The growing absurdities of reports on German energy policy in Japanese

11 December 2014 Craig Morris, Editor of Renewables International

and lead author of EnergyTransition.de.(@PPchef)

and lead author of EnergyTransition.de.(@PPchef)

Last month, the Financial Times painted a grim picture of Germany’s energy transition*. But the depiction was even more misleading than bleak.

* “The growing absurdities of German energy policy – Berlin increasingly needs dirty coal to make up for scrapping nuclear (25 November 2014, Financial Times)”

- [Main points of the FT article]

- 1. The unreliability of renewables and the exit from nuclear have created an energy supply problem, and Berlin has little choice but to rely on dirty coal-fired power stations.

- 2. German households pay twice as much for electricity as their US counterparts, due to the cost of government subsidies for green energy.

- 3. Many Germans stick to the belief that Energiewende is an exciting project, but in the short term, Germany’s great clean-up looks likely to result in more pollution and higher energy bills.

Like so many economic papers, the FT hears “energy” and thinks “companies”: “In 2000, Gerhard Schroeder’s government… announced subsidies for any company that produced green energy.” Schroeder implemented feed-in tariffs, not subsidies, and it was largely citizens, cooperatives, and new market players who built renewables. The Big Four utilities that make up three quarters of conventional power supply only accounted for 5 percent of investments in renewables as of 2012.

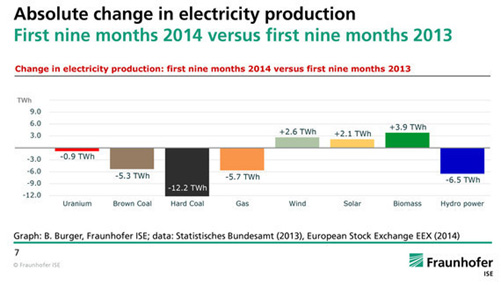

And like so many foreign onlookers, the FT depicts Germany’s energy transition, the Energiewende, as reliant on coal. Here, we need to focus on longer trends, not temporary upticks. Granted, there was a slight increase in coal consumption from 2011 to 2013 because of the 2011 nuclear phaseout. Since then, the main reason for high coal consumption has been harsh winters and power exports.

The FT conjures up the Specter of brownouts. Yet, German power exports soared in 2012 and again in 2013. The largest two importers of German power last year were the Netherlands and France. You see, Germany has massive export generation capacity – too many power plants. Renewables are growing faster than conventional plants need to be replaced in Germany. That’s why coal power production was down considerably in the first three quarters of 2014 and may drop another 20 percent by 2019.

When it comes to prices, the FT overstates the problem. German households do not “pay twice as much for electricity as their US counterparts.” Prices are higher, but Germans consume half as much, so the average monthly German power bill of around 100 US dollars is completely unremarkable by US standards. Likewise, there is no such thing as industry power prices; the price depends on how much you consume. If a firm consumes little, it pays more, but for such firms power prices make up only two percent of total expenses (the cost of labor is a bigger issue for them). In contrast, energy-intensive industry pays less for power in Germany than in most of the EU, which is why international firms in the aluminum sector, the steel sector, and the paper sector are closing shop elsewhere and moving to Germany. German industry power prices are getting more competitive, not less. Furthermore, even household power prices are currently only rising in line with inflation.

Finally, Germans do not believe their Energiewende will “leave their country enjoying the cheapest, greenest, and most sustainable energy” in the world. They believe becoming more efficient and going 60 percent renewable by 2050 is a less expensive option than business as usual, but also one that will provide more democratic participation and competition in the energy sector, which has been so monopolistic up to now.