Impacts of COVID-19 on the PV industry and countermeasures

As for the PV system facilities (PV modules, inverters, mounting structures, etc.), it is assumed that there was a sufficient stock for completion of construction and delivery by the end of FY 2019 ended March 2020, and it seems that there is no shortage at the time of writing this article. As for Chinese manufacturers that lead PV module manufacturing, it is reported that more companies resumed production as the coronavirus infection is moving towards settlement.

Meanwhile, from a business perspective, distribution and construction in Japan are expected to be affected by the COVID-19 impacts. It is assumed that various procedures may take time with the restricted manpower, etc. to prevent the expansion of the infection. There is a possibility of lack of manpower in ports for receiving products and transshipment, transport and operation of warehouses, as well as stagnation in sales and construction.

“Project to support transition towards a decarbonized society considering a reform of supply chain and reshoring of production bases”, jointly conducted by the Ministry or the Environment (MoE) and METI, has already been disclosed as part of the Emergency Economic Measures by the national government.

5 billion Yen ($ 46.7 million) out of the supplementary budget for FY 2020, will be allocated to promote decarbonization and support installation of self-consumption type PV systems, etc. through the onsite PPA model, etc. that contributes to disaster prevention. It is necessary for the PV industry to continue insisting strongly on the dissemination of PV power generation as an economic measure.

Impacts on the outlook of PV market towards FY 2030

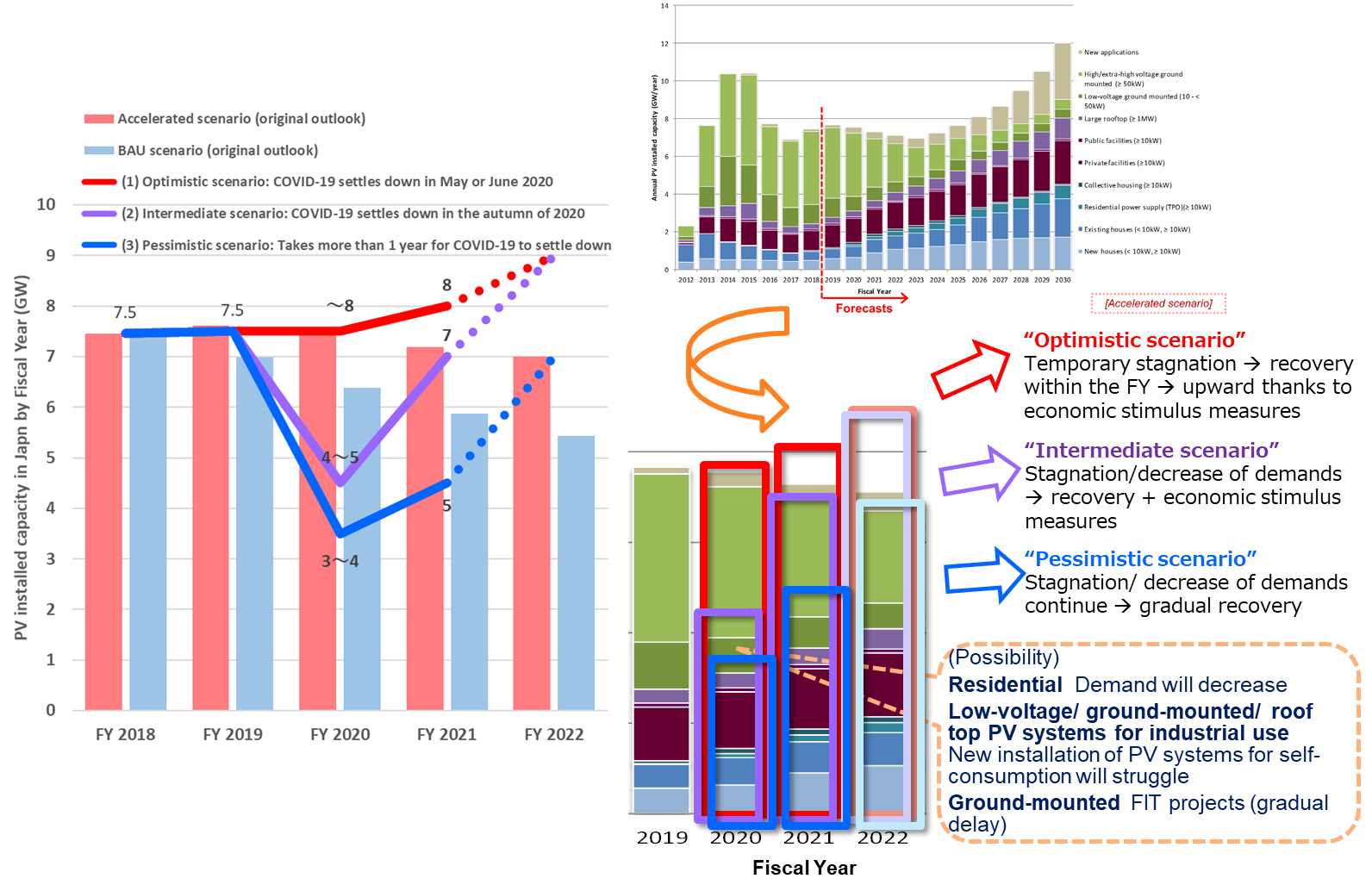

1. Residential PV system:

Construction of housing itself and PV systems will progress. However, due to the stagnation of approaches towards consumers and decrease of demand, companies may struggle to acquire new customers. In addition, there is a possibility that even if PV systems are installed on the rooftops of housing, the transfer of the housing will be delayed (the start of operation of PV system will be delayed) due to the delay of arrival of products/ construction of other residential facilities (mostly manufactured in China).

2. Low voltage/ ground-mounted, industrial rooftop PV system (low voltage/ high voltage):

Installation of PV systems under the FIT program will slow down due to the reduction of purchase price. However, at the same time, shift of demand for self-consumption type PV systems may progress due to the decease of system price, and it is expected that it will basically not be a factor to reduce the number of system installations. However, companies may struggle to acquire new customers, which may depend on how new business models of third-party ownership (TPO) and power purchase agreement (PPA) represented by zero Yen installation will penetrate.

3. Ground-mounted PV system (high voltage/ extra high voltage):

Construction will move towards its peak mainly for FIT-approved PV projects which have not started operation, and installations will increase. However, there may be restrictions of communication and manpower due to the prevention of infection expansion and there is a possibility that the completion of some projects will be delayed.

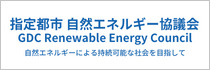

The size of the Japanese PV market in and after FY 2020 will greatly depend on when the expansion of COVID-19 infection settles down. Below, three scenarios; optimistic, intermediate and pessimistic scenarios are estimated.

1) “Optimistic scenario”: COVID-19 settles down in May or June 2020

In the quarter from April to June 2020, there may be shortage of products and the construction may start to take more time.

In and after July 2020, the market will return to normal, in addition, special demand due to economic revitalization (economic stimulus) measures is expected.

In the FY 2020 (April 2020 to March 2021), the annual installed capacity is estimated to be less than 8 GW, and a trend of (slight) year-on-year increase is expected.

2) “Intermediate scenario”: COVID-19 settles down around summer to autumn:

In the quarter from April to June 2020, existing PV projects will slow down, and new projects will not progress.

In and after July 2020, there will be great impacts and it is highly likely that the demand will also decrease (especially for distributed PV systems).

The impacts may stay until the quarter from October to December 2020. Then, the market will gradually recover and the effects of the economic stimulus measures will gradually appear.

In FY 2020, the annual installed capacity is expected to be 4 to 5 GW, a 30 % to 40 % decrease year on year.

3) “Pessimistic scenario”: It will take (more than) one year for COVID-19 to settle down

The installed capacity in FY 2020 is expected to be 3 to 4 GW, a 50 % decrease year on year.

Source: Materials from RTS Corporation

Conclusion

COVID-19 will be a trigger that greatly changes the global social system. While it goes without saying that the expansion of utilization of renewable energy will contribute to achieving the Sustainable Development Goals (SDGs), it will also provide an opportunity for the PV industry to take a lead in creating the situation with a “new norm” in the future world of energy such as “Energy is something that is self-consumed, locally-produced and locally-consumed, and surplus is shared”.

-

- Takashi Ohigashi

Director, Senior Analyst, Innovation Promotion Division, RTS Corporation - Takashi Ohigashi leads the analysis of long-term outlook of the PV market in Japan by taking advantage of his knowledge in consulting on the market, industry, and technology covering from PV materials to system. He conducts a wide range of specialized researches and business consulting for PV related companies, organizations, research institutes and public organizations, etc. in Japan and abroad. He also conducts analysis of supply chain of residential PV systems, etc. He serves as the member of project examination assessment committee of NEDO, etc. He also works as the Small and Medium sized Enterprise Management Consultant. He travels nationwide and abroad aiming for rural revitalization and promotion of business revitalization based on PV and renewable energy.

- Takashi Ohigashi