|

With a population close to 1.4 billion people – more than 10 times that of Japan – India is the world’s second most populated country just behind China. It is one of the best examples of rapidly growing emerging economies having ambitiously and successfully invested in low cost renewable energy, especially solar photovoltaic and onshore wind. To support the integration of these technologies India is advancing pioneering RE policies, in particular new auction designs focusing on providing stable power.

|

|---|

Story

At the United Nations’ Climate Summit in New York in September 2019, the Prime Minister of India, Narendra Modi, announced a new target of 450 gigawatts (GW) of renewable energy (RE) capacity (with no specific date). A new evidence again of increased ambitions for RE in India after the 2018 announcements of (1) raising the country’s 2022 RE target from 175 GW – out of which, 100 GW of ground-mounted & rooftop solar photovoltaic (PV) and 60 GW of onshore wind, notably, and excluding large hydro – to 227 GW – including 212 GW of solar and wind – and (2) setting a new target of 275 GW by 2027.1Before unveiling these higher objectives, RE was already key to India’s 2016 Nationally Determined Contribution (NDC) in which the country committed to a decarbonization goal of reducing the emissions intensity of its gross domestic product by 33-35% by 2030 compared to 2005 – not a greenhouse gas emissions reduction target per se.2 So was nuclear power at that time, which is not the case anymore because of this technology's excessively slow developments. Indeed, originally set at 63 GW by 2032, the nuclear power was quickly divided by a factor three in 2018.3 Even meeting this new lower target will be difficult because the combined capacity of existing and under constructions reactors totals only 12 GW.4

In India, two main reasons are driving the ever-increasing enthusiasm for RE: decarbonization and economics, a powerful combination supporting RE massive deployment. On the one hand, India suffers from severe air pollution issues with 70% of the world’s top 30 most polluted cities located in the country.5 On the other hand, at around $30-50 per megawatt-hour (/MWh) new solar PV and onshore wind outcompete coal power – the historically cheapest and most polluting option, which now rather costs about $45/MWh for existing plants and typically $60/MWh for new-builds.6

As a result, in India as of June 2020, installed capacity of solar PV and onshore wind reached 35 GW and 38 GW, respectively.7 In comparison, back in 2010, installed capacity of solar PV was close to zero and that of wind “only” 13 GW.8

The past decade has thus witnessed a significant penetration of RE which has even jeopardized plans for new coal power plants, with at least three states having announced they will not build new coal power stations (Gujarat, Maharashtra, and Chhattisgarh) because of relatively low electricity consumption and cheaper RE alternatives.9 These developments could ultimately lead the Government of India to advance a no new coal policy, that is not the case yet.

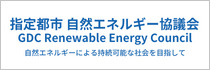

As of 2019, the share of RE (including large hydro) in India’s total electricity generation (almost 1,600 terawatt-hours) reached 19%, up 4 percentage points since 2010 (Chart 1). This increase is essentially due to the expansion of solar PV and wind which combined share rose from 2% to 7% in this period. The share of hydro slightly decreased because electricity generation from this technology grew slower than total electricity generation. The share of gas decreased as well, because domestic production has developed below expectations and imports are not competitive. Compared to nuclear power, RE’s contribution to the country’s electricity mix is more than 6 times bigger. Nevertheless, the key challenge for RE is not nuclear, but coal, which remains overwhelmingly dominant with a share of 73%.

Coal, and coal power especially, has fueled India’s growth for decades. However, because its use is unsustainable and its resources constrained (resulting in higher net imports), the country had to look for alternatives meeting four critical conditions: abundant, clean, cheap, and capable of providing stable power.

On the demand side, customers are hungry for affordable and environmentally friendly electricity. In charge of distribution and supply, power distribution companies (DISCOMs), which are mostly state-owned, have to meet their customers’ needs. This is reflected in the DISCOMs’ procurement strategies. Especially, the need for affordable electricity is exacerbated by the DISCOM’s poor financial health because of chronic losses due to the lack of metering and low payment collection rates.

Solar PV and wind are abundant and clean, but used to be criticized for being expensive and weather dependent. Taking advantage of global industrial progress, India has advanced aggressive and smart RE policies centered on auctions to deliver its population low cost and stable power.

Renewable Energy Integration

In the past decade, bullish about solar PV and wind, India made headlines with its RE auction program. At first, the main goal of these auctions was to stimulate large investments in big RE projects in a cost-efficient way. Reverse auctions, long-term power purchase agreements (PPAs) containing fixed-price contracts were the ingredients of success, and delivered very low bids. The best and most recent illustration of this success is a 2 GW solar auction which has led to a record low bid of $31/MWh in July 2020.10

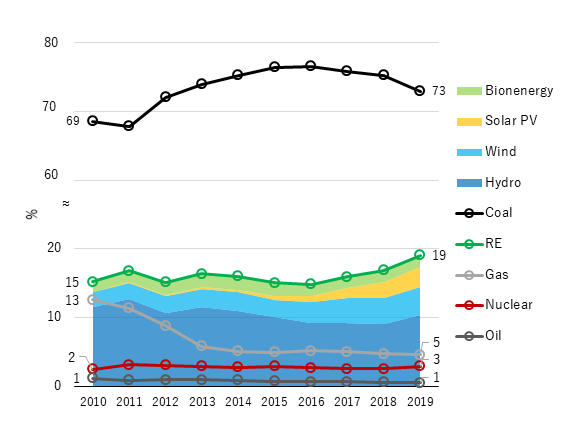

Chart 2 below shows how the utility-scale solar PV and onshore wind auction volumes have been ramped up over the past decade and the dramatic price decrease observed. In 2019, wind auctions were victims of their success of 2017-2018 as procurement prices reached and therefore sought afterwards were deemed too low by developers. Policy makers are currently trying to fix this issue which may take a little time, the situation with COVID-19 does not helping much either. In addition, it must be added that in a context of economic rationality onshore wind also suffers from the comparison with solar PV, the latter being a bit cheaper than the former: $27-45/MWh against $29-51/MWh, or typically $33/MWh or $37/MWh (levelized cost of electricity basis).11

Chart 2: India Auction Volumes and Prices 2010-2019

Note: The right axis reflects prices in $/MWh achieved in the auctions.

Source: International Energy Agency, India 2020 Energy Policy Review (January 2020).

This successful basic RE auction design may now be considered as mainstream. And India has now gone beyond it to address one of the key challenges related to solar PV and wind; variability.

In this regard, India has been particularly innovative in advancing three new types of auctions:

- Hybrid RE auctions; in 2018, to support output complementarity wind-solar hybrid auctions were introduced. This policy aimed at optimizing the utilization of infrastructure (i.e. the power grid) and better match the generation profiles of variable RE and demand by collocating wind and solar projects with a capacity factor of, originally, at least 30% for the two technologies combined (later raised to 35%). In this framework, prices as low as $39/MWh were achieved.12

- Hybrid RE + storage auctions; going further, in 2019, India also advanced RE + storage (e.g. pumped hydro or battery) auctions to seek cost competitive electricity with guaranteed peak power supply. In 2020, a 1.2 GW auction delivered impressive results with winning bids around $55/MWh – quite cost competitive with new coal power plants. Under the conditions of this specific auction, 0.6 gigawatt-hour (GWh) of peak power supply may be requested to be provided for six hours (two hours during the morning peak 6-9 AM and four hours during the evening peak 6-12 PM) per day.13

- Round-the-clock RE auctions; advanced for the first time in 2020, the main feature of this new auction design is that it requires projects to meet very high capacity factors. For instance, in the first such auction, 0.4 GW was at stake and the required annual and monthly capacity factors to be met were 80% and 70%, respectively. Projects can be a combination of any RE and storage, the latter not being mandatory. It is also possible to oversize projects. This auction delivered a low price of $39/MWh.14

In addition to being innovative with RE auction designs, India also pursues other actions in the field of RE integration. These include, but are not limited to:15

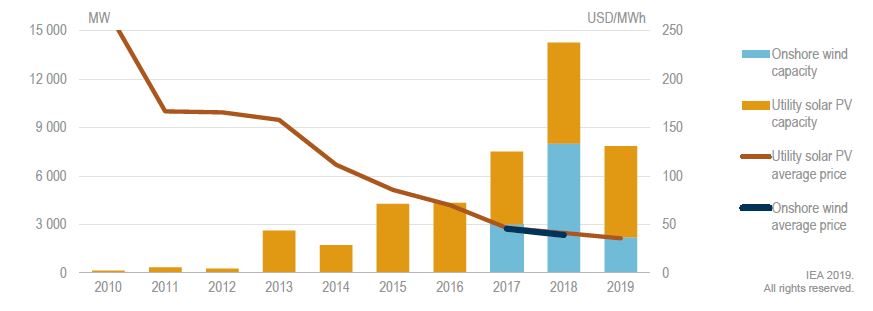

- Expanding transmission grid infrastructure, notably through the “Green Energy Corridors” program. This program was started in 2013 to establish dedicated grid infrastructure to connect resource-rich states and enable intra- and interstate transmission to load centers. For examples, to export power from the RE rich states of Tamil Nadu, Rajasthan, Karnataka, Andhra Pradesh, Maharashtra, and Gujarat, to big load centers located within or outside state like the cities of Delhi, Mumbai (state of Maharashtra) or Bangalore (Karnataka) (Map). Good progress has been made since the launch of this initiative. Two phases have been implemented: the first to integrate a total of 33 GW of RE, the second – ongoing – to help connecting RE as targeted by 2022.

- Rolling out of RE management centers to monitor in real time RE generation, forecast RE generation (intraday and day-ahead), and coordinate with load dispatch centers.

Achieving Future Goals

Despite a strong political support and all its efforts, India may fall short of its very ambitious targets for RE and nuclear power, which should not cast a shadow on the remarkable progress achieved for the former technology.

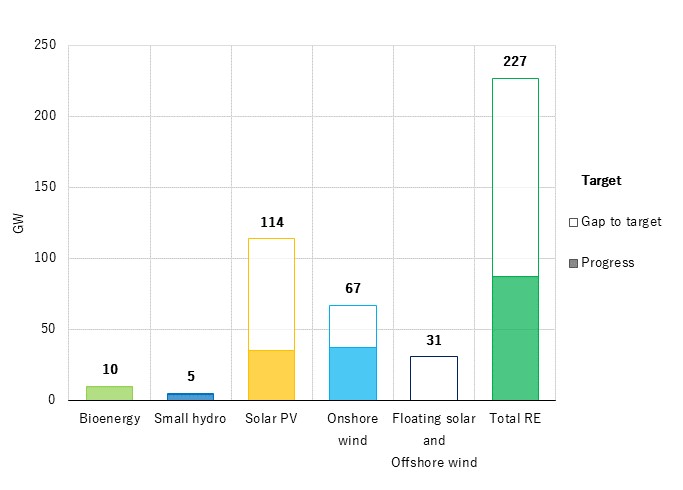

Regarding the increased 2022 RE target of 227 GW, 88 GW of RE installed capacity had been installed as of June 2020 – almost 40% of the volume target. Chart 3 summarizes progress realized and the gaps to filled in for total RE and each technology.

Chart 3: India 2022 RE Target and Progress, as of June 2020

More has to be done for solar PV and wind power. To help reaching the 2022 RE target, the Ministry of New and Renewable Energy (MNRE) announced that more than 25 GW will be tendered annually until the end of 2021, which may, however, not be sufficient.16

One reason for the 2022 RE target to be out of reach is that it is certainly quite high, one may even qualify it of “aspirational,” but this is not the only one. In India some barriers to RE deployment and integration still remain to be addressed. The main being the financial health of the DISCOMs, improvable transmission and distribution grid infrastructure, difficulties in permitting and land acquisition, and some policy inconsistencies such as import duties on solar panels to underpin the “Make in India” manufacturing strategy to the detriment of costs.17

As for the reduced 2032 nuclear target of 22 GW, it also seems out of reach today. This is because the country currently only has (1) less than 7 GW of operational nuclear installed capacity (including six small reactors with a combined capacity of more than 1GW, which are already about 35-50-year-old) and (2) about 5 GW under construction.18

Thus, India’s decarbonization is significantly moving forward thanks to RE, but an important acceleration of progress will be necessary to meet the country’s ambitious objectives.

Background Information

In India, the central Government is in charge of the national energy policy. For electricity and RE, two key ministries are in charge: The Ministry of Power and the MNRE. The former governs the electricity sector, including RE for electricity generation, and has an oversight on the latter. The MNRE is in charge of the development of policies for RE. The state-owned company Solar Energy Corporation of India is responsible for the implementation of the MNRE schemes, such as solar PV and wind auctions.

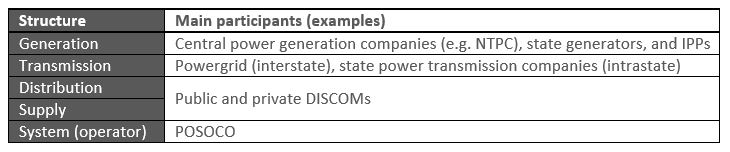

Both state-owned companies and private companies may exist in all segments (generation, transmission, distribution & supply) of the electricity business. However, state-owned companies dominate all segments.

At the generation level, mainly three types of power companies exist: central power generation companies (e.g. state-owned companies like National Thermal Power Corporation (NTPC)), state generators, and independent power producers (IPPs).

Power Grid Corporation of India (Powergrid), a listed company mostly state-owned, owns and operates the interstate transmission lines. Intrastate transmission lines are the field of state power transmission companies. In addition, private transmission companies have recently been authorized to build, own, and operate interstate transmission lines.

Public and private DISCOMs are in charge of distribution and supply to end-users.

The power system is operated by the Power System Operation Corporation (POSOCO), a state-owned company under the Ministry of Power. It is fully independent from transmission activities.

Simplified Presentation of India’s Power Sector

- 1International Energy Agency, India 2020 Energy Policy Review (January 2020).

- 2United Nations Framework Convention on Climate Change, India’s Intended Nationally Determined Contribution (October 2016).

- 3World Nuclear Association, Nuclear Power in India – updated July 2020 (accessed August 17, 2020).

- 4International Atomic Energy Agency, Power Reactor Information System: Countries, India – updated August 17, 2020 (accessed August 18, 2020).

- 5IQAir, World Air Quality Report 2019 (March 2020).

- 6Existing from Institute for Energy Economics and Financial Analysis, Risks Growing for India’s Coal Sector (September 2019), and new-builds from BloombergNEF, Levelized Cost of Electricity 1H 2020 (April 2020 – subscription required).

- 7Ministry of New and Renewable Energy, Physical Progress (accessed August 17, 2020).

- 8International Renewable Energy Agency, Renewable Energy Statistics 2020 (July 2020).

- 9Gujarat and Chhattisgarh from Quartz India, Akshat Rathi and Kuwar Singh, One of India’s Largest Coal-mining States Says it Will not Build New Coal Power Plants – September 16, 2019, and Maharashtra from The Times of India, Ashish Roy, No New Thermal Power Units in State, Says Raut – August 28, 2020 (both accessed September 1, 2020).

- 10PV Magazine, Uma Gupta, Record-setting Solar Auction Could Open India up to Foreign Investment – July 1, 2020, (accessed August 17, 2020).

- 11BloombergNEF, op. cit. note 6.

- 12International Renewable Energy Agency, Renewable Energy Auctions: Status and Trends beyond Price (December 2019).

- 13JMK Research & Analytics, Tariffs for RE+Storage Tenders Competing with Thermal (accessed August 17, 2020).

- 14ReNew Power, ReNew Power Wins India’s First Round-the-clock Renewable Energy Tender – May 12, 2020 (accessed August 18, 2020).

- 15International Energy Agency, op. cit. note 1.

- 16Ibid.

- 17Ibid.

- 18International Atomic Energy Agency, op. cit. note 4.

<Related Links>

Innovative Decarbonization Policies: California, United States (4 August 2020)