On November 9, 2021, French President Emmanuel Macron officially announced the ambition to build new nuclear reactors in France which should be generation-III evolutionary pressurized reactors (EPRs) – no detailed plans have been presented yet. Already on October 12, 2021 President Macron officially announced the ambition to build one Small Modular Reactor (SMR). These announcements are unlikely to prevent the gradual decline of nuclear energy in France caused by technical and economic difficulties. In France’s quest towards carbon neutrality by 2050, electricity will be important and depend on continued expansion of renewable energy (RE) to succeed.

Historical growth and recent decline of nuclear power in France

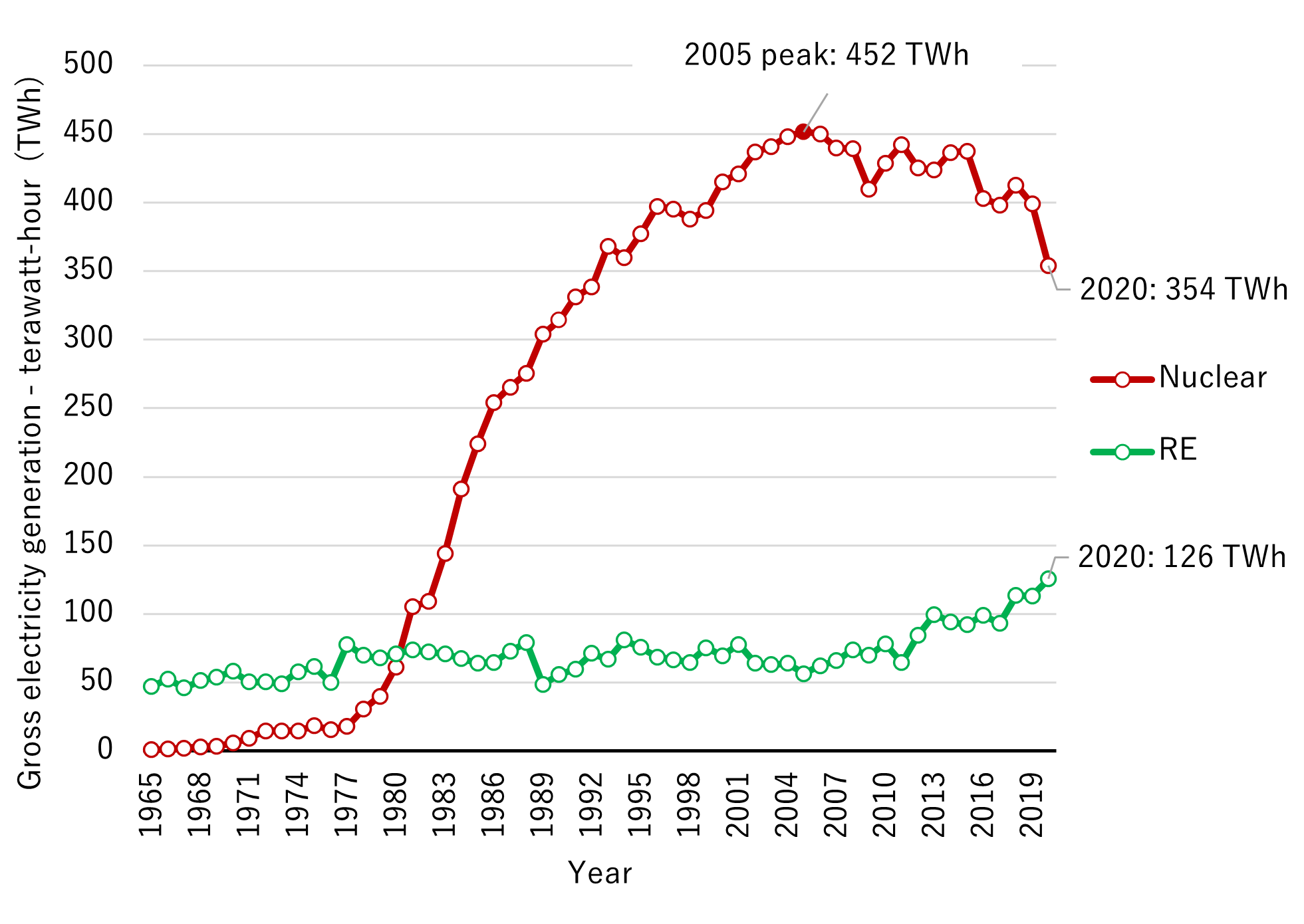

As of January 13, 2022, France had 56 operational nuclear reactors with a combined gross installed capacity of about 64 gigawatts (GW). In addition, one reactor, Flamanville-3 EPR (1,650 megawatts (MW)) has been under construction since 20071. Historically, nuclear power has been France’s major answer to the 1973 oil crisis when the fossil fuel-poor country was looking for alternatives. Nuclear, at the time, was seen as capable of delivering abundant, affordable and quasi-domestic energy. As a result, electricity generation from nuclear power grew quickly in France – especially in the 1980s, and eventually peaked in 2005. Following a decade of stagnation, electricity generation from nuclear power started to decrease from 2016. There were several reasons: On the one hand, because of issues directly related to nuclear power itself; Safety concerns due to irregularities in quality-control documentation and manufacturing defects, and the politically decided permanent shutdowns of reactors Fessenheim-1 & -2 – effective in 2020. On the other hand, the continuous increase in RE electricity generation, and the negative impacts of the COVID-19 pandemic on nuclear reactors maintenance in 2020.

In other words, RE and COVID-19 have structurally and temporarily, respectively, reduced the need for and availability of nuclear power.

Source: BP, Statistical Review of World Energy 2021 (July 2021).

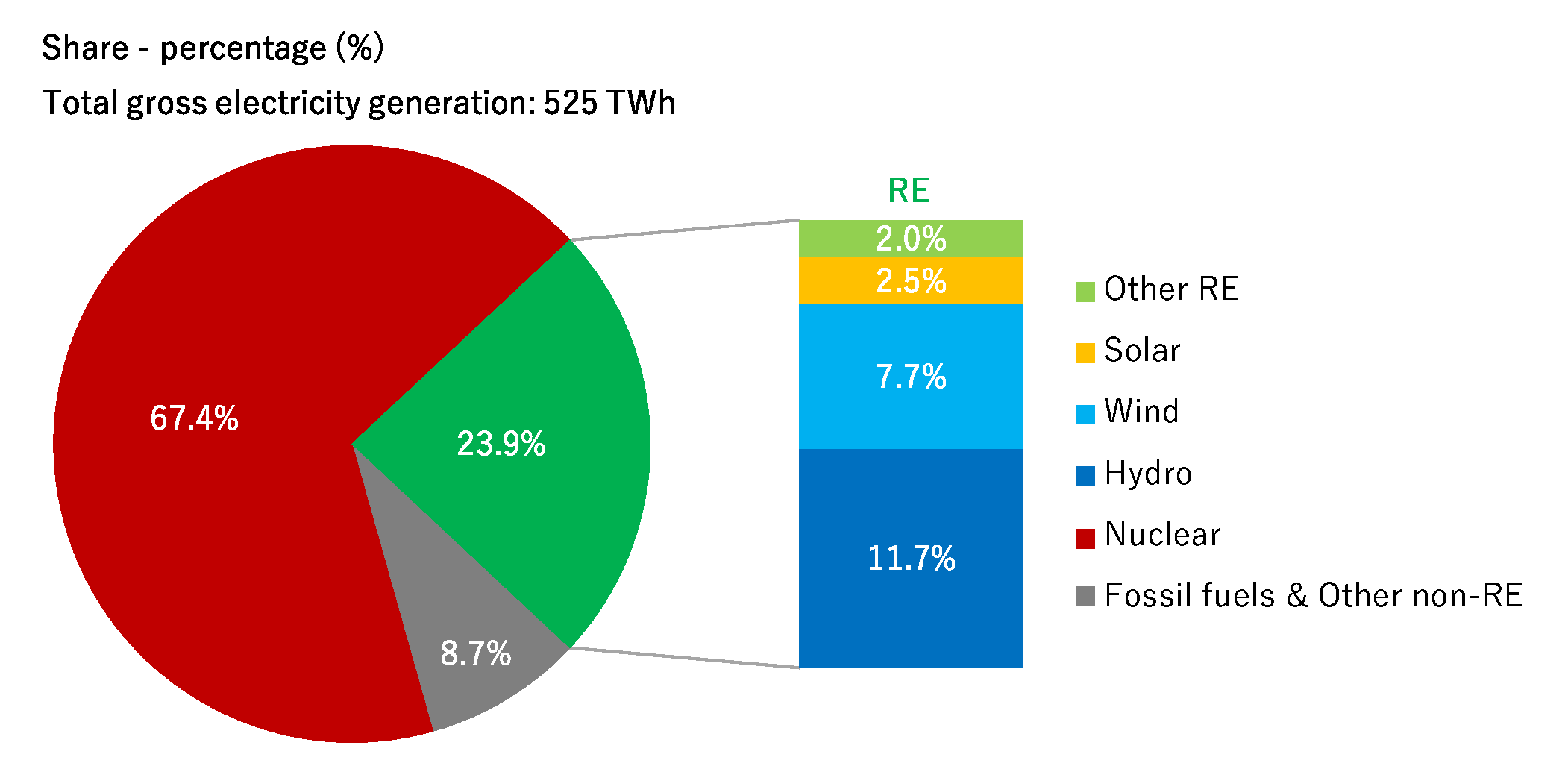

Despite these recent negative developments for nuclear power in France, the share of this technology in the country’s electricity generation mix remains high: 67% in 2020.

Source: BP, Statistical Review of World Energy 2021 (July 2021).

In France, there is a perception that nuclear power and RE can both be expanded to reach carbon neutrality. In this regard, France is certainly the world’s rare example of where nuclear power is operated with flexible load-following and moderate RE integration. Though this approach is technologically remarkable, it comes with drawbacks on the operations of nuclear reactors. First, it reduces nuclear reactors capacity factors, deteriorating their cost per unit of electricity delivered and hence their profitability. Second, attempts of flexibly operating a nuclear reactor may not always be successful and cause damages to fuel rods (e.g., nuclear reactor Brokdorf in Germany in 2017)2. The original design of reactors rarely assumes such flexible operations, and the French example is unlikely to be replicated with all existing reactors everywhere in the world.

The reasons why France goes nuclear power again

From a French point of view, there are three main arguments in favor of nuclear power today:

(1) Energy and military independence,

(2) Hedge against imported polluting fossil fuels and their price volatility, and

(3) Large-scale dispatchable decarbonized power supply fitting the state-controlled power industry.

It may be emphasized that in the current European context, reliance on fossil fuels is a burning issue: Geopolitically, economically and environmentally. Three recent events have probably played a significant role in France opting in nuclear power again: Belarus’ gas supply disruption threats to the European Union (EU) in the midst of a migrant crisis with Poland3, the ongoing episode of expensive gas4, and the questionable decision of Belgium to build combined cycle gas turbine (CCGT) plants as a consequence of its nuclear power phaseout planned for 20255.

The French government growing confidence in nuclear power is also supported by a recent report from the national independent transmission system operator Réseau de Transport d'Électricité (RTE): “Energy Futures 2050”, a long-term outlook of the French power system in the context of carbon neutrality by 2050 and beyond (2060).

The main results of this study were published in October 20216 after more than two years of work.

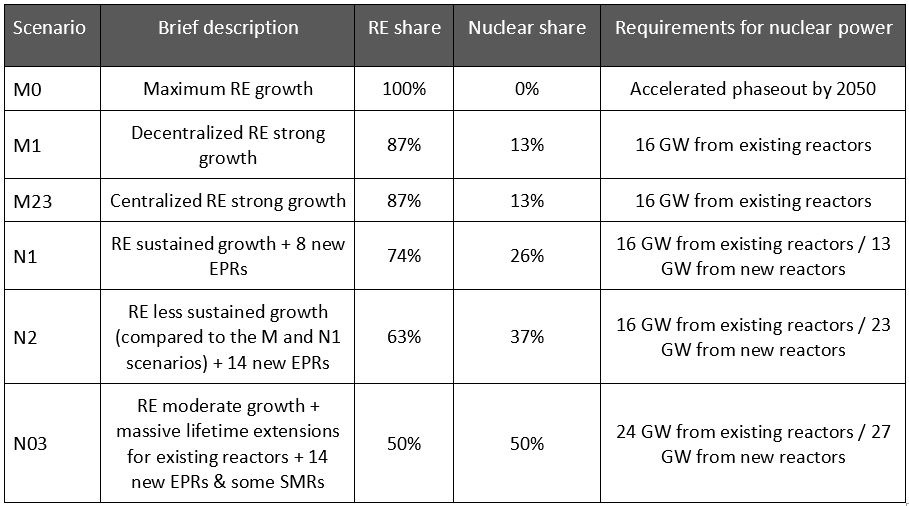

“Energy Futures 2050” explores seven different electricity demand scenarios and six different carbon neutral electricity supply scenarios, focusing more on RE (shares in electricity generation ranging from 50% to 100%) than on nuclear power (from 0% to 50%):

“Energy Futures 2050” Electricity Supply Scenarios Simplified Presentation – 2050

Source: RTE, Energy Futures 2050: Main Results (October 2021) (in French).

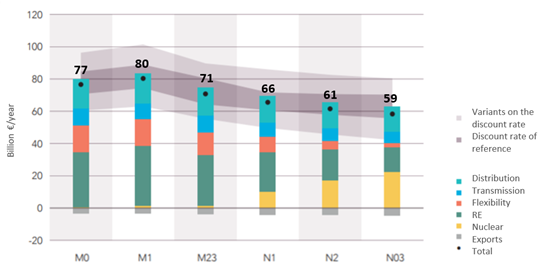

The highlighted economic finding of this analysis is that: Under an electricity consumption scenario of reference (i.e., central case scenario – 645 terawatt-hours (TWh) in 2050), the electricity supply scenario “N03” scenario (i.e., 50% RE-50% nuclear power in 2050) is the most cost-efficient electricity generation mix for the French power system in 2060.

“Energy Futures 2050” France Power System Total Costs in each Electricity Supply Scenario – 2060

Source: RTE, Energy Futures 2050: Main Results (October 2021) (in French).

This result is explained as follows7: Extending the lifetime of existing nuclear reactors is assumed to be a cost competitive option; around €30-40 per megawatt-hour (/MWh), excluding sunk costs. According to the report, new RE – especially utility-scale solar and on- & off-shore wind power, outcompetes new nuclear on a generation cost basis; €25-55/MWh against €60-85/MWh (both ranges are projections for 2050). However, with the methodology of the report, this advantage is more than counterbalanced by the “integration costs” of RE. These integration costs include: “Flexibility” from electricity demand and energy storage (battery, hydrogen and pumped storage hydropower), as well as network reinforcements (“Transmission” & “Distribution”). The main integration cost differences between the “M0” (i.e., 100% RE) and “N03” (i.e., 50% RE-50% nuclear power) scenarios are such “flexibility costs”. This is because whereas “M0” assumes 29 GW of new thermal power plants fueled by decarbonized gases (e.g., hydrogen, synthetic methane and biomethane) and 26 GW of batteries as back-up capacity in 2050, the “N03” includes only 1 GW of batteries.

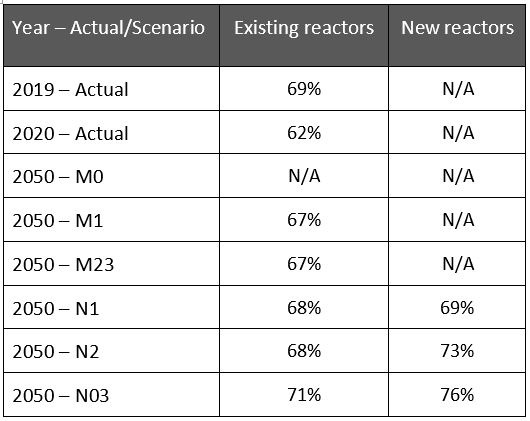

The generation costs of nuclear power are based on average capacity factors of approximately 70% for existing reactors and of 70-75% for new reactors:

Recent Empirical and “Energy Futures 2050” Nuclear Reactors Average Capacity Factors

Sources: RTE, Electricity Report 2020 (January 2021) and Energy Futures 2050: Electricity Supply – Demand Scenarios (October 2021) (in French).

These capacity factors are not very different from those observed just before the COVID-19 pandemic (i.e., 69% in 2019). It is interesting to note that the impact of future high RE shares on the capacity factors of nuclear reactors will be small. In France, power plants are economically dispatched based on the merit order principle. Expansion of RE technologies such as solar and wind, which have close to zero marginal costs, are detrimental to the operation time of nuclear reactors. Hence the finding that higher RE shares will have no impact on the capacity factors of nuclear reactors is counterintuitive at first sight. It may, however, be explained by the fact that French nuclear reactors are already frequently operated in load-following mode, due to the country’s high nuclear power share resulting in overcapacity of nuclear power. In addition, as electricity consumption is expected to grow, and nuclear power installed capacity to decrease, this is offsetting the downward impact of RE expansion.

While RTE’s analysis may be praised for its comprehensiveness and inclusiveness it may be questioned why the economic conclusion is based on one electricity consumption scenario of reference unaffected by electricity prices, and societal development.

Furthermore, it may be argued that under the current and future circumstances, 50% of electricity from nuclear power in France in 2050 seems too optimistic because of the difficulties this technology is confronted with. Therefore, the more realistic electricity supply scenarios would be 100% RE or 63-87% RE.

Difficulties lying ahead of nuclear power

Under the electricity consumption scenario of reference, and throughout all electricity supply scenarios described in the previous section of this column, the share of nuclear power in France’s electricity generation mix would fall from 67% in 2020 to 50% in 2050 in the scenario where nuclear is most successful.

Limiting the decrease of nuclear power in France to 50% by mid-century would actually be an accomplishment for the national nuclear industry, especially for the debt-laden (around €40 billion) 84% state-owned power company Électricité de France (EDF)8, which faces two main technological and financial daunting challenges:

(1) Extending the lifetime of existing nuclear reactors, and

(2) Timely and cost-efficiently building new reactors.

Both are more challenging than the model above indicates. Real costs may be significantly higher.

Regarding existing nuclear reactors lifetime extensions, this option is often described as a preferred solution of the French energy transition towards carbon neutrality because it is based on already built reactors which have been competitive to operate and sufficiently reliable and safe until now. The average age of the French nuclear reactors is 37 years9. The cost of keeping them safe and able to operate with high capacity factor, however, is difficult to predict. Indeed, as of the beginning of 2022, global experience in operating nuclear reactors over 50 years is small. No reactor in operation is older than 52 years old , and no reactor has ever been operated for 60 years. This challenge will be made more arduous by an increasingly complex future environment for which existing reactors were not originally designed for such as climate change and increased terrorist activities. These factors tend to increase nuclear costs while increased low marginal cost renewable power will make competition harder.

Another hurdle is the financing of this strategy. The cost of the “grand carénage” program aiming at refurbishing France’s nuclear power fleet, enhancing reactor safety, and if conditions allow, extending their operating lifespan is estimated by EDF to amount to about €50 billion over the period 2014-202510.

As for the timely and cost-efficient construction of new reactors, the electricity supply scenario “N03” requires 14 generation-III EPRs, and some SMRs, the latter with a combined capacity of 4 GW. It may appear as naive enthusiasm to think that these two technologies could play an important role tomorrow given their track record today:

The first and only EPR under construction in France is Flamanville-3, a project led by EDF as developer, constructor, owner and operator. This project is an industrial failure with endless delays and substantial cost overruns observed11. When the construction of this reactor started in 2007, its commissioning was scheduled for 2012 at a cost of around €4 billion. In 2022, Flamanville-3 is still not operational and it will not be before 2023 – at least an 11-year delay on a five-year project. Its cost has spiraled to more than €20 billion, a multiplication by a factor five compared to the cost estimate when decision was taken. As a result, the generation cost of Flamanville-3 is now estimated at €115-125/MWh. Explanations provided blame for unpreparedness, incorrect technical references and insufficient detailed studies as well as the loss of competences in the French nuclear industry. The absence of skills maintenance, or “learning by doing”, has proven particularly problematic for the quality of welds – requiring repairs, notably.

Following the Fukushima Daiichi nuclear accident in Japan in 2011, safety verifications have also been detrimental to the progress of the Flamanville-3 project.

At the light of this example, betting on successful multiple deployments of EPRs should invite cautiousness. That caution, while a massive financial effort will be necessary to realize such EPRs expansion plans, makes a substantial government engagement necessary. It would involve market interventions forcing customers to take the risk or pay for the nuclear projects.

SMRs are not technologically mature and their costs are very uncertain. Experience from attempts, so far is discouraging, with delays and cost overruns similar to conventional large projects12. France, with its SMR project known as “NUWARD” (nuclear forward), is a rather latecomer in this field. Though relatively little information is available on this project it may be reported that the envisioned French SMR would have a capacity of 340 MW (two reactors of 170 MW each), might be constructed at the earliest by 2030, and mainly target export markets – especially rather small isolated power systems currently relying and fossil fuels for electricity generation13. Constructions of SMRs in France is likely for demonstration purposes.

Nuclear reactors have economies of scale, the bigger the better. As a result large-scale nuclear reactors will remain the least bad option in the competitive European power system.

The same economic factors have resulted in various SMR concepts growing in size when trying to achieve better cost performance. From some 10 MW per reactor to hundreds of MW, closing in on the around 1.5 GW capacity of modern conventional reactors.

Beyond these main technological and financial challenges, prolonged reliance on nuclear power means increasing the amount of spent fuel & radioactive waste, and therefore makes it necessary to expand storage capacity for these dangerous materials. Building an additional spent fuel pool at the French reprocessing facility La Hague, for a cost estimated at €1-2 billion14 is considered necessary. Moreover, this relaunched of nuclear power will also impact the French deep geological repository Cigéo (industrial center for geological disposal), which operations should start in 203015. At present the cost is estimated to be at least €27 billion16. Those estimates are included in RTE’s “Energy Futures 2050” analysis presented in the previous section of this column.

Reactor accidents may cost hundred billion euros. The economic liability is limited for operators either by a strict liability limit or by allowing the companies to go bankrupt without the ability to pay. As the number of such accidents is not negligible in relation to the accumulated electricity generation, it appears as a significant hidden cost not fully included in the model above.

While France used nuclear power to reduce the use of fossil fuels in electricity generation already 40 years ago, Germany did not go as far. While France is not phasing out nuclear and replacing nuclear electricity with RE at a slow pace, Germany has deployed far more RE and has the ambition to phase out both nuclear and coal based electricity generation in the coming decade.

With a high share of low marginal cost RE, electricity prices will also allow for electricity to be used to replace fossil fuels in other sectors.

Having presented these challenges for nuclear power in France, it is now well-understood that even if it would be the most economic option, limiting the decrease of the share of this technology to 50% in the country’s electricity generation mix by 2050 is hardly feasible. Thus, it is clear that most of France’s additional decarbonized electricity supply should come from RE, which growth should be strongly accelerated to meet more than 50% of France’s electricity generation.

France’s hydropower potential is largely developed, most new RE electricity should come from solar and wind power. Though the country has been active in organizing multiple tenders for these technologies in the past years, actual deployments remain slow: as of December 1, 2021; installed capacity of 12 GW for solar and 19 GW for wind (essentially onshore)17. In comparison, in RTE’s “Energy Futures 2050”, under the electricity consumption scenario of reference, in the electricity supply scenario “M0” – 100% RE by 2050: 208 GW of solar, 74 GW of onshore wind and 62 GW of offshore wind are required to be installed18.

The main issue that RE is confronted with in France today is acceptance.

While climate change and nuclear accident consequences and radioactive waste will be burdens for coming generations, the social acceptance of RE, such as the visual impact of wind power plants, hits today’s electricity generation. This immediate social acceptance issue makes it easier to mobilize resistance against RE.

To unlock the potential of RE, the concept of sustainable development where the way we live today should not be allowed to reduce the opportunities of future generations must gain support.

- 1International Atomic Energy Agency, Power Reactor Information System: France – updated January 13, 2022 (accessed January 14, 2022).

- 2Energy Transition, Craig Morris, Germany shuts down next nuclear plant – December 13, 2017 (accessed December 14, 2017).

- 3BBC, Belarus threatens to cut off gas to EU in border row – November 11, 2021 (accessed December 14, 2021).

- 4Bloomberg, Rachel Morison, Europe’s energy crisis is about to get worse as winter arrives – November 28, 2021 (accessed December 14, 2021).

- 5BloombergNEF, Kesavarthiniy Savarimuthu, Belgian capacity market is a boon for gas plants – November 9, 2021 (accessed December 14, 2021). [subscription required]

- 6The in-depth analyzes supporting the main results of the “Energy Futures 2050” study will be published in the first quarter of 2022.

- 7RTE, Energy Futures 2050: Economic Analysis (October 2021) (in French).

- 8EDF, 2021 Half-year Results (July 2021).

- 9IAEA, op. cit. note 1.

- 10RTE, op. cit. note 7.

- 11Cour des Comptes, EPR Industry (July 2020) (in French) and EDF, Update on the Flamanville EPR – January 12, 2022 (accessed January 14, 2022).

- 12Mycle Schneider, The World Nuclear Industry Status Report 2021 (September 2021).

- 13EDF, EDF announces the establishment of the International NUWARD Advisory Board (INAB) to provide advice and insights on the development of NUWARD SMR – December 2, 2021 (accessed December 14, 2021).

- 14RTE, op. cit. note 7.

- 15Agence Nationale pour la gestion des Déchets Radioactifs, Cigéo: Key figures (accessed December 14, 2021).

- 16RTE, op. cit. note 7.

- 17RTE, eCO2mix - Key figures: Generation capacity – updated December 1, 2021 (accessed January 14, 2022).

- 18RTE, Energy Futures 2050: Main Results (October 2021) (in French).