Statistics | Electricity Market

- JEPX Day-ahead Market

- Baseload Market

- Futures Market

- Retail Market

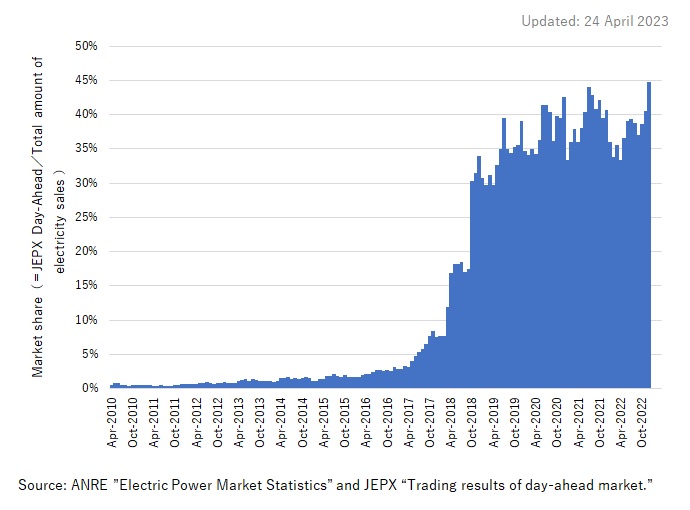

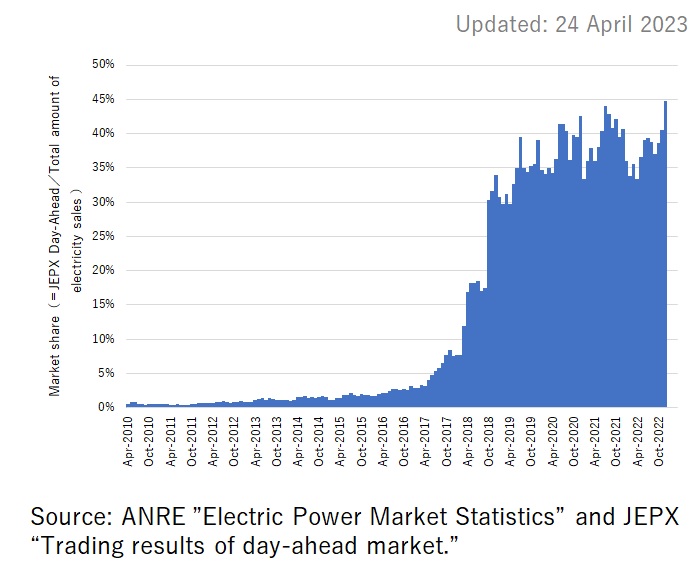

The JEPX (Japan Electric Power Exchange) day-ahead market is one of the wholesale electricity markets where power generation companies and retail companies buy and sell electricity. The trading period consists of 48 timeframes (every 30 minutes) and the delivery is for the next day. The market started in April 2005.

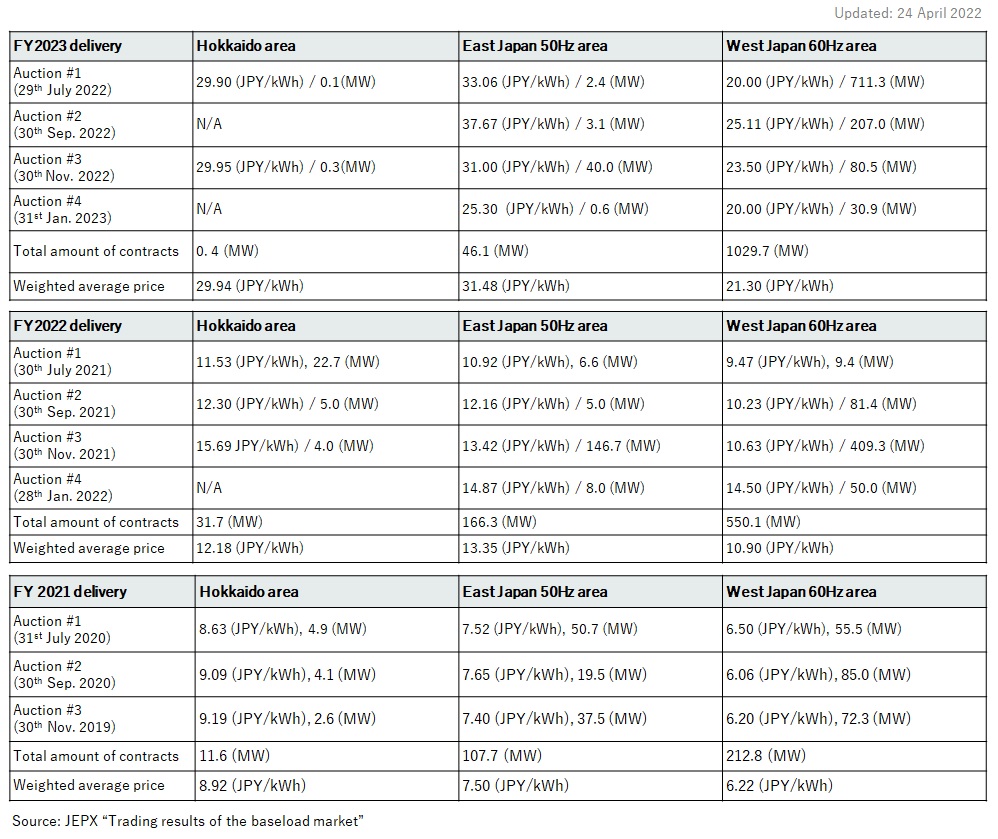

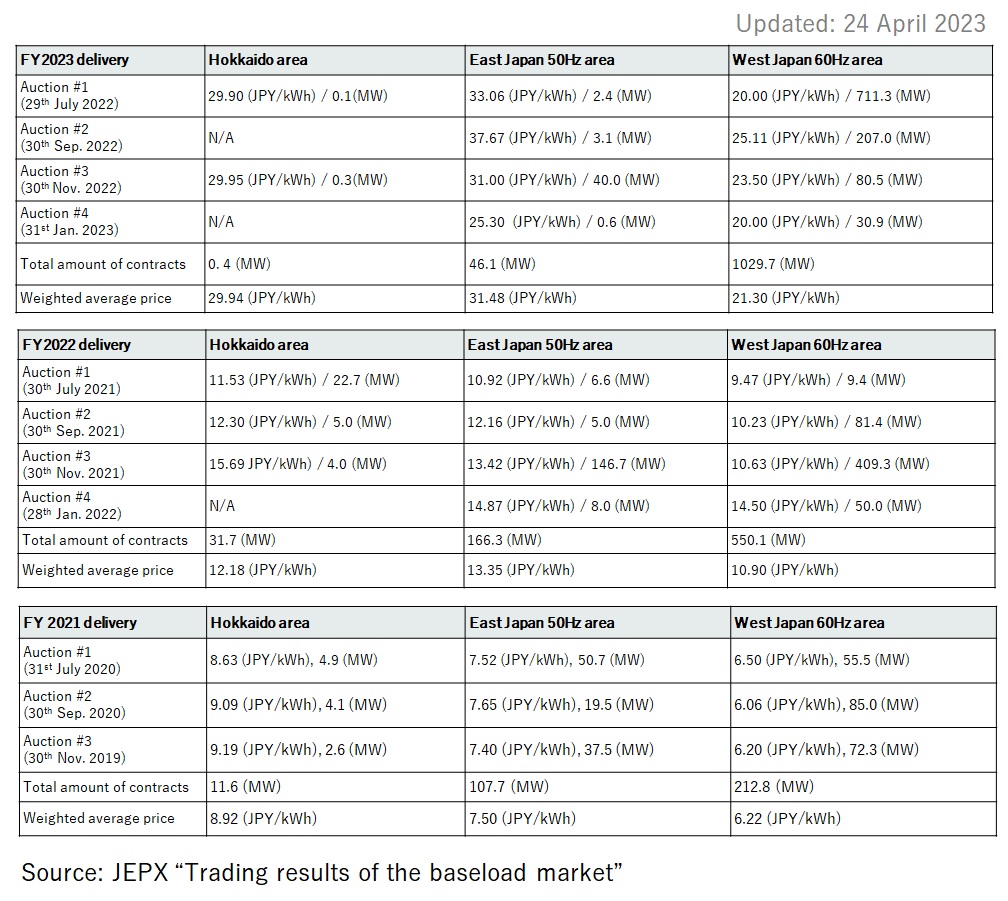

The baseload market is one of the wholesale electricity markets in order to secure equal footing regarding power supply access between major electric power companies and newly entered retail electric power companies. The former general electric power companies and the former wholesale electric power companies assume obligation for providing electric power. The products to be traded are electricity supplied 24 hours a day, 365 days a year from April to March of the following fiscal year, and trading started in 2019.

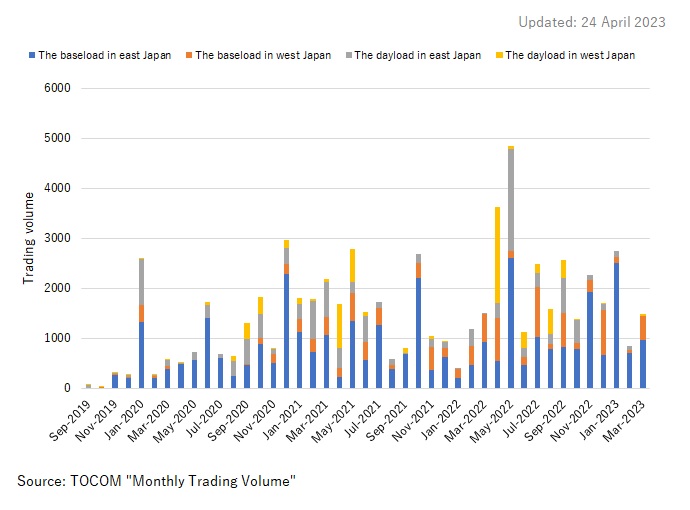

Trading Results of the Baseload Market

Futures market began trading on the Tokyo Commodity Exchange in September 2019. Four products are traded as follow; the baseload power and daytime load power (8: 00-20: 00) on the Tokyo area and Kansai area of JEPX day-ahead market.

In the case of the baseload, the transaction volume is the number of calendar days of the trading month x 24h x 100kWh, and for the daytime load, the number of calendar days of the trading month x 12h x 100kWh.

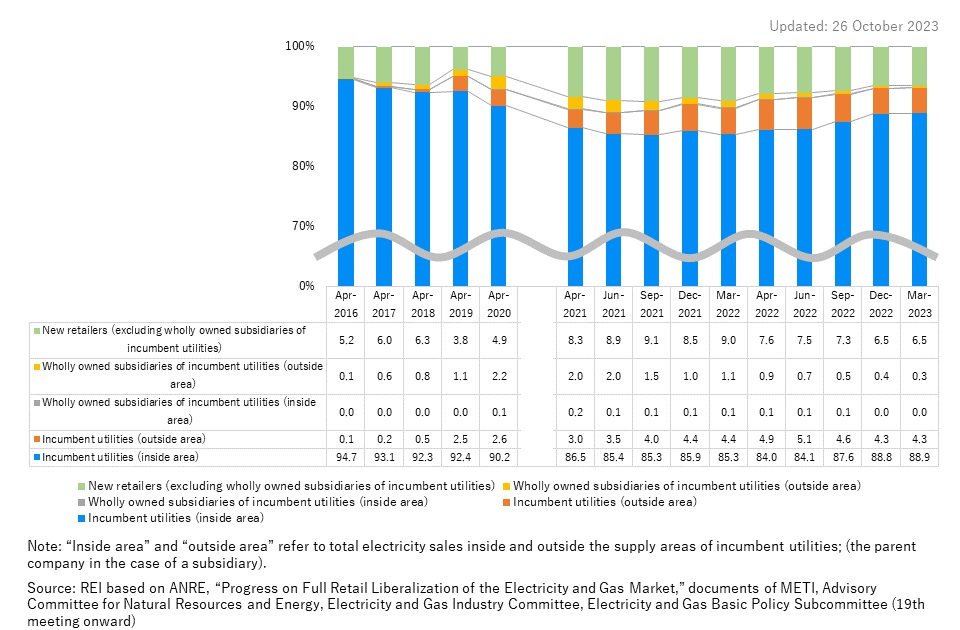

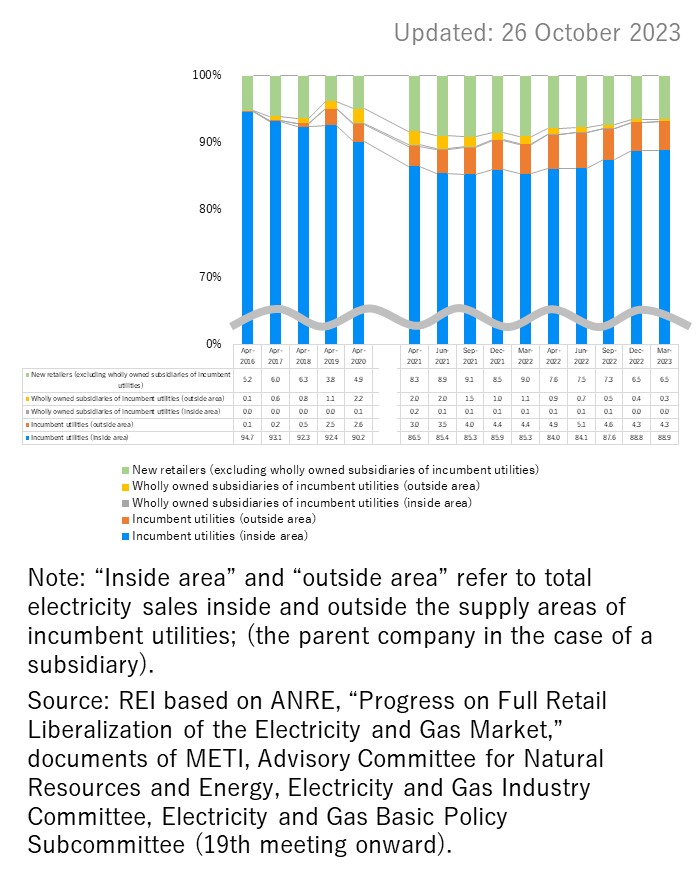

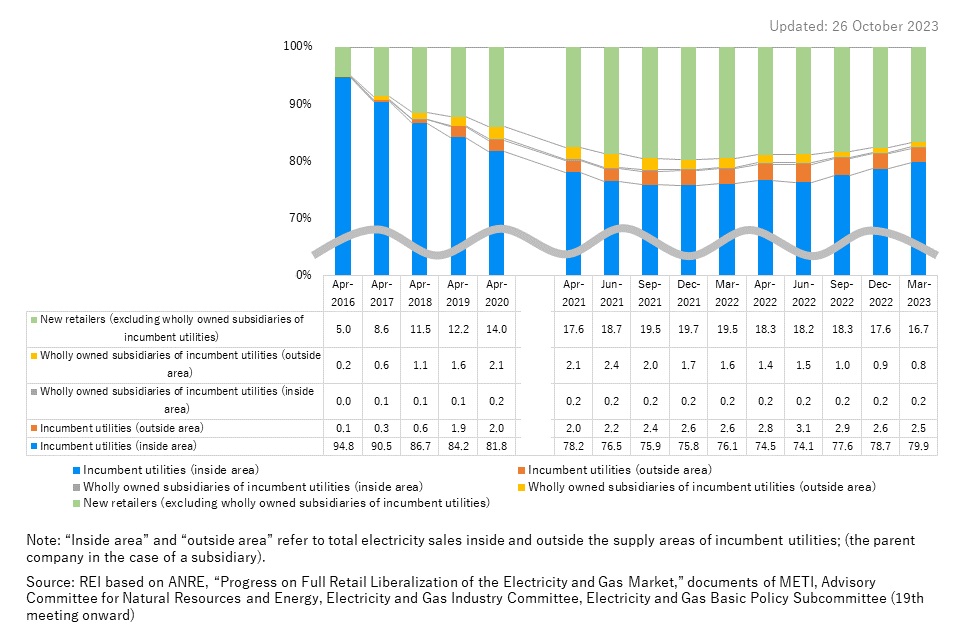

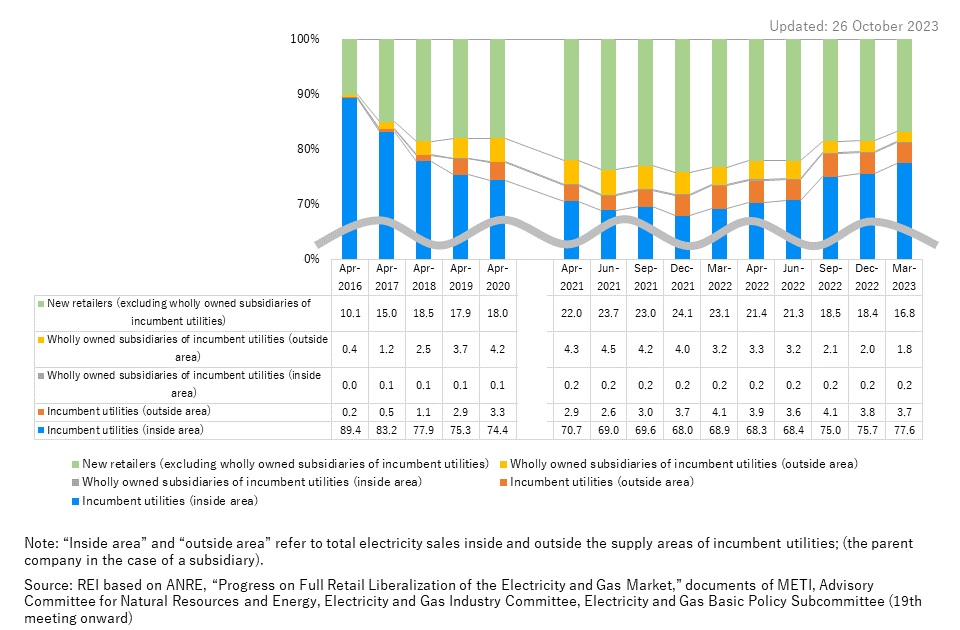

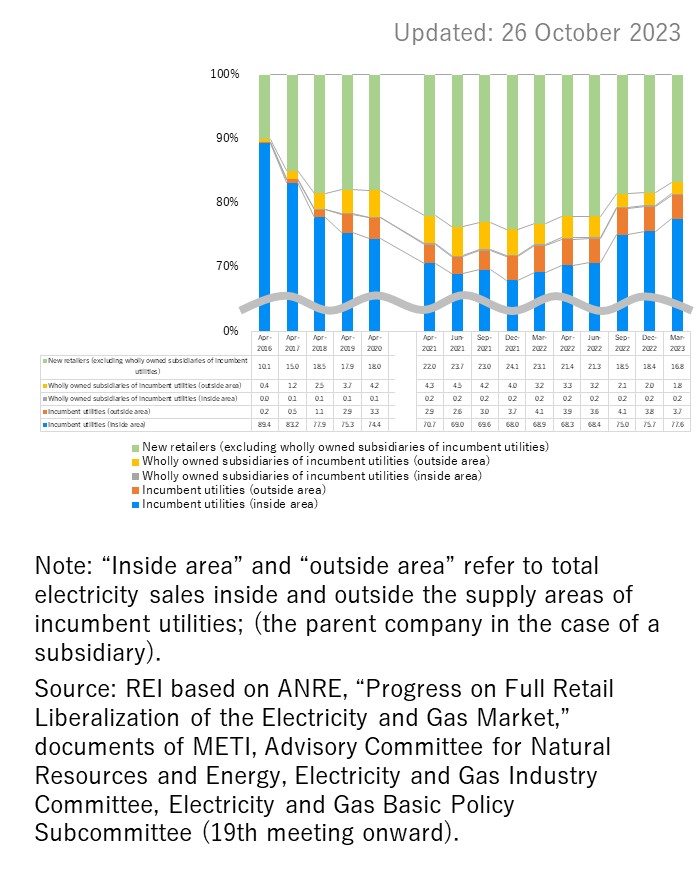

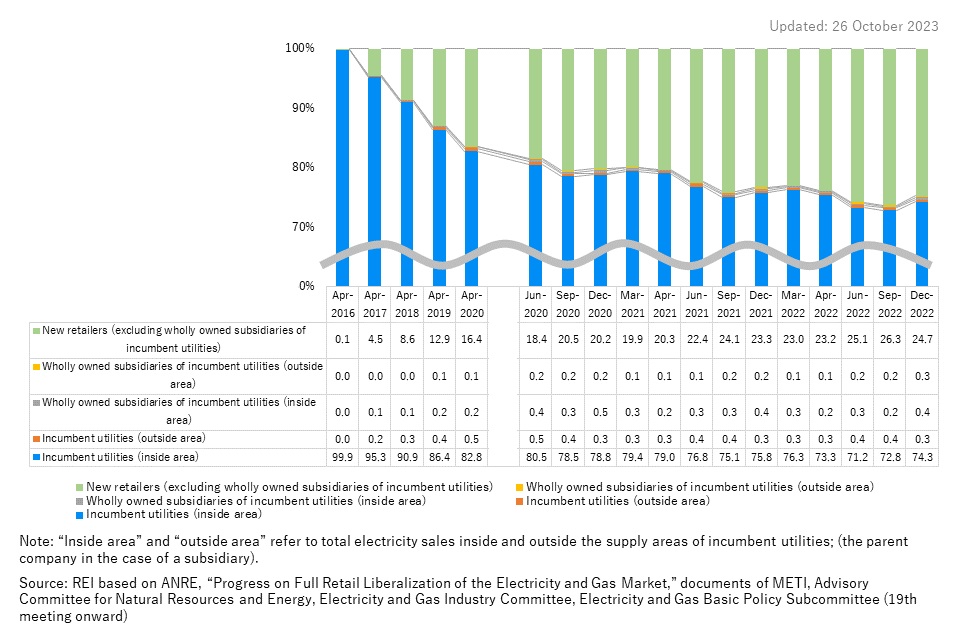

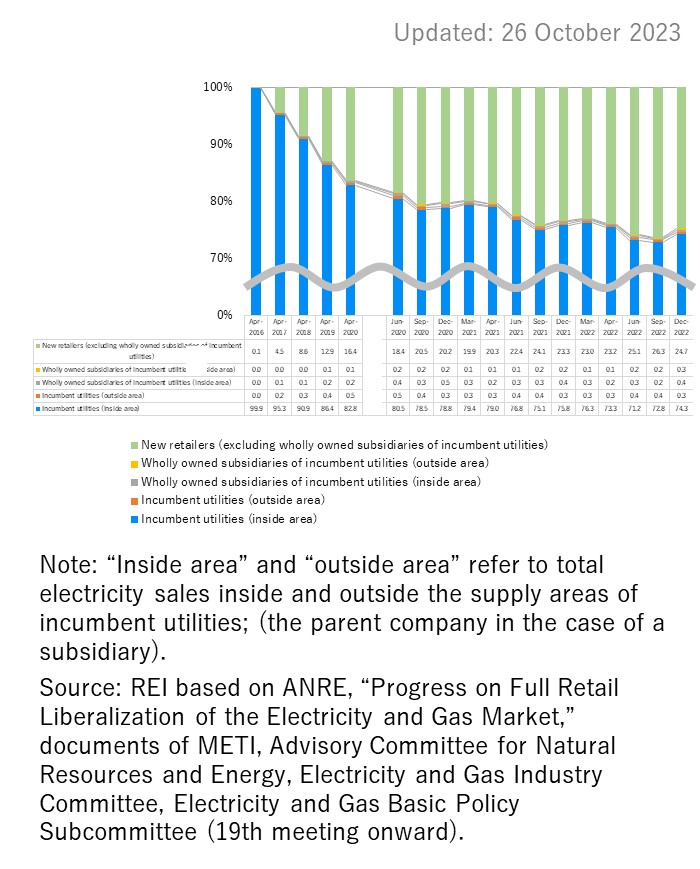

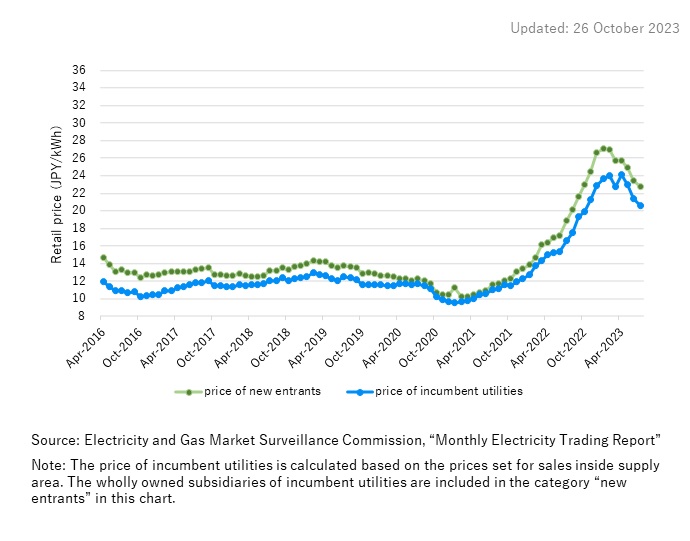

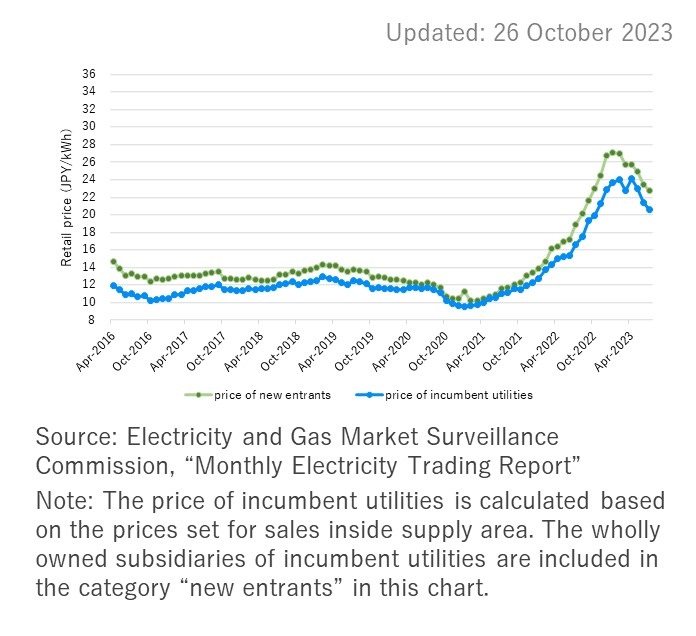

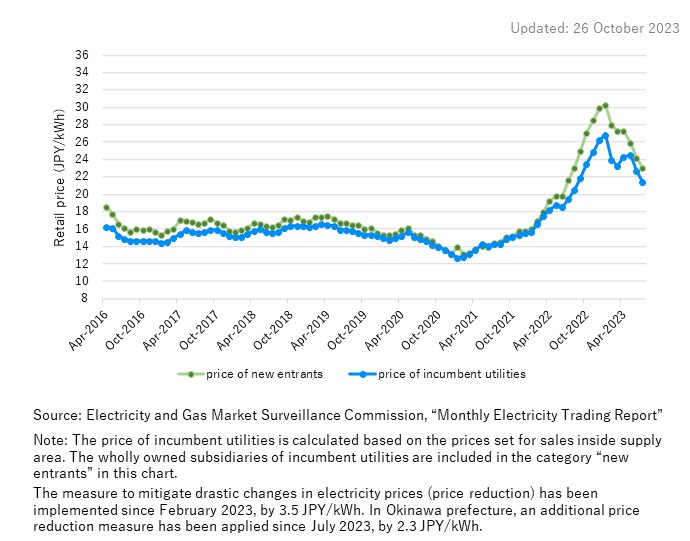

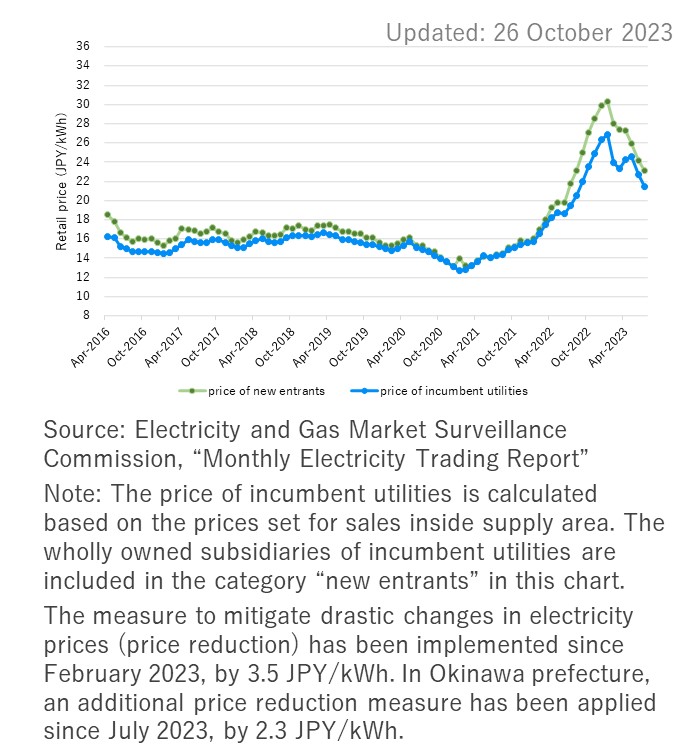

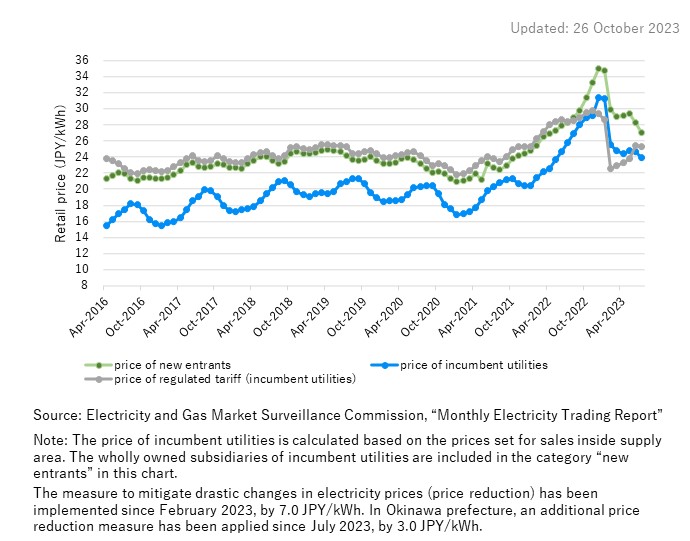

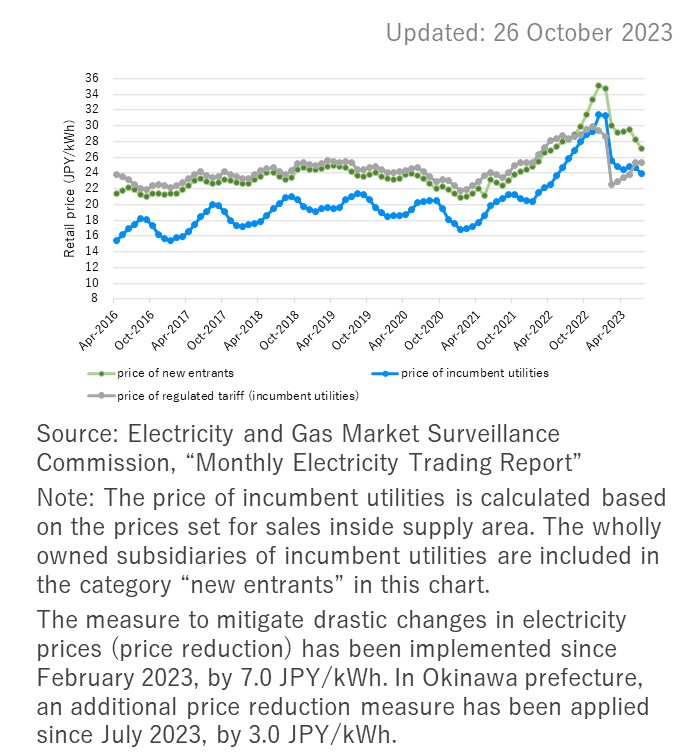

The electricity retail market is a market where retailers sell electricity to consumers. In Japan, the retail market was fully opened in April 2016. Since then, the competition between retailers including new entrants has been developing.

Retail Market Share (Extra high voltage : 2000kW or more) ※based on total electricity sales