1 Introduction

The Hydrogen Society Promotion Act passed in May 2024, was followed by the October promulgation of the “Enforcement Regulation for the Act for Promotion of Procurement and Utilization of Low-carbon Hydrogen and its Derivatives1”(a ministerial ordinance)2. This regulation sets standards for CO2 emissions of low-carbon hydrogen and derivatives, while also offering subsidies for the construction of supply chains3(relevant facilities and compensation for price gaps with existing fuels). However, the current standards fall short of significantly reduce greenhouse gas (GHG) emissions, and there are concerns about the large amounts of tax-funded support will be continued over the long term. This article examines the issues with the ordinance and suggests potential improvements.

2 Issues with the Hydrogen Society Promotion Act

2-1 Issue relating to setting CO2 emission standards

Although hydrogen does not emit any CO2 when it is burned, its environmental impact depends heavily on the feedstocks and manufacturing processes used to produce it. Around 99% of the hydrogen currently used in the world is produced from fossil fuels (gray hydrogen)4,resulting in large quantities of CO2 emissions during production (11.4 kg of CO2 per kg of hydrogen for natural gas; 25.4 for coal). In contrast, hydrogen produced in processes where CO2 is separated, captured, and stored is known as blue hydrogen. In this case, the environmental impact depends on the CO2 recovery rate. The cleanest form of hydrogen, called green hydrogen, is produced by decomposition using renewable electricity. Its CO2 emissions during production are close to zero.

CO2 emissions arise not only from production, but also from fossil fuel and raw material mining processes and the energy consumed for transportation. For this reason, when setting standards for hydrogen CO2 emissions, it is essential to clearly define the scope of emissions, i.e., the range of processes to be compared. Figure 1 shows a supply chain for blue hydrogen produced from natural gas feedstock with separation and recovery of emitted CO2, along with the scope of relevant standards. The scope of hydrogen production processes alone is referred to as “Gate-to-Gate.” With the addition of upstream feedstock supply and transportation, the range is described as “Well-to-Gate.” With the inclusion of transportation after production and delivery for distribution to users, the range is “Well-to-Point of Delivery.” And finally, the range of the entire supply chain up to final use is known as “Well-to-Wheel.”

Figure 1 Overview of an Entire Supply Chain for Blue Hydrogen Production

2-1-1 Standards are looser than in the US and Europe

Against this backdrop, the Hydrogen Society Promotion Act sets out the conditions under which low-carbon hydrogen qualifies for support (scope of calculation and carbon intensity of each fuel)5(see Table 1). Under these standards, the scope of hydrogen and ammonia emissions is defined as Well-to-Gate, with emission reductions of 70% relative to gray hydrogen, and 70% of gray ammonia, respectively6. For synthetic fuels and synthetic methane produced from low-carbon hydrogen and CO2, the scope of emissions is defined as the whole supply chain, including CO2 emissions during transportation and use.

However, as Table 2 shows, European standards are more stringent than Japanese ones. While the EU taxonomy standard (3.0 kg-CO2e/kg-H2) is only about 10% lower than the Japan standard, the UK standard (2.4 kg-CO2e/kg-H2) is 30% stricter. Meanwhile, in Germany, which is committed to green hydrogen utilizing renewable electricity, there are practically zero CO2 emissions from hydrogen. On top of this, guarantee of origin is required. Although US tax incentives start with less stringent standards than Japan's, they reward lower emissions with progressively higher incentives, encouraging further emissions reductions (tax incentive is $0.60/kg-H2 for the lowest emission standard of 0.45 kg-Co2e/kg-H2, which is five times higher than the incentive of $0.12/kg-H2 for emissions of 4.0 kg-CO2e/kg-H2). or derivative fuels such as hydrogen-based synthetic fuels and synthetic methane, while the EU RED-II (Renewable Energy Directive) of standard is 28.2 g-CO2e/MJ, the Japanese standards are 39.9 g-CO2e/MJ for synthetic fuels (1.4 times higher) and 49.3 g-CO2e/MJ for synthetic methane (1.75 times higher).

Table 1 Carbon Intensity Standards and Emission Scopes for Low-carbon Hydrogen and Derivative Fuels in Japan

Table 2 Carbon Intensity Standards and Emission Scopes in the US and Europe

2-1-2 CO2 emissions from long-distance transportation are not considered

In Japan's hydrogen supply chains, which are heavily import-dependent, GHG emissions associated with the liquefaction of hydrogen and conversion of hydrogen to ammonia and methylcyclohexane (MCH), which are required for marine transportation, as well as GHG emissions associated with transportation energy, are added.

Synthetic fuels and synthetic methane are already evaluated on a Well-to-Wheel basis (whole supply chain) within the scope of the carbon intensity standard, including transportation and final consumption. For hydrogen, too, evaluation that includes fuel conversion and transportation (i.e., Well-to-Point of Delivery) in an international standard7(ISO/TS 19870:2023) has been discussed. In reference to this, the Japanese government says that this approach “... is not envisaged at this time, because debate about measurement methods remains unsettled8.” Yet, for the procurement of hydrogen by Japan, which is heavily reliant on imports, conversion to liquified hydrogen and long-distance marine transportation are unavoidable. Although the scope of emissions in the US and Europe is currently defined as Well-to-Gate, Japan should take action in anticipation of changes to international standards.

2-1-3 The need to address methane leakage in upstream processes

When natural gas is used as a feedstock, the impact of gas leaks in the process of mining and transportation is very significant (especially considering that the global warming potential [GWP] of methane is 80 times higher than that of CO2). According to an IEA report9, upstream CO2 emissions for gray hydrogen account for approximately 15% of emissions including production (Well-to-Gate scope in Figure 1). As a consequence, even supposing that 100% of the CO2 emissions generated by the hydrogen production process were captured and stored, there would still be GHG emissions, including leaked methane from upstream processes.

Figure 2 shows emission standards for low-carbon hydrogen and derivative fuels (ammonia, synthetic methane, synthetic fuels) presented by the Ministry of Economy, Trade and Industry (Table 1) after conversion to per-calorific value figures, with comparison to data (on natural gas, gray hydrogen, gray ammonia) from the above-mentioned IEA report. To reduce the carbon intensity of gray hydrogen (95 g-CO2e/MJ_LHV) by 70% (to 28.3 g-CO2e/MJ_LHV), to make it low-carbon hydrogen, upstream GHG emissions (14.4 g-CO2e/MJ_LHV) need to be taken into account. For this reason, approximately 83% of the CO2 emissions from the hydrogen production process need to be separated and recovered. To achieve low-carbon ammonia (46.8 g-CO2e/MJ_LHV), the emissions of gray ammonia (112 g-CO2e/MJ_LHV) need to be cut by 58%. The required reduction in CO2 emissions in the production process is therefore 67%.

Like this, for hydrogen and ammonia made using natural gas feedstock, it is important not only to separate and recover the CO2 emitted in manufacturing, but also to cut the GHG emissions in upstream processes. Since the reduction of methane leakage increases natural gas production, as well as reducing GHG emissions, it offers a substantial benefit to businesses. These factors underlie the global efforts10 being made to reduce methane leakage in the process of fossil fuel extraction at gas fields and other sites.

As an LNG importer, Japan bears responsibility for upstream GHG emissions, so it has begun taking action to help reduce them11. In response to this trend, Japan’s low-carbon hydrogen efforts should aim at hydrogen procurement with lower GHG emissions, involving not only separation and capture of CO2, but also reduction of GHG emissions from upstream processes. Yet, the draft legislation allows the use of secondary data for the calculation of upstream GHG emissions. This situation makes it unnecessary to understand the state of GHG emissions from upstream processes, and it hinders efforts to reduce those emissions. For businesses to take responsibility for GHG emissions from upstream processes and to promote efforts to reduce them, they need to acquire primary data as far as possible, rather than relying on secondary data.

Figure 2 Carbon Intensity of Low-carbon Hydrogen and Derivative Fuels

Source: Created by Renewable Energy Institute based on materials by IEA and Ministry of Economy, Trade and Industry12

2-2 Issues with the support system

The main pillars of the proposed legislation are support for domestic facilities and fuel expense subsidies for the procurement of low-carbon hydrogen and derivative fuels in order to help establish supply chains. The fuel subsidy is referred to as a “price gap support”, which is generally known as Contract for Difference (CfD) because it aims to cover the price differential between conventional fossil fuels such as natural gas and low-carbon hydrogen and derivative fuels, which are more expensive. Figure 3 shows an overview of price gap support. The conventional fuel price is used as a reference price, while the price of the newly procured low-carbon hydrogen and derivatives serves as a base price. The price difference is compensated over the long term from taxes. This section outlines the issues with this scheme.

Figure 3 Overview of Japan’s CfD Scheme

2-2-1 Incentives to reduce procurement expenses do not work

Since the base price (price of procured low-carbon hydrogen and derivative fuels) shown in Figure 3 takes into account not only feedstock and equipment expenses, but also operation and maintenance expenses, financing costs, profits, and taxes, it is difficult for businesses to implement cost reduction efforts under the scheme. Furthermore, to increase investment predictability, the government is offering a long support period of 15 years from the start of support. It also plans to continue support for an additional 10 years beyond the end of this period. Additionally, the deployment of carbon pricing (carbon surcharge) for CO2 emissions, which needs to be implemented to reduce GHG emissions, will not begin until fiscal 2028. So, until then tax expenditures will not be backed by additional tax revenue (from the surcharge).

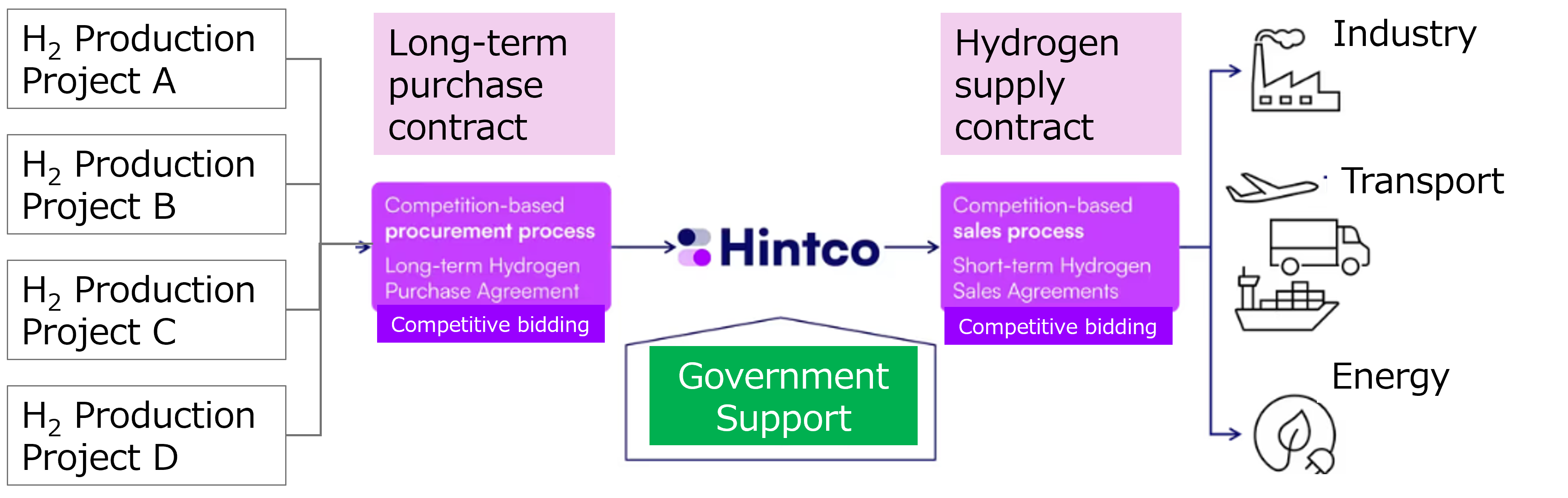

In contrast, Germany’s CfD price gap support system includes a mechanism that minimizes the price gap, reducing long-term subsidies. It works by procuring hydrogen at the lowest price possible through competitive bidding and supplying it to businesses offering the highest price (Figure 4). In Japan too, a mechanism to lower the base price through auctions or other means should be used in the operation of the support scheme. The early adoption of carbon pricing should also reduce the price gap by applying a carbon price to the calculation of the reference price, thereby reducing the level of financial support covered at national expense.

Figure 4 Overview of Price Gap Support in Germany (H2Global)

2-2-2 Fixing CO2 emissions

Public offering of price gap support began in the current fiscal year, but while hydrogen supply chains are being developed for completion by 2030, procurement of low-carbon ammonia by JERA is expected to start in 202813. In the meantime, the main focus is expected to be gray ammonia, which generates significantly more GHG emissions than natural gas (112 compared to 70.6 g-CO2e/MJ-LHV).

On the other hand, while this bill allows for the possibility of using Non-Fossil Certificates14, these do not provide an incentive to convert low-cost gray hydrogen or gray ammonia into low-carbon fuels. Since hydrogen and ammonia are fundamentally used for the purpose of reducing CO2 emissions, gray hydrogen and gray ammonia, which generate high emissions, should not be procured. Furthermore, using Non-Fossil Certificates to provide price gap support by reducing apparent emissions to below the standard value would be putting the cart before the horse. The very fact that price gap support is applied to hydrogen and ammonia that generate CO2 emissions in excess of the standard value is a problem. Therefore, the use of Non-Fossil Certificates for these fuels should not be permitted.

The bill also states that even if the standard values are revised in the future, low-carbon hydrogen that was previously certified will continue to be eligible for support15. Over time, current standard values, also international trends, are likely to be revised to become more stringent. When this happens, the revised standards should apply to businesses that have already been receiving support, or else the carbon intensity of certification should be lowered to cut CO2 emissions even further. Under the current legislation, a business that has been certified does not need to reduce GHG emissions further, so hydrogen and derivative fuels can continue to be distributed under the initial standard value (which will have a relatively high carbon intensity in the future). Furthermore, the more time passes, the lower the standard value will become, thereby hindering the entry of new businesses and limiting competition. This not only presents a barrier to technical invention and innovation, but it also protects the vested interests of the businesses that entered the market earlier. Therefore, if the standard value is changed, the revised standard should also be applied to previously certified operators. Even if support is being implemented, greenhouse gas emissions should be continually checked. And if the standard is not satisfied, support should be suspended.

3 Suggestions for Improvements

As discussed, Japan’s low-carbon hydrogen and ammonia standards are less stringent than those in the US and Europe. Additionally, Japan must address the GHG emissions from fuel conversion (liquefaction, ammonia synthesis, MCH manufacturing) and transportation over long distances. Although these quantities are not currently included in the calculation scope of these standards, ISO standards that include transportation are currently under consideration. This puts Japan at risk of being further disadvantaged relative to the US and Europe, where pipelines are the main form of transportation. What’s more, even if stricter standards are adopted in the coming years, subsidies for initially certified support recipients are expected to continue until 2045. This raises significant concerns. Incentives for already-certified businesses to reduce GHG emissions may not work, and a barrier may be created to the entry of new businesses that need to meet stricter standards, resulting in an uncompetitive market.

Price gap support for hydrogen procurement is generous, but the current system lacks competition due to the absence of a bidding process. With carbon pricing for fossil fuels delayed, substantial subsidies from national tax revenues will be needed for years. If this situation persists, large amounts of public funds will be used merely to extend the life of existing business models. This approach will not only fail to lead to price-competitive fuel procurement and innovation through new technologies, but also present a serious risk that domestic manufacturing industry will be disadvantaged in international competition, because it will be forced to use low-carbon hydrogen and derivative fuels with both high prices and high CO2 emissions.

Although the government has made energy security a key goal of its “S+3E”16 energy policy, by 2030 imported blue hydrogen is expected to account for the majority of hydrogen fuel procurement. This means that Japan’s dependence on foreign fossil fuels will continue, without any improvement in energy self-sufficiency (i.e., energy security). Given the long-term depreciation of the Japanese yen, this also means that large amounts of funds will continue to flow out of the country17.

Even under the current system, improvements are possible. These include gradually reducing base prices, introducing a bidding process for support recipients, and limiting the use of Non-Fossil Certificates and secondary data. As well as promoting the procurement of green hydrogen, these measures are likely to stimulate efforts by businesses to reduce GHG emissions, e.g., by increasing the CCS recovery rate in blue hydrogen production and reducing methane leakage in upstream processes. In light of Europe’s plans to procure large quantities of green hydrogen by 203018, Japan needs to prepare itself to meet more stringent standards in the years ahead. This will also help to improve the predictability of future projects.

In the coming years, it will be necessary to launch domestic production of hydrogen fuels, in addition to procurement from overseas, in order to ensure sufficient energy security. Under the current support system, businesses are required to supply a minimum of 1,000 tons of hydrogen per year, a condition that imposes a high barrier to the entry of new domestic businesses, which often start out at small scale. As well as boosting energy security, reviewing this requirement to open up possibilities for starting up and developing hydrogen production in Japan would also generate national and regional employment opportunities. An important prerequisite for achieving this is to ensure sufficient availability of renewable electricity from solar and wind power.

Through these additional measures, we expect hydrogen to move beyond being a mere substitute for fossil fuels, instead of driving domestic green hydrogen production and the further expansion of renewable energy.

- 1“Hydrogen and its Derivatives” is defined as “hydrogen and hydrogen compounds designated by ordinance of the Ministry of Economy, Trade and Industry,” including ammonia, synthetic fuels, and synthetic methane in addition to hydrogen.

- 2On the same day, Japan Organization for Metals and Energy Security (JOGMEC) began applying for subsidies for price gap support and hub development support.

- 3In addition to CO2 emission standards for low-carbon hydrogen and derivative fuels, this bill provides for the implementation of price gap support (subsidies for the expense of procuring higher-cost hydrogen fuels to cover price differentials with existing fuels) and facility support for the establishment of hydrogen supply chains.

- 4IEA, Global Hydrogen Review 2024 (Oct. 2024)

- 5Results of Public Comment Procedure for the Enforcement Regulation for the Act on Promotion of Supply and Utilization of Low-Carbon Hydrogen and its Derivatives for Smooth Transition to a Decarbonized, Growth-Oriented Economic Structure (Draft) (23 October 2024)

- 6Ministry of Economy, Trade and Industry, “(14th) Hydrogen and Ammonia Policy Subcommittee, Committee on Energy Efficiency and Renewable Energy, Advisory Committee for Natural Resources and Energy Document 1” Setting standards for hydrogen and ammonia, which do not emit CO2 during combustion are based on the same concept as the US and Europe.

—Hydrogen: 3.4 kg-CO2 e/kg-H2, which is equivalent to 70% reduction relative to gray hydrogen in Well to Gate

—Ammonia: 0.87 kg-CO2 e/kg-NH3, which is equivalent to 70% reduction relative to gray ammonia in Well to Gate - 7ISO/TS 19870:2023, Hydrogen technologies — Methodology for determining the greenhouse gas emissions associated with the production, conditioning and transport of hydrogen to consumption gate

- 8“CO2 emissions generated during the storage and transportation of hydrogen and ammonia are not expected to be included in CO2 emissions at the present time, since international debate about measurement methods remains unresolved.” Ministry of Economy, Trade and Industry, Results of Public Comment Procedure for the Enforcement Regulation for the Act on Promotion of Supply and Utilization of Low-Carbon Hydrogen and its Derivatives for Smooth Transition to a Decarbonized, Growth-Oriented Economic Structure (Draft)

- 9EA, The Role of Low-Carbon Fuels in the Clean Energy Transitions of the Power Sector (February 2022)

- 10In 2021, an international emission reduction initiative (Global Methane Pledge, to cut methane emissions by 30% from 2020 levels by 2030) was proposed. Around 150 countries, including Japan, are participating.

- 11In July 2023, Japan’s JERA and JOGMEC launched a joint initiative with the Korean gas supplier KOGAS titled CLEAN (Coalition for LNG Emission Abatement toward Net-zero). Under this initiative, LNG purchasers work with LNG producers to reduce methane emissions in LNG value chains.

- 12The GHG emissions of each fuel (upstream processes, combustion) were calculated using IEA, The Role of Low-Carbon Fuels in the Clean Energy Transitions of the Power Sector (February 2022); standard values for low-carbon hydrogen and derivative fuels were calculated using materials by the Ministry of Economy, Trade and Industry.

- 13JERA has concluded a joint development agreement with US company CF Industries relating to a low-carbon ammonia production project. Production is set to commence in 2028. (JERA press release dated18 April 2024)

- 14Criteria that should be used for judgments about promoting the supply of low-carbon hydrogen and derivatives by hydrogen supply businesses (Paragraph 3-4b, “In the event that the measures stipulated in Paragraphs 1 and 2 cannot be taken, acquisition of non-fossil certificates (i.e., non-fossil certificates as stipulated in Article 4, Paragraph 1-2 of the Enforcement Ordinance of the Act on the Promotion of Use of Non-fossil Energy Sources and Effective Use of Fossil Energy Materials by Energy Suppliers) and other measures shall be used.”

- 15“In the event that the stipulated requirements are revised, low-carbon hydrogen and derivatives relating to a business plan for the supply, etc. of low-carbon hydrogen and derivatives certified in accordance with the provisions of Article 7 Paragraph 1 of the relevant law, shall be deemed to satisfy the requirements of Article 2, Paragraph 1 of the law, as long as the requirements before the revision continue to be met.” Enforcement Regulation for the Act on Promotion of Supply and Utilization of Low-Carbon Hydrogen and its Derivatives for Smooth Transition to a Decarbonized, Growth-Oriented Economic Structure (Draft) <Response to changes in standard values> Chapter 1, Section 2, Paragraph 6

- 16Safety + Energy security, Environment and Economic efficiency

- 17Under the price gap support system for fuels, the basis for calculating the price of hydrogen and derivative fuels to be procured (base price) and the process by which supported businesses are selected are not disclosed. There is therefore a high risk that the system will end up serving to provide huge tax subsidies to energy companies. Furthermore, large amounts of fuel price gap support will flow out to overseas companies from which Japan imports fuels via Japanese companies receiving subsidies.

- 18The RePowerEU plan announced in May 2022 sets targets for the procurement of green hydrogen—a total of 20 million tonnes per year by 2030: 10 million tons from within Europe and 10 million tons from outside Europe.