Business Risks of the 42 New Coal-fired Power Plant Projects in Japan

—Capacity Factor May Decline to Less Than 50% by FY 2026

in Japanese

Yuri Okubo, Senior Researcher, Renewable Energy Institute

Teruyuki Ohno, Executive Director, Renewable Energy Institute

Following the adoption and the entry into force of the Paris Agreement, there has been a growing global trend to shift away from coal business with the aim of transforming to a carbon-free economy. But in Japan, the number of new coal-fired power plant projects has swollen to 42 plants (18.6 GW) since the Fukushima nuclear catastrophe for several reasons: as an alternative to nuclear power plants that have not been able to restart immediately; to respond to the anticipated increase in future electricity demand; and also to secure an inexpensive energy source needed for new comers to the market or for entering into other regions under the energy market liberalization. These new coal-fired power plant projects have so far received strong criticism, mainly for environmental reasons such as their contribution to the massive increase in CO2 emissions, and for the degradation of local environment caused by the plants.

In addition to such environmental concerns, the question we would like to raise here is that this large number of new projects might be actually a wrong choice in terms of a pure business investment decision to earn profits. The Business Risks of New Coal-fired Power Plant Projects in Japan – The Decline in Capacity Factor and Its Effect on the Business Feasibility, a report released by Renewable Energy Institute on 20 July, precisely examines this point. Based on the latest data for electricity supply and demand and the status of operations and plans of deployment of various energy sources, the report made a provisional calculation on what the capacity factor would be in fiscal year (FY) 2026 if the new projects are to be implemented. The report revealed that there is a high possibility that the profit expected at the planning stage of the new coal-fired power plant projects would not be achieved.

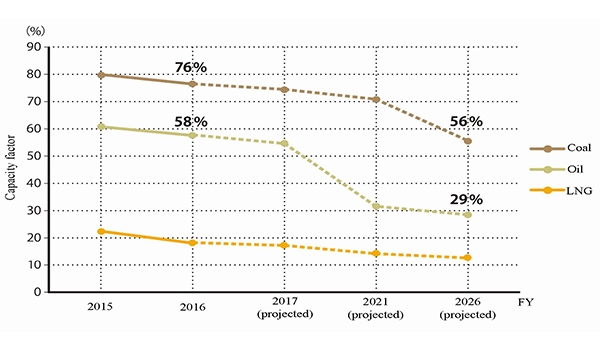

Our conclusion is that the capacity factor of coal-fired power plants will decline significantly from the current level of about 80% and fall to about 56% by FY 2026. Also, the capacity factor may fall below 50% if electricity demand declines by about 5% owing to energy savings and efficiency. In ordinary cases, it is considered that a 70% capacity factor and a 40 year operational lifetime are assumed to calculate profits when planning new coal-fired power plant projects. Hence, the result of the provisional calculation that indicates a decline to the 50% level, and even below 50% under certain conditions, raises significant doubt as to the economic relevance of pushing ahead with these new coal-fired power plant projects.

Figure: Estimated capacity factors of thermal power if new coal-fired power plant projects are implemented

Figure: Estimated capacity factors of thermal power if new coal-fired power plant projects are implemented

Source: Renewable Energy Institute

The assumptions applied in the report for the provisional calculation, which resulted in the capacity factor of 56% in FY2026, were as follows:

- (ⅰ)All new coal-fired power plant projects that are planned to start operation by FY 2026 will start operating.

- (ⅱ)Electricity demand will remain at the same level as that in FY 2016.

- (ⅲ)While nuclear power plants will restart to a certain degree, their share in the electricity mix will remain at 10%, or about a half of the figure estimated for FY 2030 by the government in the Long-Term Energy Supply and Demand Outlook, which is 20-22%.

- (ⅳ)Deployment of solar PV is assumed to be at 81.92 GW, which is a figure estimated by RTS, a leading consulting firm in Japan on solar PV, as a growth scenario based on current conditions.

These assumptions used for the provisional calculation are by no means extreme. Electricity demand in Japan decreased by about 10% in just five years from 931.1 TWh in FY 2010 to 841.5 TWh in FY 2015, as energy efficiency improved after the Great East Japan Earthquake. Compared to these figures, the assumptions that there will be no progress in energy savings and efficiency from now on and that the electricity demand in FY 2026 will be at the same level as that in FY 2016 are extremely conservative. Suppose that the demand will decline by just 5% over the next ten years (i.e. a quarter of the pace compared to what has happened in the five years following the earthquake disaster), and this assumption alone will bring down the capacity factor to below 50%.

The installed capacity of solar PV, which will become a rival of coal-fired power plants, is also given a modest assumption of 81.92 GW. In fact, the “deployment progress scenario” estimated by RTS projects an installed capacity of 97.62 GW.

In terms of the restarting of nuclear power plants, the figure may turn out to be even lower than what was assumed in the report, which was a half of the government’s estimation for 2030. The capacity factor of coal-fired power plants will become slightly higher in this case. But even so, the figure will decline to the 50% level if progress is made in energy savings and efficiency.

The report solely focused on provisional calculations of the change in the capacity factor based on electricity supply and demand data and the outlook of various energy sources. However, other actions that threaten coal-fired power businesses are also taking place in the business environment. Corporate activities toward de-carbonization have been growing in Japan as well; one example is that a leading global company have started to work toward 100% renewable energy and there are various other initiatives Coal-fired power plants, which are by far the largest greenhouse gas emitter among fossil fuels, would probably be avoided by these companies.

While the number of new coal-fired power plant projects has continued to increase since the Great East Japan Earthquake, the cancellation of four plants has been announced in 2017 due to the reduction in electricity demand and in order to strengthen efforts toward CO2 emissions reduction. The possible decline in the capacity factor revealed by the report should serve as important information for operators and financial institutions involved with the remaining 42 new coal-fired power plant projects to reconsider once again what an appropriate business decision would be.