Carbon credits1, introduced in the Kyoto Protocol, have gained a new role in the era of the Paris Agreement since 2021. It was initially introduced to allow developed nations to fund emissions reductions in developing countries, so that the cost of reduction will be kept low, while the amount of reduction promised in the Kyoto Protocol will be achieved. In the time of Paris Agreement, we need to achieve Net Zero by 2050, which means that we cannot have the emissions to be offset by carbon credits; it needs to be zero.

New purpose of the carbon credits is to accelerate transition by financially supporting reduction and removal activities otherwise not funded. The emphasis is put on forests, especially in developing countries, and the R&D of technological removal. It is crucial to understand that it is not about offsetting the ongoing consumption of fossil fuels; instead, it focuses on providing funds for projects that aim to reduce and remove emissions2.

In this position paper, we will discuss the changing role of carbon credits and their anticipated significance. Specifically, we will cover the changes in following aspects:

1. Positioning within the space of voluntary commitments, such as Science-Based Targets (SBTs), Race to Zero criteria, and the UN Net Zero Expert Group's initiatives.

2. Offsetting within regulatory frameworks like Cap-and-Trade systems.

3. Positioning within the international aviation sector, which falls outside the nationally determined contributions (NDCs) of the Paris Agreement.

4. Expected quality and integrity of the supply side to meet the demands.

We will explore the global trends that have significantly influenced these changes. Notably, there has been a shift from using carbon credits for offsetting ongoing use of fossil fuel. Instead, a greater emphasis is being placed on additional funding for developing countries and CO2 removal technologies, particularly in the context of SBTs and international aviation (points 1 and 3). Additionally, in Europe, there has been a shift towards making carbon credits ineligible for use for ETS, and other countries like the United States and those in Asia are also reducing percentage to be used in their ETS (point 2).

By examining these dynamics, we aim to provide an overview of the evolving role of carbon credits in today's changing world, and make recommendation for Japan’s GX plan to align wih global standards.

Lastly, in the emerging GX League, which serves as Japan's carbon pricing mechanism, starting from voluntary scheme with very low price expected, it is crucial to redesign the framework based on the integrity of clearly defining its purpose: to truly contribute to global decarbonization. This means moving away from unlimited offsets and proposing the following measures:

1. Early shift from voluntary scheme to regulation to ensure its effectiveness.

2. Incorporating governance aligned with international standards and contributions to the Sustainable Development Goals (SDGs) to ensure the quality of voluntary carbon credits scheme in Japan, namely J-Credits.

3. Implementing either a cap on credit utilization or limiting the role of credits to “Beyond Value Chain Mitigation (BVCM)” (additional funding) as defined by SBTi (Science-Based Targets initiative).

By implementing these measures, GX League can effectively contribute to the global decarbonization and operates with integrity.

Criticism Against the Use of Carbon Credit Offsets

If you have some knowledge about carbon credits, you may have heard criticisms regarding their use as “greenwashing”, allowing the continued use of fossil fuels while claiming to be net-zero or carbon-neutral3. In response to recommendations made by the UN Net Zero Expert Group in November 20224, UN Secretary-General António Guterres acknowledged that current voluntary net-zero targets have vague definitions (dubious or murky) and can leaves the door open to greenwashing. He emphasized that the transition to net zero must be grounded in real emissions cuts – and not relying essentially on carbon credits or shadow markets. This statement shows support for the positioning of carbon credits as outlined by the UN Net Zero Expert Group's recommendations5 .

|

1) Credits in voluntary net zero commitments

|

|---|

Role of credits in Net-Zero Target Criteria by SBTi, Race to Zero, and UN Net Zero Expert Group

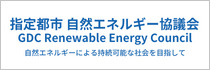

In the recommendations by the UN Net Zero Expert Group, the achievement of net-zero targets by companies and others should primarily be based on actual emission reductions within the value chain, rather than relying on credits or offsets. The use of credits is limited to two specific purposes. The first is to utilize removal 6 credits to neutralize7 residual emissions8 within the value chain that cannot be avoided at the time of claiming net-zero (e.g., in 2050) (Figure 1④). The second purpose is to provide additional funding, referred to as "Beyond Value Chain Mitigation" (BVCM), to address emissions equivalent to those emitted during the journey towards achieving a 1.5℃ pathway, separate from a company's own reduction targets (Figure 1③). This approach was introduced by the Science Based Targets initiative (SBTi)9, in which over 500 companies all over the world including 400 Japanese companies have participated. Various initiatives such as ones in the Glasgow Financial Alliance for Net Zero (GFANZ) are joining the Race to Zero Campaign by the UNFCCC, which has same criteria10 for the use of credits. In essence, it has become the de facto standard for voluntary target-setting.

Figure 1 Definition of Net Zero by SBTi

The New Role of Carbon Credits: Mobilizing funds for global decarbonization

As SBT argues, allowing offsetting through carbon credits for voluntary targets would not align the global achievement of Net Zero, however there is growing anticipation that carbon credits can mobilize significant investments needed for global decarbonization.

In March 2021, the voluntary Carbon Market Integrity Initiative (VCMI) was announced by Alok Sharma, the UK COP26 President, with the aim of mobilizing funds towards investments unavoidable to limit global warming within 1.5 degree. In June 2022, Provisional Claims Code of Practice, For Public Consultation and Corporate Road Testing was published11. VCMI specifies the SBTi as the standard that should be followed, categorizes net zero claims into "Gold," "Silver," and "Bronze," where "Gold" is comparable to SBTi standards with full amount of Beyond Value Chain Mitigation (BVCM), "Silver" requires at least 20% of BVCM instead of 100% in “Gold”, and "Bronze" allows the utilization of carbon credits for up to 20% of Scope 3 emissions until 2030 in addition to “Silver” level. While maintaining the rigorous standards of SBTi's Net Zero and short-term targets, this framework aims to activate the use of carbon credits by allowing their utilization not only for BVCM but also for a certain proportion (20% in the draft) of Scope 3 emissions12. On the other hand, SBTi plans to release guidance on Beyond Value Chain Mitigation (BVCM) in 2023, and there is a growing momentum to achieve the role of carbon credits as a means to mobilize funds with a high level of integrity, driven by the sense of urgency that all possible actions must be taken to limit global warming to below 1.5℃. It is important to note that the Voluntary Carbon Market Integrity Initiative (VCMI) requires companies' targets to align with the SBT criteria along the 1.5℃ pathway, and offsetting Scope 3 emissions is allowed within this context.

| 2) Strengthened limitation for carbon offsetting in Carbon Pricing Regulations |

|---|

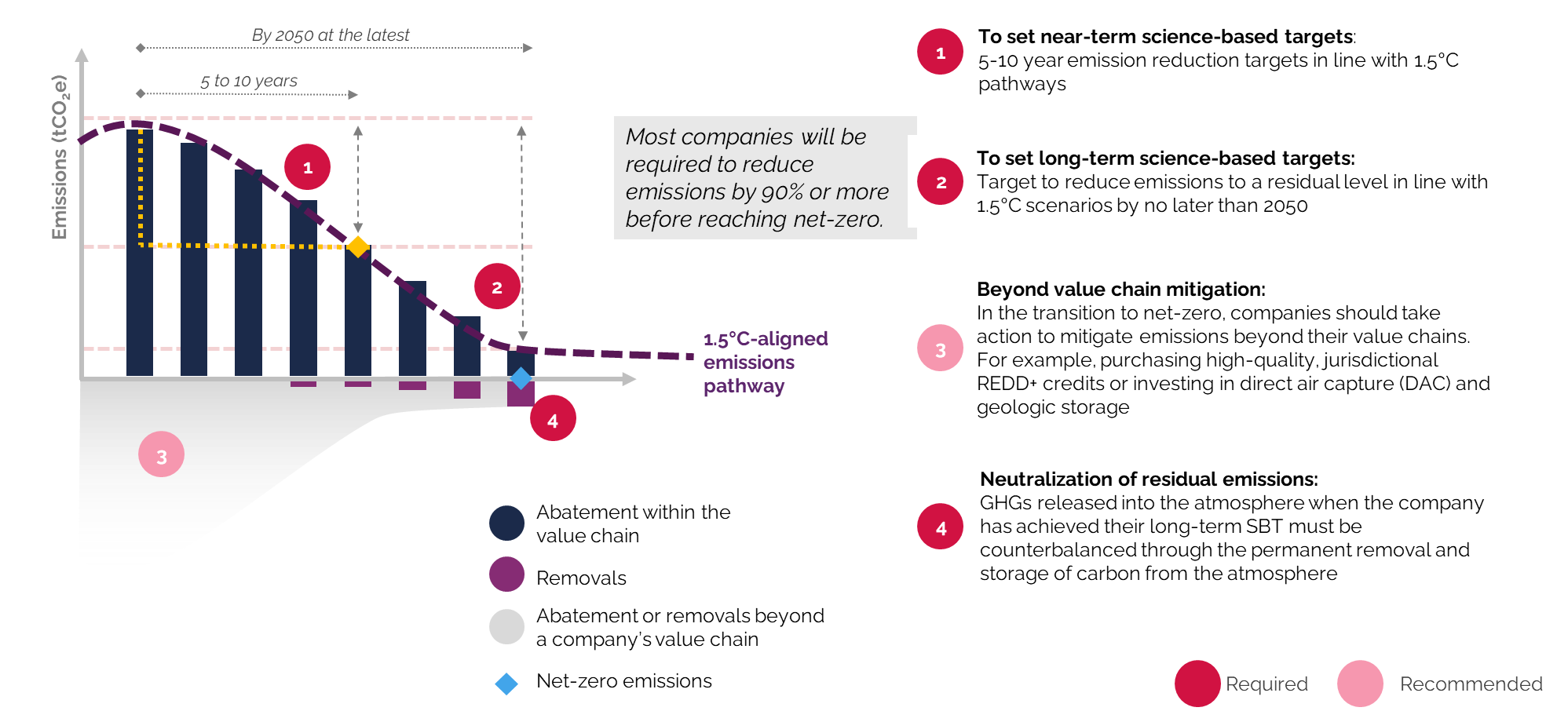

In the context of carbon pricing regulations, the use of carbon credits became more limited than before. In the European Union Emissions Trading System (EU-ETS), which is the world's first cap-and-trade scheme, there used to be a conditional allowance for a certain percentage of international credits from CDM/JI based on the Kyoto Protocol. However, since 2021, the use of these international credits has been deemed unavailable13. Similarly, in other European cap-and-trade systems such as the United Kingdom and Germany, the utilization of carbon credits is also not permitted (see Figure 2). On the other hand, the EU is expanding its coverage by launching EU ETS2 from 2027 as a separate emissions trading scheme targeting direct emissions from sectors including buildings, road transportation, and additional sectors primarily exempt from EU ETS. Additionally, measures to address leakage, such as the introduction of the Carbon Border Adjustment Mechanism (CBAM) from 202614, are being implemented, aiming to broaden the scope of regulation.

In carbon pricing scheme outside EU, there are several schemes where voluntary carbon credits are allowed to be used for certain percentage. For instance, the Regional Greenhouse Gas Initiative (RGGI) framework in the northeastern United States, which was the first cap-and-trade regulation implemented in the US, solely covers the power sector, resulting in an emission coverage rate of approximately 14%. Within RGGI participating states, the utilization of voluntary carbon credits (including those addressing methane leakage prevention) is permitted up to 3.3%15.

Similarly, China's cap-and-trade scheme currently encompasses only the power sector, allowing for the utilization of domestically generated voluntary carbon credits known as China Certified Emissions Reductions (CCER) up to 5%16. Regarding South Korea, although the coverage rate is notably high, accounting for 74% of the country's total emissions, the utilization of domestic CDM credits and Korean Offset Credits (KOC) is permitted up to 5% in Phase 3 starting from 2021. However, it is important to note that the allowable utilization ratios have shown a decreasing trend over time.

In summary, non-European carbon pricing systems provide limited allowances for the utilization of voluntary carbon credits, aiming to complement limited coverage by the regulation.

Since 2019, Singapore has implemented the first carbon tax in Southeast Asia17. Starting from 2024, international carbon credits can be used to offset the carbon tax coverage, with a maximum limit of 5% of the covered emissions18. The decision to set this 5% limit was influenced by references to California's cap-and-trade system and South Korea's Emissions Trading System (ETS). This marks the first instance within domestic and regional carbon pricing regulations where only international carbon credits are allowed for offsetting.

The purpose of allowing offsets by international carbon credit is to stimulate the carbon credit market, particularly in the Asian region, for the purpose of facilitating transactions through Singapore's carbon market. This is expected to revolve around the transactions of credits generated in Asia, catering to the needs of the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and the coming demands for BVCM (Beyond Value Chain Mitigation). The government of Singapore plans to disclose the criteria for eligible credits in the latter half of 2023.

In summary, carbon credits use is not allowed anymore in Europe, however, in countries such as the United States, China, and South Korea, use of voluntary credits from domestic projects are allowed within limited percentages (with Kazakhstan being the only exception where no limits are set19).

Regarding Japan's GX League, it currently operates as a voluntary participation framework rather than a regulated scheme. Furthermore, there are no restrictions placed on the utilization of credits, emphasizing the necessity for a thorough evaluation and enhancement of the system. The Japan GX League should clarify the objective behind permitting the use of voluntary carbon credits, ensuring alignment with the goal of limiting global temperature rise to within 1.5 degrees.

Figure 2 maximum percentages for offset utilization in ICAP member countries/regions

| 3) The Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and the anticipated transition towards Sustainable Aviation Fuel (SAF) |

|---|

For emissions from international aviation, which is not covered by the Nationally Determined Contributions (NDCs) under the Paris Agreement, the International Civil Aviation Organization (ICAO), a specialized agency of the United Nations, is responsible for goal-setting and reducing emissions from international aviation. In 2010, the ICAO adopted the aspirational goal of not increasing international aviation's greenhouse gas emissions beyond the 2020 level, in absolute term. However, for emissions that cannot be reduced through direct measures, the utilization of carbon credits is positioned as a solution, which is called the "Carbon Offsetting and Reduction Scheme for International Aviation" (CORSIA).

When discussing the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), the focus is often on carbon credits. However, CORSIA also defines "Eligible Fuels" in its efforts towards sustainable aviation fuel (SAF) adoption. The necessary amount of carbon credits for offsetting is determined by the emissions increase from the 2020 baseline, subtracting the purchase of SAF.

The International Civil Aviation Organization (ICAO) has identified four measures for achieving the aspiration goal: 1) aircraft related technology and standards, 2) improved air traffic management and operational improvements, 3) development and deployment of sustainable aviation fuel, and 4) carbon offsetting. From 2021 to 2026, the voluntary participation between countries that have expressed their commitment covers routes operated by those countries. Starting from 2027, mandatory participation will apply to all countries except exempted developing countries, and the demand for carbon credits is expected to increase based on the progress of measures 1) to 3). As of January 2023, 113 countries, including Japan, have voluntarily joined CORSIA (there are currently 193 member countries of ICAO as of May 202320).

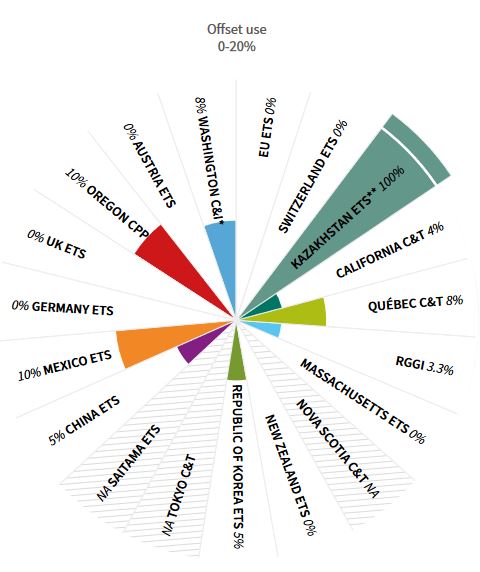

Please note that the International Civil Aviation Organization (ICAO) has established eligibility requirements, conducted assessments, and published eligible credits for the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA)21. There are exclusions based on criteria such as permanence, additionality, and sustainability.

The Japanese government underwent an assessment for J-Credits to be CORSIA eligible, but it was determined that "reapplication is required," and they were not deemed eligible22. It is important to note that if J-Credits were to become CORSIA eligible in the future and were used for offsetting purposes under CORSIA, Japan would need to add the corresponding emissions to its national emissions inventory.

Table 1 Carbon Offsetting and Reduction for International Aviation (CORSIA) eligible credits

Since the development of Sustainable Aviation Fuels (SAF) is still at an early stage, therefore, currently, the primary means of achieving carbon reduction is through the purchase of carbon credits. However, based on what the author has heard from various airlines, there seems to be a growing competition and race for the development of SAF in order to expedite progress and eliminate the ongoing reliance on purchasing significant amounts of carbon credits.

| 4) Supply side integrity |

|---|

On the demand side, the concept of "integrity" in terms of usage has been defined by the Science-Based Targets initiative (SBTi), Race to Zero, UN Net Zero Expert Group and the Voluntary Carbon Market Integrity Initiative (VCMI). In these criteria, it is recognized that integrity is essential not only for the demand side but also for the supply side, which refers to the entities/projects generating carbon credits. The role of ensuring integrity on the supply side is agreed to be undertaken by the Integrity Council for the Voluntary Carbon Market (ICVCM).

The Taskforce on Scaling Voluntary Carbon Markets (TSVCM) was established as a precursor to the Integrity Council for the Voluntary Carbon Market (ICVCM). It was initiated by Mark Carney, the former Governor of the Bank of England, and sponsored by the Institute of International Finance (IFF) to promote the expansion of voluntary carbon markets, which is essential for funding the investments required to achieve net-zero emissions. In January 2021, the TSVCM released a report that highlighted the importance of scaling voluntary carbon markets23. After conducting a public consultation from May to June of the same year, the ICVCM was announced in September 2021.

The TSVCM report emphasized the necessity of expanding carbon markets, stating that in order to limit global greenhouse gas emissions to 23 gigatons of CO2 equivalent annually by 2030, funding (i.e., carbon credit generation) must increase by over 15 times the current levels. Additionally, it highlighted the significance of voluntarily purchasing carbon credits to provide funding for emissions avoidance, reduction from other sources, or removal of greenhouse gases from the atmosphere, thereby contributing meaningfully to the transition to a global net-zero. Furthermore, it is explicitly stated that "by voluntarily purchasing carbon credits, one can provide funding for the avoidance, reduction, or removal of emissions from other sources and compensate24 or neutralize25 emissions that have not been eliminated from the atmosphere, thereby making a meaningful contribution to the transition to global net-zero."

The term "compensate" was used before the term BVCM was introduced in the same context, i.e., to provide funding for the portion of emissions that has not yet be reduced under the 1.5℃ pathway. What TSVCM says is that, the main role of carbon credits is BVCM.

The role of the ICVCM is to first establish the Core Carbon Principles (CCPs) as a foundation. Based on these principles, the ICVCM creates evaluation frameworks and processes at both the program and category levels, aiming to provide CCP certification for carbon credits. In March 2023, the Core Carbon Principles (CCPs) and program-level evaluation frameworks, along with the evaluation processes, were publicly released26.

For program-level evaluations, in the case of Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) eligible credits, additional evidence demonstrating compliance with the Core Carbon Principles (CCP) requirements concerning effective governance, credit tracking, transparency, and robust third-party certification and verification is required to undergo assessment. In addition to the already announced program-level evaluation frameworks, category-level evaluation frameworks are scheduled to be published. This will enable evaluations to take place by mid-2023, with the expectation of the first Core Carbon Principles (CCP) certified credits being issued by the end of 202327.

CCPs are not entirely new and are considered common knowledge for those involved in generating credits. Looking ahead, it will be noteworthy to observe whether specific thresholds are set for challenges such as additionality, baselines, and permanence within the category-level evaluation frameworks.

At this stage, ICVCM has not made a statement regarding whether corresponding adjustment can or should be made based on Article 6 of the Paris Agreement for voluntary carbon credits. However, it indicates that such information should be disclosed in a transparent manner.

Conclusion: Integrity in both demand and supply side is critical

Regarding the utilization for achieving emissions cap and trade or other carbon pricing regulations, which is another aspect of demand, there are three main approaches:

1) The United States' RGGI (Regional Greenhouse Gas Initiative), China, and South Korea allow for the use of voluntary carbon credits as offsets up to a certain percentage from sources not covered by the current regulatory scope, but within the boundary of the jurisdiction. This is often due to the relatively small coverage of their existing schemes.

2) Europe and various European countries, on the other hand, prioritize expanding the coverage and enhancing integrity by not allowing offsets through credits, but rather by broadening the regulatory scope.

3) Singapore carbon tax scheme allows for the use of international credits up to a certain percentage, thereby providing financial support for areas in need. This aims to bolster the exchange of carbon credits in Singapore market.

For approaches 1) and 3), the offset limits typically range from approximately 3% to 10%, with Kazakhstan being the only country without any limitations. In the case of the Japanese GX League and voluntary target setting by companies, companies are allowed to offset their emissions without any limitations using mechanisms such as JCM and J-Credits. From the perspective of integrity, is crucial to first clarify the purpose of allowing offsets and design systems in a manner that does not compromise the objective. It is important to note that relying on overseas emission reduction credits to offset the continued use of fossil fuels does not constitute a high-integrity rationale.

Since 2021, the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) has been driving the demand for carbon credits. The scheme aims to maintain international aviation emissions at 2020 levels through four measures: technological development, operational improvements, the use of Sustainable Aviation Fuels (SAF), and carbon credits. This means that any emissions increase in international aviation since 2020 must be reduced or offset by purchasing SAF or carbon credits. During the voluntary participation period from 2021 to 2026, 119 countries, including Japan, are actively participating and creating a significant demand for carbon credits. However, there is a growing interest in transitioning to SAF instead of relying heavily on purchasing carbon credits. Airlines are currently competing to procure SAF as an alternative fuel.

As for the accomplishments of CORSIA, it has been operating quality requirements since 2019 and has a track record of evaluating eligible credits. This has formed the basis for the Core Carbon Principles (CCPs) on the quality of carbon credits. It is anticipated that these principles will continue to serve as the foundation for the demand for high-quality carbon credits in the near future.

The quality requirements for carbon credits, which can be considered as supply side, were initially established by the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and later taken by the Integrity Council for the Voluntary Carbon Market (ICVCM). In March 2023, the ICVCM announced the Core Carbon Principles (CCPs), and it is expected that credits certified under these principles will be produced by the end of 2023.

It is important to note that while the ICVCM is responsible for the integrity of the supply side, the previous Taskforce for Scaling Voluntary Carbon Markets (TSVCM) report clarified that these credits are intended to address the financial needs required to achieve the 1.5-degree Celsius goal, specifically for "compensation and neutralization for emissions that cannot be reduced", but not offsetting emissions. This is the way to use carbon credits with high integrity.

Japan's GX League not only serves as a voluntary participation framework but also allows unlimited use of credits for offsetting towards achieving its goals, deviating from the standards of global carbon pricing regulations. It raises questions about the purpose of utilizing these credits—whether it aims to promote emission reductions or removals beyond coverage, provide funding for CO2 removal technologies in developing countries, or any other objectives. Designing the overall system requires integrity build on the purpose of utilizing carbon credits.

If the intention is to claim carbon neutrality while continuing to rely on fossil fuels, it may be difficult to perceive such an approach as having high integrity. I believe Japan has high integrity, and in the realm of climate change, it is expected to demonstrate integrity that garners respect from other nations.

- 1Carbon refers to the emission of carbon dioxide. Additionally, credits issued for the reduction of other greenhouse gases such as methane are often treated in terms of carbon equivalence, which is why they are collectively referred to as carbon credits.

- 2The purpose of such credits is to minimize the impacts of dangerous climate change, starting with the goal of reducing carbon emissions to the greatest extent possible. It is essential to act without engaging in any form of "cheating" or actions that could be perceived as greenwashing. Even if there may be loopholes available, integrity requires refraining from such behavior. The integrity of individuals, in terms of their conduct, may be based on morality or religion. However, when it comes to addressing climate change, reliance should be placed on science. Additionally, it is crucial to establish governance structures that consistently value and reward high-integrity initiatives, while preventing corruption and promoting transparency and improvement.

- 3"Net-zero" and "carbon-neutral" are considered synonymous on a global scale, as stated in the IPCC Glossary. Initiatives such as SBTi (Science-Based Targets initiative), Race to Zero, and the UN Net Zero Expert Group use the term "net-zero" and provide clear definitions that generally exclude the use of offsets. On the other hand, "carbon-neutral" is often used in contexts that include products or activities relying on offsets.

- 4https://www.un.org/en/climatechange/high-level-expert-group

- 5United Nations, “Secretary-General's remarks at the World Economic Forum” (18 January 2023)

- 6Carbon removal refers to the process of removing greenhouse gases that are already present in the atmosphere. Carbon reduction credits are generated based on the amount of reduced emissions compared to the baseline status, where there is no technology in place In contrast, removal credits are generated for the physical act of removing greenhouse gases from the atmosphere.

- 7Neutralization refers to the process of counterbalancing the greenhouse effect by effectively canceling out the remaining emissions within a specified time frame through physically removing GHG from the atmosphere.

- 8The term "residual emissions" is used to define emissions that cannot be reduced through technologies that is deemed feasible. For the general sectors, the threshold for residual emissions is set at 10% of the base year emissions, although the percentage may vary by sector based on calculations by organizations such as the IEA. For more detailed information, it is recommended to refer to the Net Zero Criteria and related paper provided by SBTi.

- 9SBTi, “Foundations for Net-Zero Target Setting in the Corporate Sector” (September, 2020).

- 10Race to Zero, “Race to Zero Criteria.”

- 11VCMI, “Provisional Claims Code of Practice, For Public Consultation and Corporate Road Testing,” June 7, 2022.

- 12Scope 1 represents direct emissions from an organization, Scope 2 encompasses emissions from the generation of secondary energy (such as electricity) consumed by the organization, and Scope 3 includes all other emissions within the organization's value chain. The GHG Protocol Scope 3 standard defines 15 categories to account for these emissions.

- 13European Commission, “Use of international credits”

- 14ICAP, “EU adopts landmark ETS reforms and new policies to meet 2030 target” (2023.5.3)

- 15ICAP, “USA - Regional Greenhouse Gas Initiative (RGGI)”

- 16ICAP, “China National ETS”

- 17Singapore's carbon tax has been set at a relatively low level of $5 per tonne of CO2-equivalent from 2019 to 2023. However, there are planned increases in the tax rate in the coming years. Starting from 2024, the tax rate is scheduled to rise to $25 per tonne. It will further increase to $45 per tonne from 2026, and by 2030, it is expected to reach $50 to $80 per tonne.

- 18National Climate Change Secretariat, Singapore “Carbon Tax”

- 19ICAP, “Emissions Trading Worldwide, 2023 Status Report” (2023)

- 20ICAO, “CORSIA Eligible Fuels”

- 21ICAO, “CORSIA States for Chapter 3 State Pairs”

- 22Please refer to the materials from J-Credit Scheme Operation Committee (April 28, 2023) for more details. The areas identified for improvement were governance of the system, safeguards mechanisms, criteria related to sustainable development, and net harmlessness.

- 23TSVCM, “Taskforce on Scaling Voluntary Carbon Markets, Final Report” (2021.1)

- 24The term "compensate" was later replaced with the concept of Beyond Value Chain Mitigation (BVCM). BVCM refers to the process of purchasing credits to mitigate the emissions that unavoidably occur during the progress of reduction efforts on the 1.5℃ pathway. It signifies acquiring credits to compensate the equivalent amount of emissions that are emitted in the course of reduction.

- 25Neutralization means physical removal of emissions. This includes direct air capture (DAC), which refers to the direct removal of CO2 from the atmosphere, as well as increasing the absorption capacity of forests. It should be noted that regarding the increased absorption capacity of forests, considerations are necessary regarding whether it can sustain the increased absorption over a period of 100 or 200 years in a persistent manner.

- 26ICVCM, “Core carbon principles, assessment framework and assessment procedure” (2023.3)

- 27ICVCM, “Integrity Council launches global benchmark for high-integrity carbon credits”