very likely that there will already be a large quantity of green hydrogen with B-level CO2 emissions (Fig. 1) in production and in use globally, and that this level will become the norm. Consequently, there is a serious risk that meeting the Japanese standard of emissions for hydrogen will not be good enough to qualify as “low-carbon hydrogen” under the expected global standard in the future.

14

| 3. Can Domestic Green Hydrogen Production be Accelerated? |

|---|

The policy in the 2017 Basic Hydrogen Strategy regarding procurement and supply of hydrogen was aimed, firstly, at producing hydrogen using fossil fuels from overseas and, secondly, at utilizing inexpensive renewable energy sources from overseas. There was virtually no mention at all of promoting the development of 100% domestic green hydrogen. To produce internationally competitive green hydrogen, the most important requirement is the ability to supply large quantities of renewable electricity domestically and at low cost. In this respect, the government’s energy strategy was wholly inadequate; for example, keeping its renewable electricity target at a low level. This policy significantly set back Japan’s hydrogen development.

Lack of Reflection on the Delay in Developing Renewable Power Sources

The revised Hydrogen Strategy appears to be an attempt to correct the errors of the 2017 strategy, with “Establishing a manufacturing base for domestic hydrogen production” as the first heading under “Supply-side efforts.” Yet, there is no acknowledgment anywhere in the revised strategy that the sluggish pace of domestic hydrogen production is caused by the slow pace of renewable energy development.

Not only that, the revised strategy stresses the point that “surplus electricity prices are low when renewable energy is curtailed” (power output is deliberately reduced), but it does not signal any inclination to address the high domestic renewable electricity prices per se. There has certainly been an increase in the curtailment of solar PV power, particularly in Kyushu, and wholesale electricity prices have fallen due to curtailment. However, these curtailments arise due to insufficient inter-regional utilization of electricity, preferential use of nuclear power, insufficient curtailment of thermal power generation, and delays in demand management. Frequent and repeated curtailment in today’s Japan, where renewables account for only about 20% of total electricity supply, suggests that efforts to maximize the use of renewable electric power as generated have been slow. Frequent instances of curtailment lower the profitability of renewable energy development and limit the acceleration of deployment. The point that curtailment drives down the price of renewable energy is an irrelevant one to emphasize in the context of making renewable energy a mainstream, inexpensive source of electricity for the purpose of lowering the price of green hydrogen in Japan.

Can the Delay in Electrolyzer Development be Overcome?

To produce domestic green hydrogen in Japan, it is vital to accelerate the development of renewable electricity and boost the development of electrolysis equipment. Although Japan has been seen as a world leader in the practical implementation of fuel cells, it has lagged far behind in the development and commercialization of water electrolyzers (modularization of structure and automation of manufacturing), even though these devices operate on similar principles to fuel cells. More specifically, Japan is now far behind Europe and China in terms of large-scale production and cost reduction for mass production and mass consumption, in much the same way that happened with solar cells, EV batteries, and semiconductors. Furthermore, in terms of technology, China’s LONGi has developed and commercialized alkaline electrolyzers that boast an efficiency of 4.0 kWh/Nm3 (87.9%).15 So, it can no longer be said that Japan is “winning on technology.”

Europe has clearly stated its goal of producing green hydrogen based on abundant renewable electricity, to promote investment predictability for both hydrogen equipment manufacturers and users. Meanwhile, as China continues to increase its renewable electricity capacity as part of its national policy, it is also leading the world in lowering the cost of water electrolysis equipment.

Although the revised Hydrogen Strategy sets a new target of 15 GW for deployment of water electrolyzers by Japanese companies in Japan and overseas (including manufacturers of parts and materials), it does not mention any concrete measures to resolve this situation. There is also no mention of a method for calculating the contribution of parts and materials. Above all, a target for the adoption of green hydrogen in Japan needs to be set to enable predictable investment.

| Conclusion: Establishing a Hydrogen Strategy as Part of a Decarbonization Strategy |

|---|

The revised Hydrogen Strategy begins with the policy statement, “Through green transformation (GX), we aim to simultaneously achieve the three goals of stable energy supply, enhanced economic growth and international industrial competitiveness, and decarbonization.” This suggests that the revised strategy is in line with these three goals. In particular, the revised strategy stresses the ambition of establishing a new pillar, a “Hydrogen Industry Strategy,” to tackle not only the domestic market but also the global market.

It is certainly not wrong to frame the development and use of hydrogen as an industrial strategy. But the Japanese government seems unaware that any hydrogen strategy that is not compatible with a decarbonization strategy aimed at the 1.5°C target can never succeed as an industrial strategy.

As already mentioned, the revised Hydrogen Strategy seems noncommittal from the perspective of decarbonization strategy. Firstly, it promotes coal-ammonia co-firing, which runs counter to decarbonization. And secondly, it outlines a policy of promoting gray hydrogen, at least until 2030, even though gray hydrogen contributes nothing to reducing emissions.

Europe, the US, and other countries around the world have taken a common approach to decarbonization strategies. That is, start by completely decarbonizing electricity production, focusing on renewable energy. Then, while rapidly increasing solar and wind power generation and enhancing the power grid, produce hydrogen using abundant, cheap renewable electricity, including surplus electricity. Finally, use this clean hydrogen to decarbonize the industrial and transportation sectors.

Since it lacks such a strategy for transitioning to a carbon-neutral society, Japan’s hydrogen strategy is structured to build up hydrogen demand in all sectors of the economy, including the efforts to expand the market for products that consume hydrogen—an area in which Japan has outpaced other countries. And the idea is to procure the necessary quantity of hydrogen largely from overseas until at least 2030, regardless of the carbon intensity (emissions) of those sources. The use and supply of hydrogen seem to reflect an underlying desire to preserve existing facilities, systems, and industrial structures based on the procurement and use of fossil fuels.

In the six years since the first Basic Hydrogen Strategy was published in 2017, global circumstances have changed dramatically. Global warming has accelerated, making climate change action increasingly urgent. At the same time, Russia’s invasion of Ukraine has made energy security a vital issue for national survival.

In response to these changes, the hydrogen strategies formulated by the G7 and other countries have positioned hydrogen as a means for both cutting GHG emissions and ensuring energy security. European countries have forged a plan to produce large quantities of green hydrogen derived from renewable energy sources for the dual purpose of breaking dependence on Russian natural gas and reducing CO2 emissions. Meanwhile, to overcome the climate crisis and bolster its energy security, the US is implementing a large-scale policy aimed at generating employment and fostering new industries by producing solar and wind power equipment and EVs within the US. Thus, both Europe and the US are swiftly launching effective policies based on broad visions.

Japan’s revised Hydrogen Strategy seems to have mostly rehashed the contents of six years ago, without giving due consideration to these major shifts in the world. Unless this course of action is corrected, there is a serious risk that Japan will not only fail to meet its 1.5°C targets, but also that its hydrogen strategy will come to be seen as mere “greenwashing.” It is also possible that products made in Japan will be rated as highly GHG-intensive, thereby putting at risk the international competitiveness of Japanese manufacturing.

The current government strategy of limiting renewables to just 50–60% of electricity demand in 205016 must be reviewed immediately. Then, based on this review, it is essential to devise new decarbonization and hydrogen strategies centered on ensuring a robust supply of energy in the form of renewable electricity and low-carbon hydrogen powered by renewable electricity. These strategies also need to be grounded on the principle of maximal energy efficiency and to incorporate the whole of the industrial and transportation sectors of the economy.

<Related Links>

[Report] Re-examining Japan’s Hydrogen Strategy: Moving Beyond the “Hydrogen Society” Fantasy (September 2022)

- 1Re-examining Japan’s Hydrogen Strategy: Moving Beyond the ‘Hydrogen Society’ Fantasy, REI (September 2022)

- 2 See, for example, The Future of Hydrogen (IEA, 2019), Green Hydrogen Cost Reduction (IRENA, 2020), and Geopolitics of the Energy Transformation (IRENA, 2022)。

- 3Paragraph 25 of the Leaders’ Communiqué states, “We recognize that low-carbon and renewable hydrogen and its derivatives such as ammonia should be developed and used, if this can be aligned with a 1.5 °C pathway, where they are impactful as effective emission reduction tools to advance decarbonization across sectors and industries, notably in hard-to-abate sectors in industry and transportation, while avoiding N2O as a GHG and NOx as air pollutant.”

- 4Strategic Roadmap for Hydrogen and Fuel Cells, Council for a Strategy for Hydrogen and Fuel Cells (METI, March 2019)

- 5Next Generation Vehicle Promotion Center (viewed June 20, 2023)

- 6Advanced Cogeneration and Energy Utilization Center Japan (viewed: June 20, 2023)

- 7If future technological breakthroughs make it possible to produce carbon-neutral synthetic methane at low cost, this could be a powerful means of promoting decarbonization in the transportation sector and other sectors, but this possibility is currently uncertain.

- 8Even the latest high-efficiency coal-fired power plant (USC) promoted by the government emits 2.3 to 2.5 times more CO2 per kWh than the regular natural gas-fired power plants (GTCC) currently in use. Therefore, even if the ammonia co-firing rate were reduced to 50%, emissions would still be higher than those of a natural gas-fired power plant. Furthermore, if ammonia is produced from natural gas, even the most advanced facilities will emit 1.6 tons of CO2 per ton of ammonia produced (based on a technology assessment report for R&D projects commissioned by the Ministry of Economy, Trade and Industry in FY2022 (preliminary assessment)). Consequently, the impact of ammonia co-firing on reducing emissions is almost zero. There is a plan to use blue ammonia, in which CO2 emissions during ammonia production are recovered by CCS, but the actual reduction effect needs to be verified more fully.

- 9The 2030 hydrogen supply target is a maximum of 3 million tons/year, but the government’s “Green Growth Strategy…” sets a target for clean hydrogen (hydrogen produced from fossil fuels plus CCUS, renewable energy, or other sources) of “at least 420,000 tons.” This means that it is assumed that gray hydrogen will account for most of the hydrogen supply.

- 10Policy Framework for Realizing a Hydrogen Society (draft), Ministerial Council on Renewable Energy, Hydrogen and Related Issues (3rd meeting), April 4, 2023.

- 11Minister of Economy, Trade and Industry, Yasutoshi Nishimura stated, “The concept of hydrogen carbon intensity was also put forward by Japan at the G7 meeting; Japan took the initiative of including it.” Press Conference after Cabinet Meeting on June 6, 2023.

- 12It should be noted that although CCS can theoretically achieve a capture rate of more than 90%, the actual capture rate has been much lower in some cases, due to equipment failures, leaks, or other factors. In the cases of two thermal power plants with CCS, Petra Nova in the US and Boundary Dam in Canada, the capture rate in practice was only 60–70%. See Bottlenecks and Risks of CCS Thermal Power Policy (REI, April 2022)

- 13“Low-cost unused fossil fuel resources such as lignite coal, which are abundant overseas, can be utilized as CO2-free energy through a combination of hydrogenation and CCS.”

- 14In these cases, Japanese companies gained a large share of the global market in the early stages of commercialization, before losing ground during the phase of market expansion. In the case of water electrolyzers, however, Japanese companies have been trailing the pack since the early stages of commercialization.

- 15LONGi: Usually around 4.5 kWh/Nm3 (78–80%, high heating value)

- 16Green Growth Strategy Through Achieving Carbon Neutrality in 2050 (December 2020)